2013 Chrysler 200 Series Touring on 2040-cars

Salt Lake City, Utah, United States

Engine:4 Cylinder Engine

Fuel Type:Gasoline

Body Type:4dr Car

Transmission:Automatic

For Sale By:Dealer

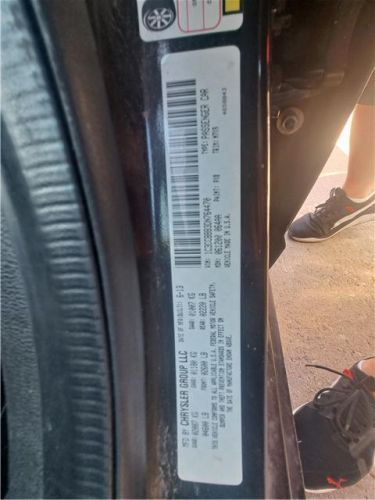

VIN (Vehicle Identification Number): 1C3CCBBB3DN764470

Mileage: 0

Make: Chrysler

Trim: Touring

Drive Type: FWD

Horsepower Value: 173

Horsepower RPM: 6000

Net Torque Value: 166

Net Torque RPM: 4400

Style ID: 353111

Features: 2.4L DOHC SMPI 16-VALVE I4 DUAL VVT PZEV ENGINE

Power Options: --

Exterior Color: Black

Interior Color: --

Warranty: Unspecified

Model: 200 Series

Chrysler 200 Series for Sale

2013 chrysler 200 series limited(US $670.00)

2013 chrysler 200 series limited(US $670.00) 2014 chrysler 200 series lx(US $550.00)

2014 chrysler 200 series lx(US $550.00) 2015 chrysler 200 series limited sedan 4d(US $11,499.00)

2015 chrysler 200 series limited sedan 4d(US $11,499.00) 2014 chrysler 200 series lx 4dr sedan(US $1,397.50)

2014 chrysler 200 series lx 4dr sedan(US $1,397.50) 2014 chrysler 200 series(US $5,495.00)

2014 chrysler 200 series(US $5,495.00) 2015 chrysler 200 series c(US $9,950.00)

2015 chrysler 200 series c(US $9,950.00)

Auto Services in Utah

Volkswagen SouthTowne ★★★★★

Tunex ★★★★★

Tip Top Transmission ★★★★★

Superior Auto Repair ★★★★★

Precision Auto Glass ★★★★★

Payson Auto Care ★★★★★

Auto blog

GM details CEO Mary Barra's pay, contacts with investor David Einhorn

Wed, Apr 5 2017Earnings/Financials Chrysler Ford GM Sergio Marchionne Mary Barra Mark Fields david einhorn greenlight capital

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.

Strains between France and Italy risk Renault-FCA merger

Thu, May 30 2019PARIS/ROME — Fiat Chrysler's proposed $35 billion merger with Renault has cheered investors, won conditional support from Paris and Rome and even earned cautious backing from trade unions. Beneath this veneer, however, the bold attempt to create the world's third-largest carmaker risks becoming rapidly embroiled in the fraught relationship between France's europhile President Emmanuel Macron and Italy's euroskeptic leaders. For while Deputy Prime Minister Matteo Salvini hailed the proposal as a "brilliant operation," Italy's creaking, state-subsidized Fiat factories are likely to bear the brunt of any production-related cost savings. FCA and Renault said this week that more than 5 billion euros ($5.6 billion) of annual savings would come mainly from combining platforms, consolidating powertrain and electrification investments and the benefits of increased scale. Salvini and France's Finance Minister Bruno Le Maire, who called the deal a "good opportunity" to build a European industrial champion able to compete with China and the United States, have both said they want guarantees on local jobs. "It's not every day that I agree with Salvini," said Le Maire, whose government appears to hold the trump cards. When it comes to where any job cuts fall, France will be helped by its existing 15 percent holding in Renault, whose superior efficiency at its five French plants makes it better placed to handle a supply glut, the demise of the petrol engine and the investments needed for electric and autonomous vehicles. "It will take many, many years to find real savings, and ugly political and operational realities can often swamp the potential of such new entities," Bernstein analyst Max Warburton said of the FCA-Renault plan to rival Japan's Toyota and Germany's Volkswagen. Advantage France? As well as Italy's government having to cope with the aftermath of European elections, which coincided with news of the FCA-Renault plans, political leaders in Rome were only informed shortly before the deal was made public, an FCA source said. This contrasted with the way the French government was treated, with Fiat Chrysler Chairman John Elkann, a fluent French speaker, letting it know of his merger proposal to Renault weeks ago, a French government official said.