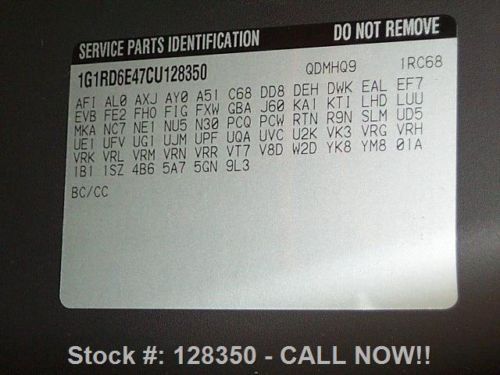

2012 Chevy Volt Premium Hybrid Electric Leather Nav 9k Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Vehicle Title:Clear

Engine:See Description

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Certified pre-owned

Year: 2012

Make: Chevrolet

Warranty: Vehicle has an existing warranty

Model: Volt

Trim: Base Hatchback 4-Door

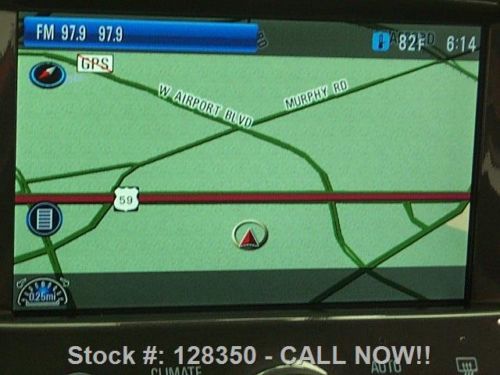

Options: Leather, CD Player

Power Options: Power Windows, Power Locks, Cruise Control

Drive Type: FWD

Mileage: 9,662

Sub Model: REARVIEW CAM

Number Of Doors: 4

Exterior Color: Black

Inspection: Vehicle has been inspected

Interior Color: Black

CALL NOW: 281-854-2539

Number of Cylinders: 4

Seller Rating: 5 STAR *****

Chevrolet Volt for Sale

2013 chevy volt hybrid gas/electric mylink alloys 16k texas direct auto(US $20,980.00)

2013 chevy volt hybrid gas/electric mylink alloys 16k texas direct auto(US $20,980.00) 2013 chevy volt hybrid electric mylink bluetooth 25k mi texas direct auto(US $20,780.00)

2013 chevy volt hybrid electric mylink bluetooth 25k mi texas direct auto(US $20,780.00) 5dr hb 1.4l onstar cd 1-speed a/t abs a/c alloy wheels(US $22,995.00)

5dr hb 1.4l onstar cd 1-speed a/t abs a/c alloy wheels(US $22,995.00) 4 door hydrid electric mpg chrome volt camry chevy

4 door hydrid electric mpg chrome volt camry chevy Clean carfax one owner siriusxm remote keyless entry alloy wheels

Clean carfax one owner siriusxm remote keyless entry alloy wheels Clean carfax one owner remote keyless entry alloy wheels cruise control

