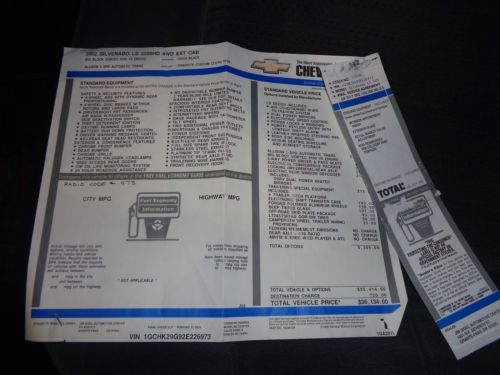

2002 Chevy Silverado Ls 2500hd 4wd Extra Cab Big Block Allison 5 Spd Auto on 2040-cars

Klamath Falls, Oregon, United States

Chevrolet Silverado 2500 for Sale

Chevy z71 duramax turbo 6.6l v8 32v 4wd onstar ltz bose sound system

Chevy z71 duramax turbo 6.6l v8 32v 4wd onstar ltz bose sound system 2004 chevy 2500hd truck(US $10,000.00)

2004 chevy 2500hd truck(US $10,000.00) 2009 chevy 2500hd diesel 4x4 lt z71 long bed leather crew cab 1 texas owner(US $27,885.00)

2009 chevy 2500hd diesel 4x4 lt z71 long bed leather crew cab 1 texas owner(US $27,885.00) 2006 chevy 2500hd 2wd 115812 miles

2006 chevy 2500hd 2wd 115812 miles 2002 chevrolet silverado 2500hd 4x4 duramax diesel extended cab truck.

2002 chevrolet silverado 2500hd 4x4 duramax diesel extended cab truck. 2004 chevrolet silverado 2500 hd w/t, cng, bi-fuel, 4x4

2004 chevrolet silverado 2500 hd w/t, cng, bi-fuel, 4x4

Auto Services in Oregon

Vic Alfonso Cadillac ★★★★★

T. B`s Oak Park Automotive ★★★★★

Sun Automotive ★★★★★

Seaport Auto Wholesale Inc ★★★★★

Schuck`s Auto Supply ★★★★★

Save On Tires ★★★★★

Auto blog

Watch this week's Top Gear America used-car challenge

Sat, Sep 9 2017Top Gear America is back for the penultimate episode of the first season. Used car challenges were some of the highlights of the original UK edition. In our exclusive clip, Tom Ford, Antron Brown and William Fichtner run their $7,000 sports cars in a drag race. As expected, the trio chose very different cars for the challenge. Watch the video to see if a Subaru WRX's all-wheel drive can overcome a power deficit to beat a Ford Mustang and a Chevy Corvette. Brown and Fichtner also spend some time relaxing with an old Jeep Wagoneer. Like them, we're really hoping Jeep will bring back the Wagoneer nameplate. Brown also drives a Maserati Levante, proving that not all family cars need be boring. This week's guest star is actor, rapper and former host of Pimp My Ride, Xzibit. Top Gear America airs Sundays at 8 p.m. Eastern on BBC America. Related Video: Celebrities TV/Movies Chevrolet Ford Subaru Top Gear exclusive top gear america

Compact SUV Comparison: Specs, pics and reviews of every brand's crossover

Wed, Jul 25 2018Honda CR-V vs Toyota RAV4. Chevy Equinox vs Ford Escape. Mazda CX-5 vs Subaru Forester. Whichever combinations of compact crossover SUV you're considering, there's probably a comparison test or chart out there to read. Heck, you can even create a three-car comparison yourself here at Autoblog. However, if you want a bunch of that information all in one convenient place, well, here it is. Our mega comparison of specs, features and photos of compact SUV entries from every mainstream manufacturer that sells them. That includes the 2018 Chevrolet Equinox, 2018 Ford Escape, 2018 GMC Terrain, 2018 Honda CR-V, 2018 Hyundai Tucson, 2019 Jeep Cherokee (it's already on sale with notable changes from 2018), 2018 Jeep Compass, 2018 Kia Sportage, 2018 Mazda CX-5, 2018 Mitsubishi Eclipse Cross (none of Mitsu's SUVs are perfect fits for this segment, so we deemed the MEC the most competitive fit), 2018 Nissan Rogue, 2018 Subaru Forester, 2018 Toyota RAV4 and 2018 Volkswagen Tiguan. We can update this comparison as more information about 2019 models is released, most notably the Forester and RAV4. Now, there are certainly some models that are smaller (Nissan Rogue Sport) or larger (Kia Sorento) that could also be considered, but we figured it was wise to stick with those in this sweet spot of comparable size and price. We also included links to Autoblog reviews, buying guides and smaller comparisons. Engines and Transmissions With rare exception, this segment features four-cylinder power. Sometimes it's turbocharged, often its not, but standard engine outputs are generally in the same ballpark. Therefore, we'd recommend focusing on torque output, as it's what will make a difference around town or when passing, and weighing that versus fuel economy (the Chevy Equinox, GMC Terrain, Honda CR-V and Mazda CX-5 make particularly strong cases in this regard). Many drivers aren't too fond of continuously variable transmissions (CVT), either, so that's another thing to consider and note during a test drive. As you can see, several models are available with performance upgrades. Besides the Jeep Cherokee's available V6, all are more powerful turbocharged four-cylinder engines. The exception to this would be the Honda CR-V and Ford Escape, as their 1.5-liter turbo engines don't prioritize performance. Instead, they serve as overall upgrades to the base naturally aspirated engines standard on only their base trim levels (CR-V LX and Escape S).

GM will make Chevy Volt production announcement tomorrow

Mon, Apr 7 2014Thing are apparently happening to get the next-generation Chevy Volt ready for public consumption. The most obvious proof is in a preview of an announcement (possibly coming tomorrow) that the two main places where General Motors gets the Volt ready -the Detroit-Hamtramck Assembly Plant and the Brownstown Township battery assembly facility - will be getting big money upgrades and lots of new positions. The Hamtramck plant builds the Volt and its fancier cousin, the Cadillac ELR, as well as the global versions of the Volt. The Detroit News reports that GM will add 1,400 jobs and spend roughly $450 million at the two locations in order to build the redesigned Volt. What's less clear is exactly what the updates will bring us. We've heard that the new volt will be a 2016 model and come on a new chassis. Speculation in The Detroit News about tomorrow's announcement runs the gamut from a new compact PHEV with less electric range and a lower price (which makes sense) to an updated Volt with more electric range (heard it before) to a new all-electric vehicle (the moon shot). If there's any hints to be gleaned in the international Volts, there are also reports coming in that the Opel brand will get an all-electric vehicle that is cheaper than the Ampera. Read into that what you will. We pestered GM's Kevin Kelly on the new Volt (again) and he said (again) that he couldn't give out any more detail other than what's been reported. He just told AutoblogGreen that there will be an announcement tomorrow and that it will be about the Hamtramck and Brownstown facilities and involve the Volt. So, stay tuned.