Leather Lt3 Lbz 2006 Silverado 2500 Diesel 4x4 6.6l Duramax Allison Bose on 2040-cars

Houston, Texas, United States

Vehicle Title:Clear

Fuel Type:Diesel

For Sale By:Dealer

Transmission:Automatic

Make: Chevrolet

Cab Type (For Trucks Only): Crew Cab

Model: Silverado 2500

Warranty: Unspecified

Mileage: 174,464

Sub Model: Crew Cab SB

Options: CD Player

Exterior Color: White

Power Options: Power Locks

Interior Color: Tan

Number of Cylinders: 8

Chevrolet Silverado 2500 for Sale

Pulling power! 07 chevy 2500hd 6.0 v8 crew 4x4! internet special pricing!(US $13,876.00)

Pulling power! 07 chevy 2500hd 6.0 v8 crew 4x4! internet special pricing!(US $13,876.00) Duramax-allison-new tires-htd pwr lthr-edge programmer-bose-dual zone ac-tx trk(US $13,999.00)

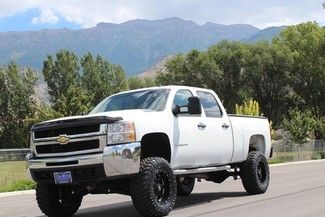

Duramax-allison-new tires-htd pwr lthr-edge programmer-bose-dual zone ac-tx trk(US $13,999.00) Lifted chevrolet silverado 2500 crew lt 4wd comparable submodel gmc sierra ton(US $23,900.00)

Lifted chevrolet silverado 2500 crew lt 4wd comparable submodel gmc sierra ton(US $23,900.00) 2008 chev silverado 2500hd crew cab lt 4x4 lift wheels tires duramax

2008 chev silverado 2500hd crew cab lt 4x4 lift wheels tires duramax 2500hd loaded. 4x4--- have original window sticker.

2500hd loaded. 4x4--- have original window sticker. 2011 chevy 2500hd 4x4 work truck great condition low mileage(US $23,500.00)

2011 chevy 2500hd 4x4 work truck great condition low mileage(US $23,500.00)

Auto Services in Texas

Yos Auto Repair ★★★★★

Yarubb Enterprise ★★★★★

WEW Auto Repair Inc ★★★★★

Welsh Collision Center ★★★★★

Ward`s Mobile Auto Repair ★★★★★

Walnut Automotive ★★★★★

Auto blog

How real is the Chevy Bolt EV and will it really cost $30,000?

Tue, Jan 13 2015"This is us bragging that we can do this kind of car." That's how Michael Simcoe, GM's executive director for NA exteriors, described the Chevy Bolt EV concept, which made a surprise appearance at the Detroit Auto Show today. While there was talk of a 2017 production debut, this is for sure a concept vehicle. But that means the ideas behind the vehicle are perhaps more important than the details. For example, no one is talking about what size battery might appear in a production Bolt, but Simcoe would talk about how rapid progress in battery improvements made it possible for GM to make the bold Bolt declaration that promises 200 miles and a price tag of around $30,000 (after incentives). But if the Bolt makes it to market, it won't be until 2017 (as rumored) or later, is it really fair to promote the car as being available with a federal tax credit? For one thing, credits for plug-in vehicles may change in the next few years, but if the laws stay the same, each manufacturer is limited to 200,000 vehicles before the credits start to decline. GM is justifiably proud that it's sold over 70,000 Volts thus far, but with a new model coming out later this year and a few years to go until the Bolt potentially arrives, GM could be pushing right up against that 200,000 limit when the Bolt goes on sale. But Volt executive chief engineer Pam Fletcher told AutoblogGreen that, "We're just trying to take some of the confusion out." "Think about talking to the average consumer," she said. "First, going through the explanation of how the federal tax credit was set up, how it's being used and so on. [In the industry, we] have the luxury of understanding the nuances of that regulation, but right now people who aren't in the marketplace, they don't have the luxury of all that. It's already hard to communicate the details so we gave them data in a way that is what they're used to seeing." There was one question that drove the two-year Bolt gestation and design period, Simcoe said: What does a better battery offer a vehicle designer? "We've got a number of spaces we play in for powertrain technology and obviously electrification is one of them," he said. "With Volt 1 and then the Spark EV, with that development and batteries getting better for us, we started doing some practical packaging to deliver a vehicle which was not the traditional aero form which you see around electric vehicles.

Michael Jordan's cars showcased in 'The Last Dance' documentary

Sun, May 10 2020After the masses begged and pleaded for an early release, ESPN finally unlocked the doors to the biggest production in company history last month. Episodes 1 and 2 of The Last Dance, a 10-part documentary special about Michael Jordan, the Chicago Bulls, and the 1997-1998 season, was released at last on April 19, 2020. Each week since, two new episodes have aired on Sunday nights, and the next two, episodes 7 and 8 are scheduled to drop this weekend on May 10. With unprecedented video access to MJ, who became averse to the media during his playing days, a byproduct from The Last Dance is a look at some of Jordan's cars. The Goat's taste ranges across a number of brands, but they all had one thing in common: performance as a top priority. Below, we have listed the rides that have already appeared in the series, and each week, we will update with new car cameos. Chevrolet Corvette C4 The photo above somewhat epitomizes one of the themes of The Last Dance. Everybody, whether that was men, women, children, franchise owners, reporters, coaches, teammates, or opponents, wanted a piece of Jordan. If that meant stopping in the middle of the road to get an autograph, then so be it. Around town, MJ was fairly easy to spot due to his flashy cars that occasionally wore Bulls red. Jordan has driven numerous Corvettes throughout the years, but the C4 is unique in that it was Chevy's top ride when Jordan signed an endorsement deal with the American company during his rookie year in 1984. Two famous photos, one in front of the Chicago skyline, show him standing next to a C4 with the license plate "Jump 23." This exact car, however, came later, as indicated by the squared-off taillights. He went on to star in a number of Chevrolet commercials with vehicles such as the Blazer and S-10 pickup truck. Chevrolet Corvette C5 The most notable Corvette His Airness ever owned was likely the C4 40th Anniversary ZR-1, but he also drove a C5 coupe at one point. Roughly nine minutes into the first episode, Jordan is seen driving the chrome-wheeled targa top into the parking lot at the Berto Center, the Bulls old practice facility.  Ferrari 550 Maranello Roughly three minutes into episode four, viewers get a glimpse of Jordan's exotic taste in the form of a red Ferrari 550 Maranello.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.