2005 Chrysler Town & Country , Minivan , Low Miles , Looks And Runs Great !!! on 2040-cars

Cleveland, Ohio, United States

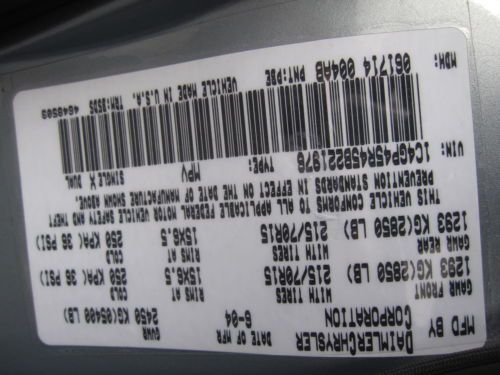

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Year: 2005

Make: Chrysler

Warranty: Vehicle does NOT have an existing warranty

Model: Town & Country

Mileage: 89,000

Options: CD Player

Sub Model: NO RESERVE

Power Options: Cruise Control

Exterior Color: Other

Interior Color: Gray

Number of Cylinders: 6

Vehicle Inspection: Inspected (include details in your description)

Chrysler 200 Series for Sale

02 pt cruiser low miles no reserve

02 pt cruiser low miles no reserve 2013 300 s .no reserve.leather/navi/heat/camera/20's/spoiler/salvage/rebuilt

2013 300 s .no reserve.leather/navi/heat/camera/20's/spoiler/salvage/rebuilt 1978 chrysler cordoba base hardtop 2-door 6.6l

1978 chrysler cordoba base hardtop 2-door 6.6l 1989 chrysler tc maserati base convertible 2-door 2.2l(US $5,000.00)

1989 chrysler tc maserati base convertible 2-door 2.2l(US $5,000.00) Srt-8, ivory tri-coat, safety tec package, black vapor chrome, panoramic sunroof(US $48,995.00)

Srt-8, ivory tri-coat, safety tec package, black vapor chrome, panoramic sunroof(US $48,995.00) No reserve 32k automatic base a/c power windows cd runs/drives great rebuilt

No reserve 32k automatic base a/c power windows cd runs/drives great rebuilt

Auto Services in Ohio

Weber Road Auto Service ★★★★★

Twinsburg Brake & Tire ★★★★★

Trost`s Service ★★★★★

TransColonial Auto Service ★★★★★

Top Tech Auto ★★★★★

Tire Discounters ★★★★★

Auto blog

Chrysler fires protest organizer at MI assembly plant

Tue, 12 Mar 2013Chrysler has reportedly fired a Warren Stamping Plant worker for what the company is calling a violation of its code of conduct. Alex Wassell (left), a 20-year veteran with the automaker, was suspended without pay after he was quoted in an article in The Detroit News. The 63-year-old welder repairman helped organize a demonstration against a new work schedule and was protesting outside the Michigan plant on February 28 when he was interviewed. Chrysler then fired Wassell when the paper published his comments. Wassell, has since filed a grievance and says that he's looking for an amicable settlement between his union and his former employer.

Meanwhile, multiple civil liberties groups have spoken out against Chrysler's decision to dismiss Wassell. Both the National Lawyer's Guild and the American Civil Liberties Union have released statements on the situation, with the ACLU saying "Employees have a right to air their grievances, even if that means a public demonstration or a comments to the media."

According to The Detroit News, Chrysler spokesperson Jodi Tinson said that Wassell was fired for "engaging in activity constituting or appearing to constitute a conflict with the interest of the company."

Buy Ford and GM stock and make 5%

Tue, Feb 2 2016Want to make a five-percent return when 10-year treasuries are paying around two percent? Ford (F) and General Motors (GM) have solid balance sheets, strong cash flow, solid earnings, and growing markets. By all accounts, they are smart investments. But the market is down on these stocks. Why? Some of the stupid excuses include: They are cyclical companies The Detroit 3 have lost 3.5 million in sales since 2000 The world economy is shaky GM recently filed for bankruptcy Their markets have peaked They haven't changed their ways Let's take these criticisms one by one: They Are Cyclical Companies Yes, they are cyclical. Every company is cyclical. Every industry is cyclical. Some more than others, but not every company is immune from swings in the market. Banks used to be 'non-cyclical' leader, not anymore. Airline stocks are just as cyclical as auto stocks, yet they are trading at multiples greater than the auto industry. Why? And what accounts for the irrational stock price for Tesla (TSLA)? At least Ford (F) and General Motors (GM) make money and have positive cash flows. In fact, both companies have a net positive cash position. They have more cash on hand than liabilities. Auto sales in the United States hit a record 17.5 million vehicles in 2015. During the Great Recession, Ford (F) and General Motors (GM) cut their break even points to 10 million vehicles per year. Anything above an annual U.S. volume of 10 million vehicles is profit. And what a profit they make. Sales of Ford's F-150 continues to be the best-selling vehicle in the United States for over 30 years. Detroit 3 Have Lost 3.5 million in Sales Since 2000 Automotive News reports General Motors (GM), Ford (F) and Chrysler (FCA) have lost a combined 3.5 million vehicles sales since 2000. So how can they be making more money? Two big reasons – Fleet Sales and the UAW. Fleet Sales The Detroit 3 used to own car rental companies to keep their factories running. Ford owned Hertz (HTZ), General Motors owned all of National Car Rental and 29 percent of Avis, and Chrysler, the forerunner to Fiat Chrysler (FCA), used to own Thrifty Car Rental and Dollar Rent-A-Car. The Detroit 3 owned these rental companies to have a place to sell their bad product and keep their factories running. These were low margin sales, and in many cases, were money losers for the Detroit 3. They no longer own auto rental companies.

Best and worst car brands of 2022 according to Consumer Reports

Thu, Feb 17 2022It's that time again, Consumer Reports this morning lifting the curtain on its 2022 Annual Car Brand rankings and its 10 Top Picks in the car, crossover, and truck category. Drumroll, please: This year, Subaru climbs two spots to claim the winner's circle, having come third the last two years. Last year, Mazda climbed three spots from 2020 to take the crown. This year, Mazda slipped to second, BMW taking the last spot on the podium, also a one-spot drop from 2021. Six automakers in the top 10 hailed from Japan, which is one more than last year, and five luxury makers occupied the top 10, which is two more than last year. And South Korean representation didn't crack the top this year, after Hyundai managed tenth last year. The seven makes after BMW are: Honda, Lexus, Audi, Porsche, Mini, Toyota, and Infiniti. The magazine and testing concern says its Brand Report Card "[reveals] which automakers are producing the most well-performing, safe, and reliable vehicles based on CR’s independent testing and member surveys," and that "Brands that rise to the top tend to have the most consistent performance across their model lineups." The domestics also took steps back among the 32 OEMs ranked on the 2022 card. Chrysler and Buick were the domestic carmakers who made last year's top 10 in eighth and ninth, respectively. This year, Buick dropped to eleventh, Chrysler to thirteenth. Dodge went from fourteenth to sixteenth. CR continues to ding Tesla's yoke steerer, the not-exactly-natural handhold responsible for the electric carmaker going from sixteenth last year to twenty-third this year.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.142 s, 7898 u