Clean carfax one owner remote keyless entry alloy wheels cruise control

Auto Services in Texas

World Tech Automotive ★★★★★

Western Auto ★★★★★

Victor`s Auto Sales ★★★★★

Tune`s & Tint ★★★★★

Truman Motors ★★★★★

True Image Productions ★★★★★

Auto blog

Want a V8 on the cheap? Buy a work truck

Thu, Aug 3 2017In case you didn't notice, V8 cars have gotten pretty expensive. If you want a modern muscle car like the Dodge Challenger R/T, Ford Mustang GT, or Chevy Camaro SS, you'll need between $34,000 and $38,000 for a stripped out example of one. The cheapest of those is the Challenger, and the priciest is the Camaro. These are also the cheapest V8 cars the companies offer. But if you absolutely have to have a V8 for less, there is an option, work trucks. As it turns out, all of the Big Three offer their most basic work trucks with V8s. And because they're so basic, they're pretty affordable, especially when sticking with the standard two-wheel drive. A Ram 1500 Tradesman with a V8 can be had for as little as $29,840, which is a little more than $4,000 less than a Challenger R/T. For a bit more at $30,275, you can have a Chevy Silverado W/T, almost $8,000 less than a Camaro SS. The most expensive is the V8 Ford F-150 starts at a starting price of $30,670, which is a bit over $5,000 less than the Mustang. Of course you'll be in an ultra bare bones vehicle with few comforts, and the price will go up if you add stuff, but we're bargain hunting here, and sacrifices are sometimes necessary. Besides, what you lose in comfort, you gain in loads of cargo space and towing (try to look at the bright side). Also, as a side note, all three trucks are available with optional electronic locking rear differentials. At the discounted price of these trucks, you still get a heaping helping of power. The most potent of the trio is the Ram 1500 Tradesman with 395 horsepower and 410 pound-feet of torque generated by a 5.7-liter V8. Compared with the Challenger R/T, the Ram is up by 20 horsepower and they're tied for torque. The value proposition is even more stark between the two vehicles when looking at the price per horsepower. Each pony in the Ram costs $75.54, while the Challenger charges you $90.91. The Challenger is also more expensive per horsepower than its close competitors. The F-150's 5.0-liter V8 is just barely behind the Ram with 395 horsepower and 400 pound-feet of torque. That's still more power than the Challenger, and it matches the torque of the 2017 Mustang GT. On the down side, it still would be down 20 horsepower on that same 2017 Mustang, and it's behind by 60 horsepower and 20 pound-feet on the new 2018 Mustang GT. The F-150 also just edges out the Mustang in the dollar per horsepower measure.

Next Chevrolet Malibu to have 'groundbreaking,' 'passionate' design

Mon, Dec 29 2014In our First Drive of the Chevrolet Malibu after its redesign in 2013 we wrote, "Chevy has quickly worked up a host of changes for its ever-important midsize sedan, and will be launching this 'there, we fixed it' 2014 Malibu like it's an all-new product." Still, no one cared. The Malibu has been mentioned in eight posts this year, all but two of them dealt with recalls, and one of those two was about a 2011 Malibu university science project. It came up in precisely zero posts from November 2013 to March 2014. That's why, according to a report in Automotive News, Chevrolet honchos are "hustling" to have a new Malibu ready in a year. Mark Reuss, General Motors' head of global product development, said it will have "groundbreaking design" and "groundbreaking technology," and asked investors who were showed a picture of it, "When is the last time you saw a [midsize] car this distinctive and this dramatic from General Motors?" Doubling down on the bullishness, Reuss said, "We've got our act together here on the midsize-car segment." Then, throwing every last chip on the pile, global design head Ed Welburn said the next Malibu's design will "make a significant statement" with "a very passionate design." Based on the number of comments Malibu posts get, we figure a fair few number of you would love for this to be the case; yet this is a lot of braggadocio to slather on a car that probably hasn't made "a significant statement" since Elton John had a number one record with Honky Chateau. That was 1972, if you're trying to remember. No matter the looks, the AN report says the new 'Bu will make a profit statement, selling for more money while costing less to produce. Alongside the Cruze, GM figures the pair will bring in an extra $800 million in variable profit in 2016. Which, in case it ends up being another 'butterface,' isn't bad for a silver lining. Featured Gallery 2014 Chevrolet Malibu: First Drive View 36 Photos News Source: Automotive New - sub. req. Design/Style Chevrolet GM Sedan

Expect greater differentiation in GM's next-generation SUVs

Thu, 03 Jan 2013General Motors says its next-generation Chevrolet Tahoe, Suburban, GMC Yukon and Cadillac Escalade models will offer shoppers improved interior differentiation. Car and Driver recently caught up with Chris Hilts, GM's creative manager of interior design, who said that the cabins will all feature unique instrument panels, consoles, center stacks and switchgear moving forward. Apparently GM is now aware that consumers may be bothered by the fact that today's $85,000 Escalade has effectively the same cabin as a $45,000 Tahoe. Hilts says SUV buyers want more refinement than their pickup purchasing counterparts - and those same buyers also want their SUVs to have more exterior differentiation between the company's Silverado and Sierra pickup lines. Shocking.

That all sounds good to us, but we've heard this song and dance before. GM made big waves about how different the new-for-2013 Silverado and Sierra would look from each other, but judging by what we've seen so far, GM's stylists are painting in shades rather than with the full spectrum. For more on the what to expect out of GM's new SUVs, click on the C/D link below.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.178 s, 7900 u