2016 Chrysler 200 Series Limited on 2040-cars

Engine:2.4L I4 MultiAir

Fuel Type:Gasoline

Body Type:4D Sedan

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1C3CCCAB3GN192229

Mileage: 40395

Make: Chrysler

Trim: Limited

Features: --

Power Options: --

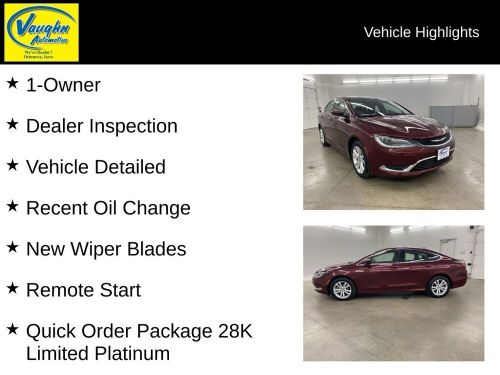

Exterior Color: Red

Interior Color: Black

Warranty: Unspecified

Model: 200 Series

Chrysler 200 Series for Sale

2014 chrysler 200 series touring convertible(US $8,990.00)

2014 chrysler 200 series touring convertible(US $8,990.00) 2014 chrysler 200 super s group(US $8,995.00)

2014 chrysler 200 super s group(US $8,995.00) 2014 chrysler 200 series lx(US $9,400.00)

2014 chrysler 200 series lx(US $9,400.00) 2015 chrysler 200 series lx(US $15,500.00)

2015 chrysler 200 series lx(US $15,500.00) 2014 chrysler 200 series limited(US $4,000.00)

2014 chrysler 200 series limited(US $4,000.00) 2016 chrysler 200 series lx sedan 4d(US $11,998.00)

2016 chrysler 200 series lx sedan 4d(US $11,998.00)

Auto blog

Bailout dealership cuts did their job as profits surge

Tue, 01 Oct 2013Almost five years after US taxpayers bailed out General Motors and Chrysler, a large majority of their slimmed-down dealership networks are posting soaring profits, Bloomberg reports, and contributing to the US auto industry on track this year to deliver 15.4 million vehicles, the most since 16.15 million were delivered in 2007.

Consider another important figure: Bloomberg says that more than 90 percent of GM dealerships are profitable, compared to about half of them in 2008 and 2009. At the start of 2013, GM had 4,355 US dealerships and Chrysler had about 2,600. Compare that with just a few years ago, when GM had 6,246 dealers in 2008, while Chrysler had 3,200 in 2009.

As part of their bankruptcy restructuring, both GM and Chrysler decided that their retail networks contained far too many dealerships and insisted that they be slimmed down. The resultant dealership terminations followed by a rebounding auto market - in part due to better new GM and Chrysler vehicles - have increased the number of sales per dealership to record levels. Many dealers are taking advantage of increasing profits and investing in facility renovations and updates, such as Chrysler dealership owner David Kelleher. He's spending $2 million to expand his store.

Ferrari stock demand exceeding supply

Sun, Oct 18 2015As with the Ferrari cars, so it is with shares in the company's initial public offering: When Ferrari has a limited quantity of something to sell, demand far outstrips supply. Investors told banks weeks ago that bids for the $1 billion in stock – up to 18.89 million shares – would exceed the number of shares available over the entire expected range of $48 to $52. Ten percent of the company is going on the block' Bloomberg reports that the books close on the IPO on Monday at 4:00 pm. The final price will be set on Tuesday, and trading will begin Wednesday under the ticker symbol RACE on the New York Stock Exchange. Piero Ferrari, the son of Enzo Ferrari, will hold onto the ten-percent stake he currently has in the company. Fiat Chrysler will disburse the final 80 percent to its investors sometime in 2016. In combination with spinning Ferrari off from its parent company next year, the share sale is expected to put $4 billion into Fiat Chrysler coffers, which will be used to help fuel the growth of Alfa Romeo, Jeep, and Maserati. Assuming all goes to plan, Bloomberg says Ferrari will be valued at roughly $12 billion, a number $1 billion greater than the valuation Fiat Chrysler CEO Sergio Marchionne put on Ferrari earlier this year and higher than the brand's own internal assessment. Related Video:

Google-Chrysler autonomous project will include ride-sharing

Fri, Dec 16 2016Google's new Waymo automobile-technology division might have just gotten "way mo" interesting, if you'll excuse the pun. Google, which this spring said it would work with Fiat Chrysler Automobiles on the development of a self-driving Chrysler minivan prototype, is adding a ride-sharing component to the project, Bloomberg News says, citing people familiar with the process. Representatives with both Fiat Chrysler and Google parent Alphabet Inc. declined to comment to Bloomberg. The ride-sharing service, which would compete with fellow San Francisco Bay Area-based companies such as Uber and Lyft, may debut as soon as the end of next year. Uber continues to move forward with its own self-driving efforts, launching self-driving tests (with engineers behind the wheel) in Pittsburgh in September and announcing this week that it would start tests in San Francisco. Those efforts may be delayed, however, as the state of California requires special permitting for testing out self-driving technology, and while the state has granted those permits to automakers such as General Motors, Tesla and Ford, it hasn't for Uber. Google and Chrysler said earlier this year that it would develop about 100 autonomous-driving Pacifica prototypes, but the ride-sharing service would require more of those vehicles to be built. Google's auto-technology operations, now called Waymo, have been headed by former Hyundai executive John Krafcik since September 2015. The division has reportedly brought in more executive-level personnel to speed things along. Meanwhile, Chrysler is slated to unveil an all-electric prototype version of the Pacifica at Las Vegas's annual CES show next month. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.