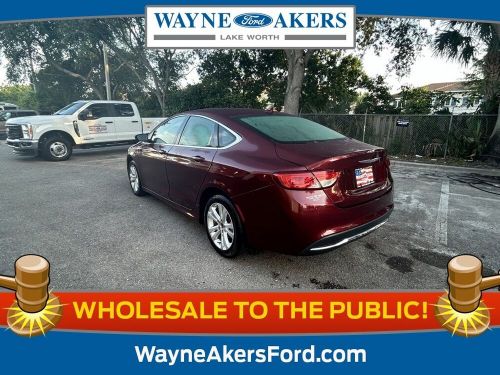

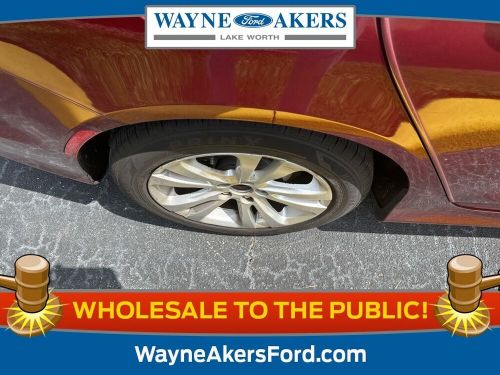

2015 Chrysler 200 Series Limited on 2040-cars

Engine:2.4L L4 DOHC 16V

Fuel Type:Gasoline

Body Type:SEDAN 4-DR

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1C3CCCABXFN611093

Mileage: 101126

Make: Chrysler

Trim: Limited

Drive Type: --

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: 200 Series

Chrysler 200 Series for Sale

2011 chrysler 200 series touring(US $500.00)

2011 chrysler 200 series touring(US $500.00) 2011 chrysler 200 series touring(US $8,999.00)

2011 chrysler 200 series touring(US $8,999.00) 2017 chrysler 200 series limited(US $11,995.00)

2017 chrysler 200 series limited(US $11,995.00) 2015 chrysler 200 series 4dr sedan limited fwd(US $2,100.00)

2015 chrysler 200 series 4dr sedan limited fwd(US $2,100.00) 2017 chrysler 200 lx power seat sirius xm radio bluetooth backup cam(US $12,991.00)

2017 chrysler 200 lx power seat sirius xm radio bluetooth backup cam(US $12,991.00) 2017 chrysler 200 series limited(US $11,995.00)

2017 chrysler 200 series limited(US $11,995.00)

Auto blog

Fiat To Pay $3.65 Billion For Remaining Chrysler Shares

Thu, Jan 2 2014Italian automaker Fiat SpA announced Wednesday that it reached an agreement to acquire the remaining shares of Chrysler for $3.65 billion in payments to a union-controlled trust fund. Fiat already owns 58.5 percent of Chrysler's shares, with the remaining 41.5 percent held by a United Auto Workers union trust fund that pays health care bills for retirees. Under the deal, Fiat will make an initial payment of $1.9 billion to the fund, plus an additional $1.75 billion upon closing the deal. Chrysler will also make additional payments totaling $700 million to the fund as part of an agreement with the UAW. The deal is expected to close on or before Jan. 20, according to a statement from Chrysler. Sergio Marchionne, CEO of both Fiat and Chrysler, has long sought to acquire the union's shares in order to combine the two companies. "The unified ownership structure will now allow us to fully execute our vision of creating a global automaker that is truly unique in terms of mix of experience, perspective and know-how, a solid and open organization," Marchionne said in a statement issued by Turin, Italy-based Fiat. The deal eliminates the need for an initial public offering of the union fund's stake, which analysts had previously valued at $5.6 billion. Fiat went to court last year seeking a judgment on the price, but the trial date was set for next September. Marchionne can't spend Chrysler's cash on Fiat's operations unless the companies merge. In recent months he made it clear that he preferred to settle the dispute without an IPO, but filed the paperwork for the offering in September at the trust's request. Chrysler's profits have helped prop up Fiat on the balance sheet as the Italian automaker struggles in a down European market. The Auburn Hills, Mich., automaker earned $464 million in the third quarter on U.S. sales of the Ram pickup and Jeep Grand Cherokee, its ninth-straight profitable quarter. The results boosted Fiat, which earned $260 million in the quarter. Without Chrysler's contribution, Fiat would have lost $340 million. UAW/Unions Chrysler Fiat

