2014 Chevrolet Suburban 1500 Lt on 2040-cars

1117 State Route 32, Batavia, Ohio, United States

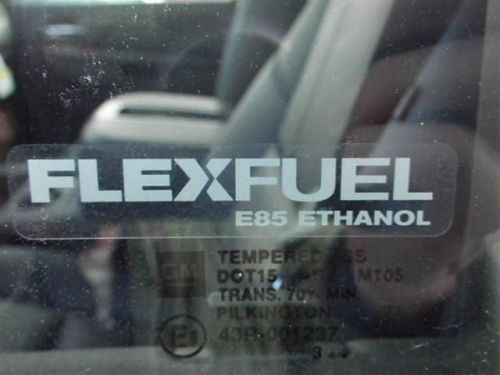

Engine:5.3L V8 16V MPFI OHV

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1GNSKJE78ER215523

Stock Num: A35945

Make: Chevrolet

Model: Suburban 1500 LT

Year: 2014

Exterior Color: Silver Ice Metallic

Interior Color: Ebony

Options: Drive Type: 4WD

Number of Doors: 4 Doors

Need gas? I don't think so. At least not very much! 21 MPG Hwy! 4 Wheel Drive!!!4X4!!!4WD... Safety Features Include: ABS, Traction control, Curtain airbags, Passenger Airbag...Relax in the comfort of features like: Leather seats, Bluetooth, Power locks, Power windows, Heated seats...

Chevrolet Suburban for Sale

2014 chevrolet suburban ltz(US $67,385.00)

2014 chevrolet suburban ltz(US $67,385.00) 2014 chevrolet suburban ltz(US $65,095.00)

2014 chevrolet suburban ltz(US $65,095.00) 2013 chevrolet suburban ltz(US $50,000.00)

2013 chevrolet suburban ltz(US $50,000.00) 2002 chevrolet suburban lt(US $4,988.00)

2002 chevrolet suburban lt(US $4,988.00) 2011 chevrolet suburban 1500 ltz(US $40,000.00)

2011 chevrolet suburban 1500 ltz(US $40,000.00) 2015 chevrolet suburban 1500 ls(US $51,590.00)

2015 chevrolet suburban 1500 ls(US $51,590.00)

Auto Services in Ohio

West Chester Autobody Inc ★★★★★

West Chester Autobody ★★★★★

USA Tire & Auto Service Center ★★★★★

Trans-Master Transmissions ★★★★★

Tom & Jerry Auto Service ★★★★★

Tint Works, LLC ★★★★★

Auto blog

GM and Isuzu to partner for medium-duty commercial truck

Tue, Jun 16 2015General Motors is returning to the medium-duty truck business in the US for the first time since 2009 thanks to a new deal with longtime-partner Isuzu. The arrangement brings the Isuzu N-series models to Chevrolet dealers with the Bowtie's branding on them in 2016. There are six medium-duty Chevy models arriving at dealers in regular cab and crew cab bodies: the 3500, 3500HD, 4500, 4500HD, 5500, and 5500HD. The trucks will be sold as a bare chassis for buyers to outfit to their needs. Depending on model, customers will have the choice of an Isuzu-sourced 3.0-liter and 5.2-liter diesel engines or a 6.0-liter V8 gasoline-fueled engine from GM and six-speed gearbox. According to company spokesperson Bob Wheeler to Autoblog, the diesel models will be built in Japan and the rest assembled from knockdown kits in Charlotte, MI. This kind of vehicle sharing isn't uncommon for GM in the commercial segment, and it already partners with Nissan to use the Japanese brand's NV200 as the City Express van. The General also once owned a significant stake in Isuzu, and the two have remained collaborators even since then. Isuzu and GM Enter Commercial Vehicle Collaboration Agreement in the U.S. 2015-06-15 DETROIT and FUJISAWA, Japan – General Motors Co. (NYSE: GM) and Isuzu Motors (TSE 7202) have reached an agreement on a U.S. commercial vehicle collaboration, allowing Isuzu to strengthen its product lineup and GM to expand its commercial vehicle portfolio. Isuzu will produce low cab forward models for GM, based off of the Isuzu N-Series. The vehicles will be distributed by participating Chevrolet dealers in the U.S. market starting in 2016. To strengthen the product lineup, GM and Isuzu will explore the use of GM commercial vehicle components for Isuzu low cab forward trucks and GM will continue to produce and supply the 6.0L V-8 gas engine and six-speed transmission for Isuzu gasoline-powered low cab forward trucks. Isuzu and GM have maintained a strategic partnership for more than 40 years, producing collaborative business opportunities throughout the world. This agreement continues that tradition and reinforces a long-term relationship that helps to explore future collaborations in the U.S. commercial vehicle business. About General Motors General Motors Co. (NYSE:GM, TSX: GMM) and its partners produce vehicles in 30 countries, and the company has leadership positions in the world's largest and fastest-growing automotive markets.

No diesels in the running for 2016 Green Car Of The Year

Thu, Oct 15 2015It's a new era for the Green Car Of The Year. In the past, the theme of the award was to take a broad look at alternative powertrains and pick the best among them. "Clean diesels" from the Volkswagen group were often among the finalists and won the award twice. For the 2016 edition - which will be handed out at the LA Auto Show next month - not a single diesel made the list. There's little wonder why. Green Car Journal, which names the winner with a panel of experts, had to strip two VW brand vehicles of their past wins. The 2009 VW Jetta TDI, which won in 2008, and the 2010 Audi A3 TDI, which won in 2010, have both lost their titles now that the world knows about the "defeat devices" that VW installed in many of its TDI vehicles around the world. So, what does that leave us with for 2016? Two plug ins, a hybrid, and two gas vehicles. The two electric vehicle are the Audi A3 e-tron and the Chevy Volt, while the all-new Toyota Prius (which will come with a plug-in version later) is the lone pure hybrid. Rounding out the pack are two efficient gas models: the Hyundai Sonata and the Honda Civic. This is the tenth year for the Green Car Of The Year, and it will be interesting to see if diesels can come back into the award's good graces (for the record, no diesels were among the finalists in 2013, either) in the future. For now, we'd like to know who you think should win. You can read more about the finalists in the press release below and then cast your vote in our poll. Show full PR text FINALISTS ANNOUNCED FOR 2016 GREEN CAR OF THE YEAR Green Car Journal to Reveal Winner of 11th Annual Award at LA Auto Show Press & Trade Days, November 19 LOS ANGELES, CA (October 15, 2015) – Green Car Journal has announced its five finalists for the magazine's prestigious 2016 Green Car of the Year® award. The 2016 models include the Audi A3 e-tron, Chevrolet Volt, Honda Civic, Hyundai Sonata, and Toyota Prius. An increasing number of vehicle models are considered for the Green Car of the Year® program each year, a reflection of the auto industry's expanding efforts in offering new vehicles with higher efficiency and improved environmental impact. Green Car Journal has been honoring the most important "green" vehicles every year at the LA Auto Show, since its inaugural award announced at the show in 2005.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.