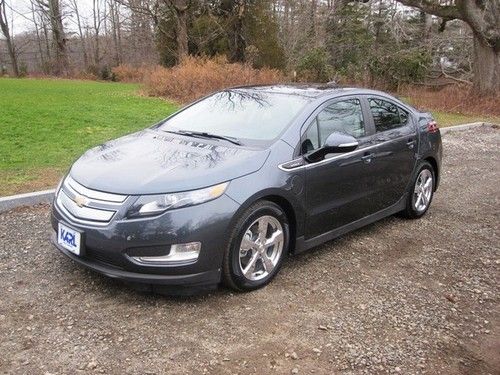

2013 Chevrolet Volt - $35,990 Includes $2000 Rebate + 0% Wac X 72 Months on 2040-cars

Greenville, South Carolina, United States

Vehicle Title:Clear

Engine:1.4

Fuel Type:Hybrid-Electric

For Sale By:Dealer

Number of Cylinders: 4

Make: Chevrolet

Model: Volt

Warranty: Vehicle has an existing warranty

Trim: volt

Options: CD Player

Drive Type: front wheel drive

Safety Features: Anti-Lock Brakes, Driver Airbag, Side Airbags

Mileage: 10

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Exterior Color: Silver

Interior Color: Black

Chevrolet Volt for Sale

2012 chevrolet volt premium(US $34,927.00)

2012 chevrolet volt premium(US $34,927.00) 2012 chevrolet volt base hatchback 4-door 1.4l(US $28,500.00)

2012 chevrolet volt base hatchback 4-door 1.4l(US $28,500.00) 2012 chevrolet volt 5dr hb

2012 chevrolet volt 5dr hb $12000 demo discount! 4000 miles*can export*nav*leather(US $32,575.00)

$12000 demo discount! 4000 miles*can export*nav*leather(US $32,575.00) Red, electric, save on gas!! rear back up camera, we finance!!!!

Red, electric, save on gas!! rear back up camera, we finance!!!! 2012 chevrolet volt premium package brand new untitled rear cam white diamond

2012 chevrolet volt premium package brand new untitled rear cam white diamond

Auto Services in South Carolina

X-Treme Audio Inc ★★★★★

Window Tinting by David Fields Tires And Brakes ★★★★★

Whetzels Automotive, Inc ★★★★★

Volkswagen Of South Charlotte ★★★★★

T & W Motors ★★★★★

T & W Motors ★★★★★

Auto blog

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

Bentley Continental GT V8 and Toyota 4Runner | Autoblog Podcast #604

Fri, Nov 15 2019In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski and Senior Editor, Green, John Beltz Snyder. First, they talk about driving the 2020 Bentley Continental GT V8 First Edition, followed by the 2020 Toyota 4Runner TRD Off-Road. Then they revive a format called "This or That," discussing the Jeep Wrangler vs. Gladiator, Subaru Forester vs. Outback, Mustang vs. Camaro vs. Challenger, and whether they'd rather spend $25,000 on a new or vintage car. They've got an update on a previous Spend My Money segment, and, finally, they help another listener pick a daily driver. Autoblog Podcast #604 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2020 Bentley Continental GT V8 2020 Toyota 4Runner This or That: Jeep Gladiator or Jeep Wrangler Subaru Forester or Subaru Outback Ford Mustang, Chevy Camaro or Dodge Challenger Vintage car or new car Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Podcasts Bentley Chevrolet Dodge Jeep Subaru Toyota Truck Coupe SUV Luxury Off-Road Vehicles Performance Classics

How Chevy Silverado, GMC Sierra will take on the Ford F-150 profit machine

Fri, Aug 10 2018FORT WAYNE, Ind. — When General Motors engineers were developing the 2019 Chevrolet Silverado and GMC Sierra pickup trucks, some of them joined public tours of Ford's Dearborn, Mich., factory to watch aluminum-bodied F-Series trucks go down the assembly line. The redesign of the Ford F-Series trucks, launched in 2014, set a new standard for fuel economy and lightweight vehicle construction. But armed with stopwatches and trained eyes, the GM engineers believed they saw problems. "They had a real hard time getting those doors to fit," Tim Herrick, the executive chief engineer for GM truck programs, told Reuters. His team did more intelligence gathering. They bought and tore apart Ford F-Series doors sold as repair parts. Their conclusion: GM could cut weight in its trucks for a lower cost using doors made of a combination of aluminum and high-strength steel that could be thinner than standard steel, shaving off kilograms in the process. These pounds-and-pennies decisions will have major implications in the highest-stakes game going in Detroit: dominance in the world's most profitable vehicle market, the gasoline-fueled large pickup segment. What's more, GM is banking on strong sales of overhauled 2019 Silverados and GMC Sierras to fund its push into automated and electric vehicles — a business many investors see as the auto industry's long-term future. The risks are high given the hits automakers have taken from U.S. President Donald Trump's trade policies. Rising aluminum prices spurred by Trump's tariffs are driving up costs on the Ford's F-Series, while rising steel and aluminum prices likewise drag on GM results. GM also has a significant risk should the United States, Mexico and Canada fail to agree on a new NAFTA trade deal, given GM trucks built at its Silao, Mexico, factory could face a 25 percent tariff if NAFTA collapses. Major profit per truck Interviews with GM executives and a tour at its factory here in northwest Indiana provide a detailed look inside GM's plan for the most important vehicles in its global lineup. These big pickups are everything Tesla's Model 3 or Chevy's Bolt electric car is not. The mostly steel body is bolted to the truck's steel frame, rather than the one-piece body and frame electric vehicles. The majority of trucks will have a V-8 gasoline engine powering the rear wheels — like the classic GM cars of the 1950s. Some Silverados will have new four-cylinder engines, but there is no electric or hybrid offering as of now.