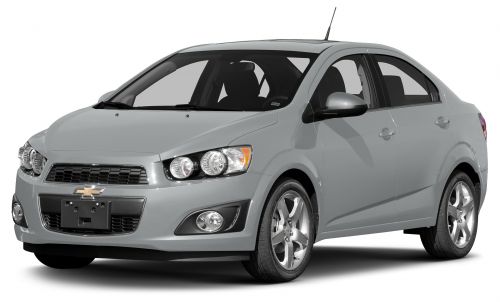

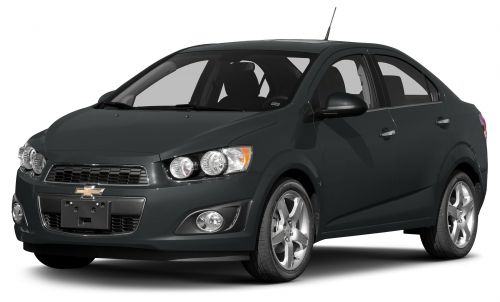

2014 Chevrolet Sonic Lt on 2040-cars

4135 East State Road 44, Wildwood, Florida, United States

Engine:1.8L I4 16V MPFI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1G1JC5SH2E4169571

Stock Num: C4638

Make: Chevrolet

Model: Sonic LT

Year: 2014

Exterior Color: Silver Ice Metallic

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 99

Please visit us at www.georgenahaschevrolet.com for a complete list of vehicles. We have many new, certified and pre owned vehicles to choose from. If you don't find what your looking for we can locate a vehicle for you. George Nahas Chevrolet 4135 E State Rd 44, Wildwood, FL 34785 Call 888-476-4941

Chevrolet Sonic for Sale

2014 chevrolet sonic lt(US $18,990.00)

2014 chevrolet sonic lt(US $18,990.00) 2014 chevrolet sonic lt(US $18,415.00)

2014 chevrolet sonic lt(US $18,415.00) 2013 chevrolet sonic ls(US $13,900.00)

2013 chevrolet sonic ls(US $13,900.00) 2014 chevrolet sonic lt(US $17,072.00)

2014 chevrolet sonic lt(US $17,072.00) 2014 chevrolet sonic lt(US $17,372.00)

2014 chevrolet sonic lt(US $17,372.00) 2012 chevrolet sonic 1lt(US $12,915.00)

2012 chevrolet sonic 1lt(US $12,915.00)

Auto Services in Florida

Z Tech ★★★★★

Vu Auto Body ★★★★★

Vertex Automotive ★★★★★

Velocity Factor ★★★★★

USA Automotive ★★★★★

Tropic Tint 3M Window Tinting ★★★★★

Auto blog

Chevy Bolt will go into production in Michigan in 2016 [UPDATE]

Fri, Feb 6 2015While nothing official has been announced, it appears that General Motors may actually put the all-electric Chevy Bolt into production next year. That's the rumor that Reuters is reporting, citing two sources at suppliers for the upcoming $30,000 EV (although that $30,000 number bears some scrutiny). This rumor does fit in with earlier comments that the Bolt would arrive on the market in 2017. If it gets built, the Bolt will share more than a similar-sounding name with the Chevy Volt: the EV will be put together in metro Detroit. Reuters says the 200-mile electric car (and an Opel version) will be made in "an underused small-car plant north of Detroit," which means the Orion Township plant. GM could make between 25,000 and 30,000 Bolts a year there, if what the suppliers are saying is true. We have asked GM for a statement on this story and will update it if we hear back. UPDATE: General Motors manager of electrification technology communications, Kevin Kelly, told AutoblogGreen that, "Bolt EV Concept is just that – a concept. We're currently evaluating the vehicle program, but do not have any production announcements to make at this time."

Weekly Recap: Electric Rapide concept showcases Aston's future

Sat, Oct 24 2015Aston Martin showed off an all-electric Rapide S prototype this week and announced an agreement with investment firm ChinaEquity to explore development of a production version of the sports sedan. The car could arrive in about two years if the project advances, and it would be built in Gaydon, England. The concept car, called the "RapidE" was developed with Williams Advanced Engineering. The electric Rapide is meant to highlight British innovation, and it was revealed during a state visit by Chinese president Xi Jinping to the United Kingdom. Spec were not available for the concept on display. "The car we showed in London is a fully running concept but not yet defining [of] our choice of battery, motor, inverter, etc," spokesman Simon Sproule said. "Now that we have a clearer path for producing the car, we will be defining all the parameters." Aston Martin has been vocal about its electric ambitions this year, and Sproule told us at the New York Auto Show that an all-electric Rapide could cost $200,000 to $250,000 or more. "It's a study, but we're serious about it," he said. Some reports have indicated the electric Rapide could pack as much as 1,000 horsepower. Aston considers electric technology the strongest play for modernizing its powertrains and meeting emissions standards around the world. Hybrids and all-electric models can offer high outputs and strong torque delivery, which is in keeping with the Aston's image as a sportscar maker. Company brass prefer this option over dropping down to four-cylinder engines. And yes, V8s and V12s remain part of the plan. The electric push is part of Aston's future strategy to remake its lineup, which includes refreshing its sportscars, building a production version of the electric all-wheel-drive DBX concept shown at the Geneva Motor Show, and adding a four-door Lagonda. OTHER NEWS & NOTES Domino's serves up purpose-built delivery car Domino's revealed a purpose-built pizza delivery car based on the Chevy Spark. It's called the DXP, for Delivery Expert, and it can handle up to 80 pizzas. The pies stay warm thanks to an oven located behind the driver's seat, and the DXP is sauced up with a puddle-lighting feature that projects the Domino's logo outside of the car. Power comes from the Spark's stock 1.2-liter four-cylinder engine rated at 84 hp that gets up to 39 mpg on the highway. Chevy dealers will be trained to service the DXP.

Buick Velite is a not-so-Volt-like plug-in hybrid concept for China

Mon, Nov 7 2016Is the Buick Velite a Volt by any other name? That's a question worth asking after General Motors said that the Buick Velite concept vehicle will make its global debut at the Guangzhou Auto Show later this month. GM says the car "will provide a template for upcoming models being launched under the Buick Blue new energy vehicle strategy." Whether that means the Velite is a variant of the second-generation of the Chevrolet Volt extended-range plug-in is open to interpretation. Some automotive publications, including Autoweek, are saying that's the case, but GM China doesn't mention the Volt in its press release, only saying that the car is a "high-performance" plug-in hybrid vehicle. As we know, GM doesn't use the "PHEV" descriptor for the Volt, which makes us thing the Velite's powertrain is more like the Cadillac CT6 PHEV. Either way, the concept was developed by the Pan Asia Technical Automotive Center (PATAC), which is a joint venture between GM and Shanghai-based SAIC. As far as the name, GM has been shopping the Velite moniker around for a while now. The automaker first used Buick Velite for the convertible concept vehicle it showed off at the 2004 New York Auto Show. More recently, GM in 2014 filed to use the name for the US variant of its Opel Cascada four-seat convertible model, which debuted in 2013. As for the second-generation version of the Volt, that model appears to be gaining favor in the US. Domestic sales of the Volt through October have surged 64 percent from a year earlier to more than 18,500 units. The new version boosted its all-electric range by 40 percent to 53 miles while increasing its power output by 20 percent. Related Video: News Source: General Motors via Autoweek, Automotive News-sub.req. Green Buick Chevrolet Electric Hybrid PHEV buick velite