2014 Chevrolet Silverado 1500 Work Truck on 2040-cars

9912 Harrison Ave., Harrison, Ohio, United States

Engine:Gas/Ethanol V6 4.3L/262

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1GCNCPEH6EZ292907

Stock Num: 9614

Make: Chevrolet

Model: Silverado 1500 Work Truck

Year: 2014

Exterior Color: Summit White

Interior Color: Jet Black/Dark Ash

Options: Drive Type: RWD

Number of Doors: 2 Doors

Mileage: 6

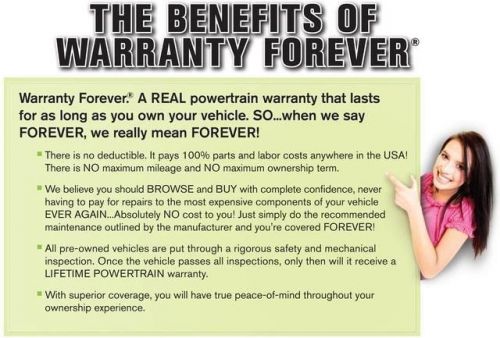

Preferred Equipment Group 1WT, 6-Speed Automatic Electronic with Overdrive, Jet Black/Dark Ash w/Cloth Seat Trim, CARGO BOX LIGHTING, and LOCKING DIFFERENTIAL. WARRANTY FOREVER!!! LIFETIME POWERTRAIN WARRANTY AT NO CHARGE!!If you've been hunting for the perfect 2014 Chevrolet Silverado 1500 to get some work done, then stop your search right here. You just simply can't beat a Chevrolet product. It is nicely equipped with features such as Preferred Equipment Group 1WT, 6-Speed Automatic Electronic with Overdrive, Jet Black/Dark Ash w/Cloth Seat Trim, CARGO BOX LIGHTING, and LOCKING DIFFERENTIAL. Price includes all rebates and dealer cash. In lieu of special financing. Tax, title, and license fees additional. See dealer for details. While every reasonable effort is made to ensure the accuracy of this data, dealer is not responsible for any errors/omissions which may occur. Please verify all information with dealer sales . Must show proof of current ownership and trade a 1999 or newer vehicle on certain vehicles. Residency restrictions may apply and not everybody will qualify for all incentives. See dealer for details. CONTACT GARY, Mark, OR MIKE AT 866-601-6063 FOR A GREAT DEAL ON THIS VEHICLE!

Chevrolet Silverado 1500 for Sale

2014 chevrolet silverado 1500 work truck(US $24,995.00)

2014 chevrolet silverado 1500 work truck(US $24,995.00) 2011 chevrolet silverado 1500 ltz(US $25,956.00)

2011 chevrolet silverado 1500 ltz(US $25,956.00) 2014 chevrolet silverado 1500 work truck(US $27,295.00)

2014 chevrolet silverado 1500 work truck(US $27,295.00) 2012 chevrolet silverado 1500 lt(US $29,261.00)

2012 chevrolet silverado 1500 lt(US $29,261.00) 2014 chevrolet silverado 1500 work truck(US $29,995.00)

2014 chevrolet silverado 1500 work truck(US $29,995.00) 2014 chevrolet silverado 1500 work truck(US $31,586.00)

2014 chevrolet silverado 1500 work truck(US $31,586.00)

Auto Services in Ohio

Yocham Auto Repair ★★★★★

Williams Auto Parts Inc ★★★★★

West Chester Autobody ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Sweeting Auto & Tire ★★★★★

