2015 Chevrolet Silverado 1500 1500 Lt on 2040-cars

Hobbs, New Mexico, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Engine:5.3L Gas V8

Body Type:Crew Cab Pickup

Vehicle Title:Clean

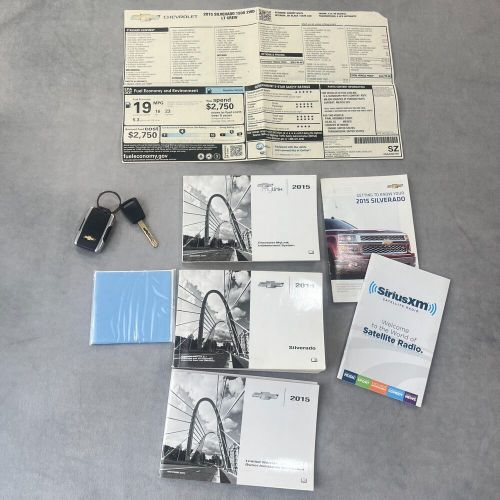

Year: 2015

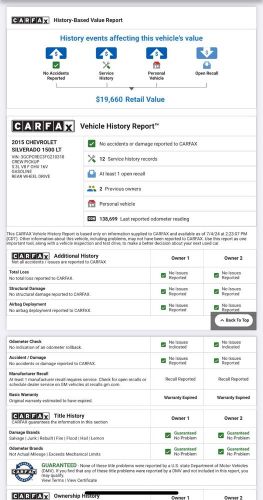

VIN (Vehicle Identification Number): 3GCPCREC3FG210318

Mileage: 142400

Interior Color: Gray

Previously Registered Overseas: No

Number of Seats: 5

Number of Previous Owners: 2

Horse Power: More Than 185 kW (247.9 hp)

Drive Side: Right-Hand Drive

Independent Vehicle Inspection: No

Engine Size: 5.3 L

Exterior Color: White

Car Type: Passenger Vehicles

Number of Doors: 4

Features: Air Conditioning, Alarm, Alloy Wheels, AM/FM Stereo, Automatic Headlamp Switching, Automatic Wiper, Auxiliary heating, CD Player, Climate Control, Cloth seats, Cruise Control, Electric Mirrors, Folding Mirrors, Navigation System, Parking Sensors, Power Locks, Power Seats, Power Steering, Power Windows, Seat Heating, Split Bench Seat, Tilt Steering Wheel, Tinted Rear Windows, Trailer Hitch, Truck Registration

Trim: 1500 LT

Number of Cylinders: 8

Make: Chevrolet

Drive Type: RWD

Fuel: gasoline

Date of 1st Registration: 20150917

Model: Silverado 1500

Chevrolet Silverado 1500 for Sale

2003 chevrolet silverado 1500 62k miles * 1-owner * v8 * 4x4 * stepside * beauty(US $11,500.00)

2003 chevrolet silverado 1500 62k miles * 1-owner * v8 * 4x4 * stepside * beauty(US $11,500.00) 1979 chevrolet silverado 1500(US $1,300.00)

1979 chevrolet silverado 1500(US $1,300.00) 2008 chevrolet silverado 1500 shortbox(US $10,000.00)

2008 chevrolet silverado 1500 shortbox(US $10,000.00) 2003 chevrolet silverado 1500(US $8,500.00)

2003 chevrolet silverado 1500(US $8,500.00) 2002 chevrolet silverado 1500(US $19,000.00)

2002 chevrolet silverado 1500(US $19,000.00) 1990 chevrolet silverado 1500(US $15,000.00)

1990 chevrolet silverado 1500(US $15,000.00)