Chrysler recalls 112k family-haulers over airbag controllers

Sun, Feb 7 2016The Basics: Chrysler has issued a recall for an array of minivans and crossovers manufactured in 2007 and 2008. The models affected include the 2009 Dodge Journey, 2008-09 Dodge Grand Caravan, and 2008-09 Chrysler Town and Country. The 2009 Volkswagen Routan, which was manufactured by Chrysler, is also being recalled by FCA. The automaker estimates that 112,001 units in the United States are affected, all told. The Problem: Corrosion in the air bag control unit could prevent the air bags from deploying in the event of a crash, or alternatively deploy prematurely. Chrysler points out that "none of the affected vehicles are equipped with ammonium-nitrate inflators" like those fitted by Takata. Injuries/Deaths: The manufacturer reports seven minor injuries (but no accidents) potentially related to this issue. The fix: Chrysler will replace the air bag control unit, though it has not yet outlined a timeframe for doing so. If you own one: Look for a recall notice in the mail and then schedule service with your local dealership. If you don't receive one, you can contact Chrysler customer service at 1-800-853-1403 and reference recall number S07. Related Video: RECALL Subject : Air Bag Control Unit Power Supply Corrosion Report Receipt Date: JAN 29, 2016 NHTSA Campaign Number: 16V047000 Component(s): AIR BAGS Potential Number of Units Affected: 112,001 Manufacturer: Chrysler (FCA US LLC) SUMMARY: FCA US LLC (Chrysler) is recalling certain model year 2009 Dodge Journey vehicles manufactured December 31, 2007, to August 31, 2008, 2008-2009 Dodge Grand Caravan and Chrysler Town and Country vehicles manufactured June 18, 2007, to August 31, 2008, and 2009 Volkswagen Routan vehicles manufactured August 11, 2008, to August 31, 2008. In the affected vehicles, the air bag control units may corrode and fail. CONSEQUENCE: If the air bag control unit fails, the air bags may not deploy in the event of a crash, increasing the risk of occupant injury. Additionally, the air bags may inadvertently deploy, increasing the risk of a crash. REMEDY: Chrysler will notify owners, and dealers will replace the air bag control unit, free of charge. The manufacturer has not yet provided a notification schedule. Owners may contact Chrysler customer service at 1-800-853-1403. Chrysler's number for this recall is S07. NOTES: Owners may also contact the National Highway Traffic Safety Administration Vehicle Safety Hotline at 1-888-327-4236 (TTY 1-800-424-9153), or go to www.safercar.gov.

America was the unexpected theme at the 2017 Detroit Auto Show thanks to Trump

Wed, Jan 11 2017President-elect Donald Trump was not in attendance at this year's Detroit Auto Show, but it sure seemed like he was the target audience for many of the press conferences and announcements surrounding the event. Several manufacturers chose to play up existing and future commitments to the US in general and American jobs specifically in their presentations to the press, and we're pretty sure that has everything to do with Trump's recent targeting of automakers on Twitter. To us, it seemed automakers were going on the offensive to try and preempt any future tweet-shaming for investing in auto manufacturing anywhere but the US. The pro-America sentiment started the week prior to the auto show, with Ford announcing that it would build several future electrified vehicles at its Flat Rock Assembly Plant in Michigan and also cancel a $1.6 billion factory planned for Mexico. Ford announced the two items on the same day, but the reality is that they likely have no relation to each other; the Mexican plant is being skipped because the company doesn't need the extra capacity to build the Ford Focus right now. Trump was still happy to share the news on Twitter. Then, on Sunday, FCA announced it would invest $1 billion in manufacturing plants in Ohio and Michigan to produce the new Jeep Wagoneer, Grand Wagoneer, and Wrangler-based pickup. It's not as though those potential new jobs were on their way out of the US, necessarily, but FCA took the opportunity to mention that plant upgrades at the Warren Truck Plant would allow the company to build Ram heavy duty trucks, which are currently assembled in Mexico, there. CEO Sergio Marchionne confirmed that Trump and his proposed tariffs had nothing to do with the decision. We certainly believe that, but we also have to believe that the timing of the release, positive outcome for America, and zero gain for Mexico were all orchestrated. Again, Trump sent out a victory tweet as if this had been his doing. Ford then used its press conference at the show on Monday to reiterate the plans for Flat Rock and also confirm that the Ford Bronco and Ranger nameplates will be returning to the US market, and that both will be built at a plant in Michigan. Announcements of manufacturing locations are usually aimed at the UAW, which certainly has a stake in these things, but again this one was broadcast to the auto show crowd in general.