Auto blog

GM is quietly slashing prices on base models

Fri, Jan 30 2015While General Motors' fourth quarter financial figures haven't yet been released, the automaker seems to be weathering a potentially rocky time well, even beating third-quarter projections last year. To keep the climb going, the company is launching new base trims for several popular models that make them cheaper than ever but with tight dealer margins. The new entry-level trims are the Chevrolet Cruze L, Equinox L, GMC Terrain SL and Buick LaCrosse 1SV. Buyers lose some content by picking them, but the prices are slashed. According to Cars Direct, the biggest savings are on the LaCrosse, where customers pay $31,065, plus $925 destination, $2,570 less than the previous base 1SB trim but must accept things like 17-inch wheels and no cargo net in the back. If you're wondering how Buick can remove only a little equipment but cut the price so much, it's because the company also slashed dealer margins. According to Cars Direct, the difference between the invoice and MSRP for the LaCrosse 1SV is only around $150, compared to around $1,350 before. The disparity is even greater for the Cruze with an $81 difference in the prices, compared to about $600 for the LS version. Showrooms are expected to keep very low stocks of these trims, though. "Dealers use such vehicles to get people in the door, but they do not generally want to do high volumes of these strippers. The margins are next to nothing; they don't make much money off these cars," said Ed Kim, Vice President of Industry Analysis for AutoPacific to Autoblog. Dealers are also expected to advertise that these new base trims undercut major competitors. For example, the Cruze L rings up for about $2,320 less than a Honda Civic LX, according to Cars Direct. One potential drawback for buyers is that these models might not be eligible for incentives. While the attractive prices might get customers into dealers, folks may not actually end up driving home with these entry-level models. Kim indicated base trims also make up a small portion of the sales mix. "Consumers aren't asking for stripped out vehicles, even at the low end of the marketplace," he said. Featured Gallery 2015 Chevrolet Cruze View 9 Photos News Source: Cars DirectImage Credit: Chevrolet Buick Chevrolet GM GMC Car Buying Car Dealers Crossover Sedan gmc terrain cheap cars

U.S. new-vehicle sales in 2018 rise slightly to 17.27 million [UPDATE]

Thu, Jan 3 2019DETROIT — Sales of new vehicles in the U.S. rose slightly in 2018, defying predictions and highlighting a strong economy. Automakers reported an increase of 0.3 percent over a year ago to 17.27 million vehicles. The increase came despite rising interest rates, a volatile stock market, and rising car and truck prices that pushed some buyers out of the new-vehicle market. Industry analysts and automakers said strong economic fundamentals pushed up sales and should keep them near historic highs in 2019. "Economic conditions in the U.S. are favorable and should continue to be supportive of vehicle sales at or around their current run rate," Ford Chief Economist Emily Kolinski Morris said after the company and other automakers announced their sales numbers Thursday. That auto sales remain near the 2016 record of 17.55 million is a testimonial to the strength of the economy, said Mark Zandi, chief economist at Moody's Analytics. The job market, he said, has created new employment, and wage growth has accelerated. "That's fundamental to selling anything," he said. "If there are lots of jobs and people are getting bigger paychecks, they will buy more." The unemployment rate is 3.7 percent, a 49-year low. The economy is thought to have grown close to 3 percent last year, its best performance in more than a decade. Consumers, the main driver of the economy, are spending freely. The Federal Reserve raised its key interest rate four times in 2018 but is only expected to raise it twice this year. Auto sales also were helped by low gasoline prices and rising home values, Zandi said. It all means that people are likely to keep buying new vehicles this year even as they grow more expensive. The Edmunds.com auto-pricing site estimates that the average new vehicle price hit a record $35,957 in December, about 2 percent higher than the previous year. It will be harder for automakers to keep the sales pace above 17 million because they have been enticing buyers for several years now with low-interest financing and other incentives, Zandi said. He predicts more deals in the coming year as job growth slows and credit tightens for higher-risk buyers. Edmunds, which provides content, including automotive tips and reviews, for distribution by The Associated Press, predicts that sales will drop this year to 16.9 million.

Corvette Stingray designer lists five goals of new exterior shape

Fri, 12 Apr 2013Redesigning an icon is a difficult task, especially when you've got a blank sheet of paper in front of you and the all-new C7 Chevrolet Corvette Stingray is intended to be your final objective.

General Motors has released a new short video featuring Kirk Bennion of the Corvette's exterior design team, talking about the challenges of sculpting Chevrolet's new flagship sports car and the five goals the team had to keep in mind as it worked. In the end, Bennion's team had the pleasure of seeing their hard work take center stage as the Corvette captured the world's eyes at the Detroit Auto Show earlier this year.