Auto Services in New Mexico

Venegas & Sons Auto Upholstery ★★★★★

The Mechanic ★★★★★

Shop Automotive ★★★★★

Ochoa`s Auto Sales ★★★★★

Hi-Tech Auto Center & Transmissions ★★★★★

Color Express ★★★★★

Auto blog

Personal testimonies show real-world effect of plugging in with Chevy Volt

Mon, Jan 13 2014At this point, there are tens of thousands of individual stories about what it's like to live with a Chevrolet Volt. But it also remains informative to take a look at one of these in depth. For example, one Atlanta-area Volt owner says he's cut his cents-per-mile ownership costs by almost 40 percent compared to his previous car primarily because of his ability to drive almost all the time on electric power. Jeffrey Cohen told Clean Technica that he put about 14,000 miles on his Volt extended-range plug-in hybrid for the year that ended October 2013, and that more than 92 percent of those were on electrons. He estimates his "lifetime" miles per gallon rating at a whopping 384 mpg, a figure pushed upward by the fact that he installed a Level 2 charger at home while his employer added an external 110-volt charger at work. Cohen is spending 45 cents a mile for his car, compared to 73 cents in his Infiniti M35. As a result, he's spending 45 cents a mile for his car, compared to 73 cents a mile with his prior vehicle, an Infiniti M35. About two-thirds of those Volt costs are for the $349-a-month lease payments, while 15 percent is insurance, 11 percent is for the charger and seven percent for the gas and electricity that actually powers the car. Helping lower that last figure is an overnight electricity rate that's about 10 percent of Cohen's daytime rate. Chevy parent General Motors hopes such testimonies will re-trigger sales for the Volt in 2014. Last year, GM sold 23,094 Volts, down 1.6 percent from 2012. We expect our readers have similar stories they'd like to share in the Comments. Related Gallery 2011 Chevrolet Volt: Review View 22 Photos News Source: Clean TechnicaImage Credit: Lead image: AP Photo/Jae C. Hong Green Chevrolet GM Electric running costs

Driving the C8 Corvette, and previewing GM's electric future | Autoblog Podcast #617

Fri, Mar 6 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by West Coast Editor James Riswick and Road Test Editor Zac Palmer. First they dive right in to the experience of driving the 2020 Chevrolet Corvette, followed by their review of the Mercedes-Benz GLE 350. Then they talk about the week's news, beginning with the whole slew of electric vehicles General Motors surprised us with at its EV Day. Next, they discuss the possibility of Porsche building a hybrid 911, as well as news about Ford's electric Transit van making its way to the U.S.. Last, but not least, they take to the mailbag to help a listener pick his next car in the "Spend My Money" segment. Autoblog Podcast #617 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Driving the 2020 Chevrolet Corvette Stingray Driving the 2020 Mercedes-Benz GLE 350 GM EV Day: Cadillac Celestiq and Lyriq, GMC Hummers and more A hybrid Porsche 911? Ford Transit electric commercial vans coming to U.S. Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

GM slashes prices in China as sales falter

Thu, May 14 2015Buying a vehicle from General Motors' stable of brands might be a lot cheaper in the near future – at least for customers in China. The effort comes as GM hopes to keep sales there growing, and the decision alludes to yet another sign that the Asian country no longer has the booming auto market of past years. GM and its Chinese joint venture partner SAIC are slashing prices by as much as the equivalent to $8,700 on 40 models from Buick, Chevrolet, and Cadillac, according to The Detroit News. Across all of automaker's nameplates, the overall sales dipped in China in April by 0.4 percent to 258,484 vehicles. Among the drops, Buick was down 8.5 percent, and Chevy shrunk 5.6 percent. Caddy's numbers increased 4.6 percent for the month, though. Buick remains a popular brand in the minds of Chinese consumers, but according to The Detroit News domestic automakers there are starting to eat into the dominance of foreign companies in the market. The country remains important for GM, though. Late last year, it outlined a future strategy that included China as a major pillar, including a $14 billion investment to build five new factories and boost sales. News Source: The Detroit NewsImage Credit: Alexander F. Yuan / AP Photo Buick Cadillac Chevrolet GM Car Buying Car Dealers saic