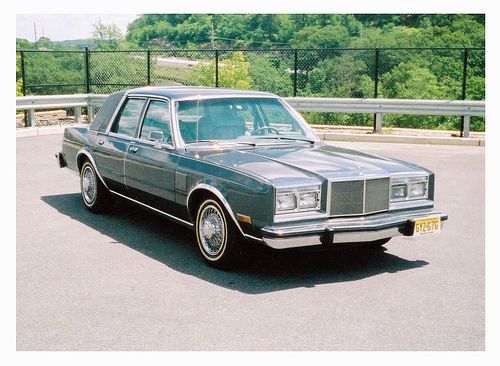

1987 Chrysler 5th Avenue - 45,000 Orig Miles on 2040-cars

Lyndhurst, New Jersey, United States

Chrysler 200 Series for Sale

2008 chrysler sebring ltd convertible nav htd seats 60k texas direct auto(US $12,980.00)

2008 chrysler sebring ltd convertible nav htd seats 60k texas direct auto(US $12,980.00) 2010 touring dual dvd rearcam leather htd seats stow n go town and country 52k(US $17,930.00)

2010 touring dual dvd rearcam leather htd seats stow n go town and country 52k(US $17,930.00) 2006 chrysler 300c hemi engin 5.7l

2006 chrysler 300c hemi engin 5.7l 2003 chrysler town and country lx! 1-owner! no reserve! free carfax! clean! nice

2003 chrysler town and country lx! 1-owner! no reserve! free carfax! clean! nice No reserve in az-2013 chrysler 300 wrecked-runs-salvage title-only 17k miles

No reserve in az-2013 chrysler 300 wrecked-runs-salvage title-only 17k miles 2003 chrysler 300m

2003 chrysler 300m

Auto Services in New Jersey

Woodstock Automotive Inc ★★★★★

Windrim Autobody ★★★★★

We Buy Cars NJ ★★★★★

Unique Scrap & Auto - USA ★★★★★

Turnersville Pre-Owned ★★★★★

Trilenium Auto Recyclers ★★★★★

Auto blog

European new car sales drop nearly 8% in first half of 2019

Thu, Jul 18 2019PARIS ó European car sales dropped 7.9% in June, led by bigger declines for Nissan, Volvo and Fiat Chrysler (FCA), according to industry data published on Wednesday. Registrations fell to 1.49 million cars last month from 1.62 million a year earlier across the European Union and EFTA countries, the Brussels-based Association of European Carmakers said in a statement. Calendar effects resulted in two fewer sales days in most markets, accentuating the decline. Registrations for the first half closed 3.1% lower, ACEA said. For European carmakers, weakening demand at home compounds the pressure from a sharper contraction in China and emerging markets that may yet bring more profit warnings. Nissan¬ís aging model lineup contributed to a 26.6% June sales slump while Volvo Cars, owned by China¬ís Geely, saw deliveries tumble 21.7%. Registrations also fell 13.5% last month at FCA, 10.1% at BMW, 9.6% at Volkswagen Group and 8.2% for both Mercedes parent Daimler and France¬ís PSA Group. The Peugeot maker¬ís domestic rival Renault suffered less, posting a 3.9% decline. By the Numbers BMW Chrysler Fiat Nissan Volkswagen Volvo Peugeot Renault

Major automakers post mixed US June sales figures

Mon, Jul 3 2017General Motors, Ford and Fiat Chrysler Automobiles NV posted declines in US new vehicle sales for June on Monday, while major Japanese automakers reported stronger figures. Once again, demand for pickup trucks and crossovers offset a decline in sedan sales. Automakers' shares rose as overall industry sales still came in above Wall Street expectations. The US auto industry is bracing for a downturn after hitting a record 17.55 million new vehicles sold in 2016. Analysts had predicted that overall, US vehicle sales would fall in June for the fourth consecutive month. As the market has shown signs of cooling, automakers have hiked discounts and loosened lending terms. Car shopping website Edmunds said on Monday the average length of a car loan reached an all-time high of 69.3 months in June. "It's financially risky, leaving borrowers exposed to being upside down on their vehicles for a large chunk of their loans," said Jessica Caldwell, Edmunds' executive director of industry analysis. GM said its sales fell about 5 percent versus June 2016, but that the industry would see stronger sales in the second half of 2017 versus the first half. "Under the current economic conditions, we anticipate US retail vehicle sales will remain strong for the foreseeable future." GM shares were up 2.4 percent in morning trading, while Ford rose 3.3 percent and FCA shares jumped 6 percent. "US total sales are moderating due to an industry-wide pullback in daily rental sales, but key US economic fundamentals clearly remain positive," said GM chief economist Mustafa Mohatarem. "Under the current economic conditions, we anticipate US retail vehicle sales will remain strong for the foreseeable future." Ford said its sales for June were hit by lower fleet sales to rental agencies, businesses, and government entities, which fell 13.9 percent, while sales to consumers were flat. But it sold a record 406,464 SUVs in the first half of the year, with Explorer sales increasing 23 percent in June. And sales of the F-150 had their strongest June since 2001. On a media call, Ford executives said an initial read of automakers' sales figures indicated a seasonally adjusted annualized rate of around 17 million new vehicles for the month, which would be better than 16.6 million units analysts had predicted. FCA said June sales decreased 7 percent versus the same month a year earlier.

Ferrari raises $893M, valued at $12B

Wed, Oct 21 2015Ferrari's stock is moving as quickly on the New York Stock Exchange as the brand's iconic sports cars do on the road. The company's incredibly popular initial public offering has already raised $893.1 million by virtue of 17.18 million shares sold for $52 apiece. If the deal's underwriters buy in as well, the figure would grow to $982.4 million. Plus, even after shouldering some of FCA's debt, the automaker carries an enterprise value of $12 billion, Bloomberg reports. Just as the company starts trading on the New York Stock Exchange, the share price is already racing upward, too. As of this writing, Ferrari stock, which is listed under the symbol RACE, is priced at $57.59. At its high so far today, the value reached as high as $60.95. While Ferrari is looking strong, the big winner in this success looks to be FCA because the company should raise $4 billion in the spin-off, according to Bloomberg. With nine percent of the sports car maker on the NYSE and one percent for the underwriters, another 80 percent will be distributed to FCA investors in 2016. When that's through, Exor, the holding company for the Agnelli/Elkann family, should have the largest stake at about 30 percent. Piero Ferrari holds the remaining 10 percent and has no intention to sell it. Related Video: FCA Announces Pricing of Initial Public Offering of Ferrari N.V. Common Shares Fiat Chrysler Automobiles N.V. (NYSE: FCAU/MI: FCA) ("FCA") and its subsidiary Ferrari N.V. ("Ferrari") announce today the pricing of Ferrari's initial public offering of 17,175,000 common shares at an offering price of $52 per share for a total offering size of $893.1 million ($982.4 million if the underwriters exercise the option described below in full). The shares are expected to begin trading on the New York Stock Exchange on Wednesday, October 21, 2015, under the symbol "RACE", and closing of the offering is expected to occur on October 26, 2015. In addition, the underwriters have a 30-day option to purchase an aggregate of up to 1,717,150 common shares of Ferrari from FCA. The offering is intended to be part of a series of transactions to separate Ferrari from FCA. Following completion of this offering, FCA expects to distribute its remaining ownership interest in Ferrari to FCA shareholders at the beginning of 2016. UBS Investment Bank is acting as Global Coordinator for the offering.