2012 Chrysler 200 Lx on 2040-cars

1202 Washington Ave., Huntington, West Virginia, United States

Engine:2.4L I4 16V MPFI DOHC

Transmission:4-Speed Automatic

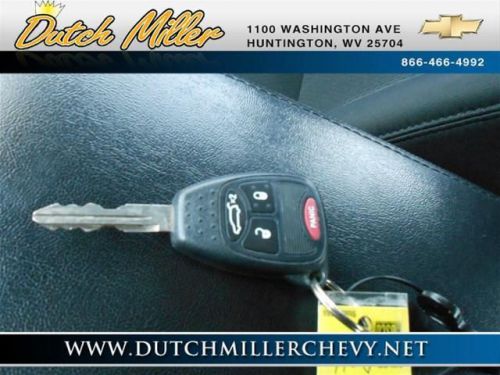

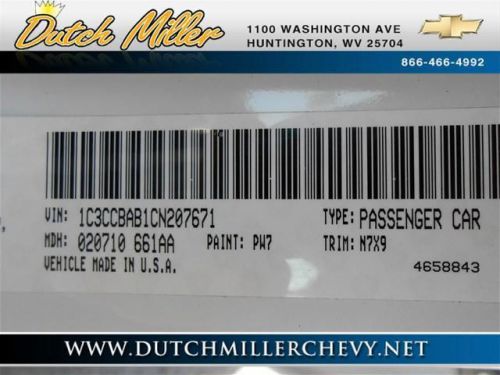

VIN (Vehicle Identification Number): 1C3CCBAB1CN207671

Stock Num: B3279

Make: Chrysler

Model: 200 LX

Year: 2012

Exterior Color: White

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 44798

This could be the vehicle for you. This Chrysler 200 is new addition to our inventory and is already creating a buzz. Call Dexter Chapman now at 877-782-0110 to discuss this listing further.

Chrysler 200 Series for Sale

2013 chrysler 200 touring(US $15,995.00)

2013 chrysler 200 touring(US $15,995.00) 2013 chrysler 200 touring(US $16,395.00)

2013 chrysler 200 touring(US $16,395.00) 2013 chrysler 200 touring(US $16,450.00)

2013 chrysler 200 touring(US $16,450.00) 2013 chrysler 200 touring(US $16,750.00)

2013 chrysler 200 touring(US $16,750.00) 2013 chrysler 200 limited(US $20,900.00)

2013 chrysler 200 limited(US $20,900.00) 2012 chrysler 200 limited(US $17,933.00)

2012 chrysler 200 limited(US $17,933.00)

Auto Services in West Virginia

Tire Outfitters ★★★★★

Superior Chry-Plym-Dodge-Jeep Eagle Of Ashland Inc ★★★★★

Quality Body Shop ★★★★★

Oesterle Auto Glass & Paint ★★★★★

Midas Auto Service Experts ★★★★★

M & D Auto Clinic ★★★★★

Auto blog

Dodge, Jeep and Ram could soon be owned by Chinese automakers

Mon, Aug 14 2017For the past several years, Fiat Chrysler CEO Sergio Marchionne has made it widely known that the automaker he helms is up for grabs. First, he sent an email to GM CEO Mary Barra, who immediately refused to even discuss a merger. Later, Marchionne set his sights on Volkswagen. That too was swiftly rebuffed. It seemed like no global automaker was remotely interested in a partnership. Now, Automotive News reports that several Chinese automakers have come calling, only FCA isn't ready to answer. At least not yet. The news broke this morning that a major Chinese automaker had made an offer to purchase FCA for slightly above market value. FCA refused, saying the offer wasn't quite generous enough. It's unclear which automaker made the offer, but Automotive News says there's more than one interested party. FCA representatives have recently traveled to China to meet with Great Wall Motors, while Chinese representatives were seen at FCA corporate headquarters in Auburn Hills, Mich. The Chinese government has a lot of money invested in local automakers. It's putting pressure on these automakers to expand globally, including to the United States. As it stands, it's a matter of when a Chinese automaker will start selling cars here, not if. Purchasing an established automaker with a wide range of products and a huge dealer network would do wonders in giving the Chinese a foothold here. Sure, Geely owns Volvo, but a luxury automaker doesn't have nearly as much reach as a more mainstream company like FCA. This seems like the best case scenario for both a Chinese automaker looking to move into the U.S. and for FCA, at least from a business standpoint. The latter doesn't seem to have any other interested parties. It will be interesting to see how FCA would sell a deal like this to the public. We're not sure everyone will be happy with Dodge, Jeep and Ram falling under Chinese ownership. FCA didn't turn down the Chinese because they didn't like the idea. It turned down the offer because there wasn't enough money on the table. Related Video: News Source: Automotive News Earnings/Financials Alfa Romeo Chrysler Dodge Fiat Jeep RAM

Minivan market not what it used to be, but margins make up for it

Thu, 05 Jun 2014

Residual values for last year's minivans are higher than they were in 2000.

Much like the station wagon was the shuttle of Baby Boomer generation, the minivan has been the primary means of transport for Generations X and Y. Just as the boomers abandoned the Country Squire, though, those kids that were toted around in Grand Caravans and Windstars are adults, and they certainly don't want to be seen in the cars their parents drove.

Fiat Chrysler open to mergers, and PSA is looking for one

Fri, Mar 8 2019GENEVA — Fiat Chrysler (FCA) is open to pursuing alliances and merger opportunities if they make sense, but a sale of its luxury brand Maserati is not an option, Chief Executive Mike Manley said on Tuesday. "We have a strong independent future, but if there is a partnership, a relationship or a merger which strengthens that future, I will look at that," Manley told reporters at the Geneva Motor Show. Asked whether he would consider selling Maserati to China's Geely Automobile Holdings, as suggested by recent media reports, Manley said: "Maserati is one of our really beautiful brands and it has an incredibly bright future. ... No." FCA is often cited as a possible merger candidate. Bloomberg said this week that the Italian-American carmaker was attractive to France's PSA Group given its exposure to the U.S. market and its popular Jeep brand. The Detroit News' headline on the situation Friday read, "Fiat Chrysler CEO open to a deal as PSA circles" and stated that Manley's open-to-just-about-anything comments were aimed directly at PSA. Bloomberg said talks between the two were preliminary and said PSA chief Carlos Tavares has also contemplated mergers with General Motors or Jaguar Land Rover, which is losing money for Indian owner Tata. PSA has enjoyed a decade of turnaround and has $10.2 billion in net cash available. The maker of Peugeot, Citroen and DS, acquired Opel and Vauxhall in 2017 and made them almost instantly profitable. Manley, who took over after the death of Sergio Marchionne, said he currently had no news on possible deals. Manley also said the world's seventh-largest carmaker, which is lagging rivals in developing hybrid and electric vehicles, would take the least costly approach to comply with increasingly more stringent European emissions regulations. "There are three options. You can sell enough electrified vehicles to balance your fleet. Two: You can be part of a pooling scheme. Three is to pay the fines," he said. "I don't see a scenario when (carmakers) continue to subsidize technologies ... indefinitely." The carmaker had said last June it would invest 9 billion euros ($10.19 billion) over the next five years to introduce hybrid and electric cars across all regions to be fully compliant with emissions regulations. Asked about a 5-billion-euro investment plan for Italy FCA announced in November but then put under review, Manley said the plan had been confirmed as originally presented.