2000 Chevy Tahoe Z71 4x4 79k No Rust No Reserve! on 2040-cars

Silver Spring, Maryland, United States

|

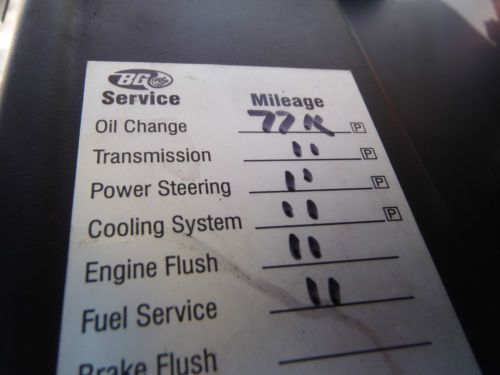

I am an Ebay seller since 2003 2000 Chevy Tahoe Z71 4X4 Only 79K and No Rust! Stop looking. This is about as good as they get for this age group. A Beautiful Tahoe with no rust and low mileage! 79K miles is only 6K per year. That is less then half of the average mileage of a 13 year old vehicle. The pictures speak for them selves. This SUV will be sold with NO RESERVE. The top bidder will get this Tahoe. I drove this Tahoe all week and it handled like a charm. No surprises.

|

Chevrolet Tahoe for Sale

2011 chevy tahoe lt 4x4 lift sunroof nav dvd 20" wheels texas direct auto(US $38,780.00)

2011 chevy tahoe lt 4x4 lift sunroof nav dvd 20" wheels texas direct auto(US $38,780.00) 2008 used 5.3l v8 16v automatic rwd suv premium onstar

2008 used 5.3l v8 16v automatic rwd suv premium onstar 2010 chevy tahoe ltz 7pass sunroof nav rear cam dvd 37k texas direct auto(US $37,980.00)

2010 chevy tahoe ltz 7pass sunroof nav rear cam dvd 37k texas direct auto(US $37,980.00) 2003 chevrolet tahoe z71 sport utility 4-door 5.3l(US $10,000.00)

2003 chevrolet tahoe z71 sport utility 4-door 5.3l(US $10,000.00) 2003 chevrolet tahoe z71 package

2003 chevrolet tahoe z71 package Moonroof park tow 3rd row leather one owner non smoker clean carfax we finance(US $17,700.00)

Moonroof park tow 3rd row leather one owner non smoker clean carfax we finance(US $17,700.00)

Auto Services in Maryland

Wes Greenway`s Waldorf VW ★★★★★

star auto sales ★★★★★

Singer Auto Center ★★★★★

Prestige Hi Tech Auto Service Center ★★★★★

Pallone Chevrolet Inc ★★★★★

On The Spot Mobile Detailing ★★★★★

Auto blog

GM recalling 316k vehicles due to headlamp faults

Mon, Dec 1 2014General Motors has announced a recall covering 316,357 vehicles globally, due to the possibility of sporadic or permanent failure of the low-beam headlamps. 273,182 of these vehicles are in the United States, while the remaining affected units are in Canada, Mexico, and elsewhere. This recall includes the 2006-09 Buick LaCrosse (pictured above), 2006-07 Chevy TrailBlazer and TrailBlazer EXT, 2006-07 GMC Envoy and 2006 GMC Envoy XL, 2006-07 Buick Rainier, 2006-08 Saab 9-7X, and 2006-08 Isuzu Ascender. In an email sent to Autoblog, General Motors explains that if the headlamp driver modules are not functioning correctly, "the low-beam headlamps and daytime running lamps could intermittently or permanently fail to illuminate." GM states that this problem does not affect things like high-beams, turn signals, marker lamps, or foglamps. As of this writing, GM states it "has not been able to confirm whether the HDMs in these vehicles caused any vehicle accidents." The National Highway Traffic Safety Administration has been notified, but the recall has not yet posted to the government agency's website. Scroll down to read the full details in GM's email. General Motors is recalling 273,182 Buick LaCrosse sedans and Chevrolet, GMC, Buick, Saab and Isuzu midsize SUVs in the U.S. for possible intermittent or permanent loss of low beam headlamps. Affected models are: 2006-2009 Buick LaCrosse sedans; 2006-2007 Chevrolet TrailBlazer and 2006 TrailBlazer EXT; 2006-2007 GMC Envoy and 2006 Envoy XL; 2006-2007 Buick Rainier; 2006-2008 Saab 9-7X and 2006-2008 Isuzu Ascender midsize SUVs. If the headlamp driver modules is not operating correctly, the low-beam headlamps and daytime running lamps could intermittently or permanently fail to illuminate. This condition does not affect the high-beam headlamps, marker lamps, turn signals, or fog lamps. GM has not been able to confirm whether the HDMs in these vehicles caused any vehicle accidents. The total population, including the U.S., Canada, Mexico and exports from North America is 316,357. The NHTSA was sent the Part 573 information for this recall on November 25. It has not yet posted to the NHTSA website. Featured Gallery 2008 Buick LaCrosse CXS News Source: General Motors Recalls Buick Chevrolet GM GMC Isuzu Saab SUV Sedan chevy trailblazer buick rainier isuzu ascender

Watch this week's Top Gear America used-car challenge

Sat, Sep 9 2017Top Gear America is back for the penultimate episode of the first season. Used car challenges were some of the highlights of the original UK edition. In our exclusive clip, Tom Ford, Antron Brown and William Fichtner run their $7,000 sports cars in a drag race. As expected, the trio chose very different cars for the challenge. Watch the video to see if a Subaru WRX's all-wheel drive can overcome a power deficit to beat a Ford Mustang and a Chevy Corvette. Brown and Fichtner also spend some time relaxing with an old Jeep Wagoneer. Like them, we're really hoping Jeep will bring back the Wagoneer nameplate. Brown also drives a Maserati Levante, proving that not all family cars need be boring. This week's guest star is actor, rapper and former host of Pimp My Ride, Xzibit. Top Gear America airs Sundays at 8 p.m. Eastern on BBC America. Related Video: Celebrities TV/Movies Chevrolet Ford Subaru Top Gear exclusive top gear america

Camaro driver clocked at 171 miles per hour

Wed, Apr 13 2016Chevy's 2016 Camaro SS is a fantastic piece of automotive engineering. It is also, apparently, very, very fast. This latter fact was perfectly illustrated when, on April 8, a Camaro SS driver was nailed in Two Harbors, Minnesota for doing 171 mph. According to WFAA, the unnamed speed demon was flying down Highway 61 near Two Harbors when Hermantown, MN Deputy Police Chief Shawn Padden clocked him at an eye-watering 171 mph. He then recorded the speeder at 168 and 141. At the time, Deputy Chief Padden was working with Minnesota State Patrol on an anti-DWI program called "Toward Zero Deaths". Padden, who was interviewed by the Duluth News Tribune, said he was surprised at the driver's sheer speed. "When he went by me, it was a blur," Padden told the News. "You get used to seeing people going 65 or 70 and what that looks like. But I've never seen anything like this. It's like a rocket on wheels." Fadden chased the Camaro down eventually, but it took some doing. To catch the Camaro, he pushed his Dodge Charger Pursuit to 135 mph just to get into range so the Camaro could see his emergency lights. The speeding driver was ticketed for careless driving, but may lose his license due to a Minnesota law that gives courts the option of revoking licenses for drivers caught doing more than 100 mph. News Source: WFAA, Duluth News Tribune Weird Car News Chevrolet Dodge Driving Safety Coupe Police/Emergency Performance Sedan camaro ss camaro