13 Touring Used 2.4l I4 Clean Autocheck One Owner Satellite Radio Cruise on 2040-cars

Salina, Kansas, United States

Chrysler 200 Series for Sale

5.7l power door locks power windows power driver's seat power passenger seat

5.7l power door locks power windows power driver's seat power passenger seat 2011 chrysler 200 touring convertible 11k miles uconnect bluetooth mp3 cd usb(US $17,950.00)

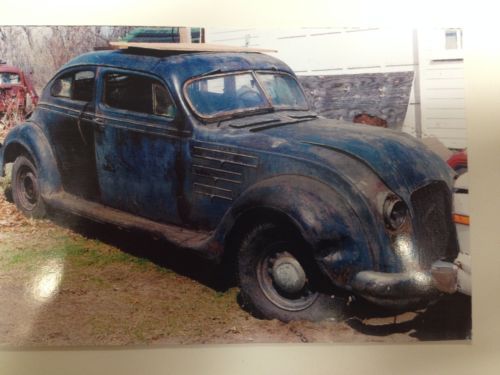

2011 chrysler 200 touring convertible 11k miles uconnect bluetooth mp3 cd usb(US $17,950.00) Rare 1934 chrysler imperial airflow model cv 5 passenger coupe w parts art deco

Rare 1934 chrysler imperial airflow model cv 5 passenger coupe w parts art deco 2007 chrysler 300 leather cruise ctrl alloy wheels 20k texas direct auto(US $14,980.00)

2007 chrysler 300 leather cruise ctrl alloy wheels 20k texas direct auto(US $14,980.00) 2008 chrysler pt cruiser automatic cd audio only 60k mi texas direct auto(US $8,980.00)

2008 chrysler pt cruiser automatic cd audio only 60k mi texas direct auto(US $8,980.00) Htd leather power hard top touch screen phone warranty net direct autos texas(US $24,988.00)

Htd leather power hard top touch screen phone warranty net direct autos texas(US $24,988.00)

Auto Services in Kansas

Toy Techs ★★★★★

Tire & Wheel ★★★★★

Sigg Motors ★★★★★

Shields Motor Co Inc ★★★★★

Ripley`s Automotive ★★★★★

RIGHT NOW ROADSIDE SERVICE ★★★★★

Auto blog

Editors' Picks March 2021 | Ford Mustang Mach-E, Polestar 2, Land Rover Defender and more

Thu, Apr 8 2021The month of March was unofficial minivan month here at Autoblog. We drove all of them but the Kia Carnival, but don’t worry, you wonÂ’t have to wait much longer to read that review. Among all the family-toting machines, we drove some more exciting vehicles including the Land Rover Defender and a pair of up-and-coming EVs. It was a month of excellent cars, meaning that this monthÂ’s litter of EditorsÂ’ Picks is stacked. In case you missed FebruaryÂ’s picks, hereÂ’s a quick refresher on whatÂ’s going on here. We rate all the new cars we drive with a 1-10 score. Cars that are exemplary or stand out in their respective segments get EditorsÂ’ Pick status. Those are the ones weÂ’d recommend to our friends, family and anybody whoÂ’s curious and asks the question. The list that youÂ’ll find below consists of every car we rated in March that earned the honor of being an EditorsÂ’ Pick. 2021 Ford Bronco Sport 2021 Ford Bronco Sport First Edition View 32 Photos Quick take: Ford's baby Bronco is an authentic foil to the big Bronco 2-Door and 4-Door. It brings rugged styling, better-than-average off-road capability and thoughtful utility features to a generic segment of cars. Score: 8 What it competes with: Jeep Compass, Jeep Cherokee, Mazda CX-30, Subaru Crosstrek, Kia Seltos, Chevrolet Trailblazer Pros: Stellar design, excellent off-road, clever interior details throughout Cons: Pricier than most, average transmission, underwhelming interior quality and ambiance in lowest trims From the editors: Road Test Editor Zac Palmer — “I genuinely enjoy driving this cute crossover. It feels like a mini truck on the road, and Ford admirably translated the design from its big Bronco over to this Escape-based crossover. News Editor Joel Stocksdale — "The Bronco Sport isn't perfect, the transmission could use some work, and it's a little bumpy, but it's a characterful little thing with loads of style, great visibility and space, and impressive capabilities on and off road in the powerful Badlands form." In-depth analysis: 2021 Ford Bronco Sport Review | Bronco for the masses  2021 Land Rover Defender 2021 Land Rover Defender 110 View 64 Photos Quick take: The Land Rover Defender provides everything you'd hope for in a modern Land Rover: superlative off-road capability, surprisingly plush on-road demeanor, abundant interior space and abundant character. The base four-cylinder is likely all you'll need and lower trim levels provide more than enough equipment.

Chrysler and Google launch virtual 200 factory tour [w/video]

Tue, 23 Sep 2014Google is no stranger to showing off some of the most interesting automotive destinations in the world, like the museums for Lamborghini and Ducati, or even a Tesla showroom. However, it's taking that technology even further with a new, in-depth look of the Sterling Heights Assembly Plant where the Chrysler 200 is made. Unlike these earlier online excursions, the new Chrysler factory tour is a fully guided experience that includes several 360-degree videos explaining many parts of the production process.

"Just as we pioneered a completely new Chrysler 200, we are pioneering a new way for consumers to research a vehicle. The Factory Tour is an opportunity for us to prove to consumers that the all-new 2015 Chrysler 200 is not one ever built before," said Olivier Francois, Chrysler's chief marketing officer, in the company's release.

Chrysler was already pretty proud of its nearly $1 billion in recent updates to the Sterling Heights factory having released a look at the 200's assembly process earlier this year. However, the new Google tour goes far deeper by including 12 videos, and between highlighted stops, viewers can swing the camera all over to get a full view of the action. The whole thing is an intriguing way to show the way a modern car gets built.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.