2014 Chevrolet Silverado 1500 on 2040-cars

Orange, California, United States

Engine:4.3L V6 12V

For Sale By:Private Seller

Fuel Type:Flex Fuel Vehicle

Transmission:Automatic

Vehicle Title:Clean

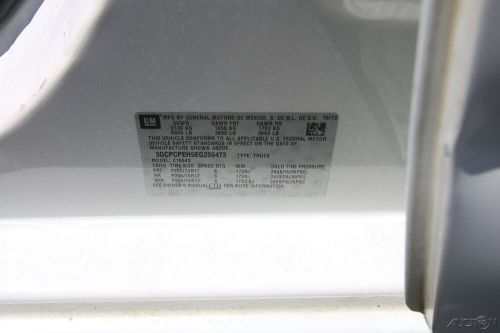

VIN (Vehicle Identification Number): 3GCPCPEH9EG259473

Mileage: 333324

Drive Type: 4X2

Exterior Color: White

Interior Color: Gray

Make: Chevrolet

Manufacturer Exterior Color: Summit White

Model: Silverado 1500

Number of Cylinders: 6

Number of Doors: 4 Doors

Sub Model: 4x2 4dr Crew Cab 5.8 ft. SB w/1

Warranty: Vehicle does NOT have an existing warranty

Chevrolet Silverado 1500 for Sale

1998 chevrolet silverado 1500(US $11,000.00)

1998 chevrolet silverado 1500(US $11,000.00) 2000 chevrolet silverado 1500 c1500(US $18,900.00)

2000 chevrolet silverado 1500 c1500(US $18,900.00) 2020 chevrolet silverado 1500 4x4 extended ltz-edition(w/t)(US $19,995.00)

2020 chevrolet silverado 1500 4x4 extended ltz-edition(w/t)(US $19,995.00) 2006 chevrolet silverado 1500 no reserve 93k miles 4x4 1500(US $5,200.00)

2006 chevrolet silverado 1500 no reserve 93k miles 4x4 1500(US $5,200.00) 2022 chevrolet silverado 1500 crew limited lt-edition(all start package)(US $29,995.00)

2022 chevrolet silverado 1500 crew limited lt-edition(all start package)(US $29,995.00) 2005 chevrolet silverado 1500 c1500(US $3,500.00)

2005 chevrolet silverado 1500 c1500(US $3,500.00)

Auto Services in California

Z Best Body & Paint ★★★★★

Woodman & Oxnard 76 ★★★★★

Windshield Repair Pro ★★★★★

Wholesale Tube Bending ★★★★★

Whitney Auto Service ★★★★★

Wheel Enhancement ★★★★★

Auto blog

GM announces 3 new recalls affecting 1.7M vehicles in North America [w/video]

Mon, Mar 17 2014Still embroiled in the ongoing ignition switch recall, General Motors announced today three more discrete recalls, affecting a grand total of 1,546,900 vehicles in the US. The Detroit News reports that some 1.7 million vehicles are affected overall in North America. The first and largest of the trio of new recalls concerns some 1.18-million Buick Enclave and GMC Acadia crossovers from the 2008-2013 model years, Chevrolet Traverse from 2009-2013 (pictured above) and Saturn Outlook vehicles from 2008-2010. All of the crossover utilities may have an issue with the wiring harness for their seat-mounted side airbags. Apparently, the vehicles are equipped with a Service Air Bag warning light that, if ignored, "will eventually result in the non-deployment of the side impact restraints." Those restraints include the side airbags, a front-center airbag if the vehicle is so equipped and seatbelt pretensioners. Dealers of affected vehicles will be instructed to remove driver and passenger side airbag wiring harness connectors, and then "splice and solder the wires together." The second recall affects 303,000 Chevrolet Express (pictured right) and GMC Savana vans from model years 2009-2014, and with gross vehicle weights under 10,000 pounds. Said vehicles do not comply with a head impact requirement for unrestrained occupants, and will need a reworking of the instrument panel material to be sent back on the road. It doesn't sound as though there's a quick fix for this one, as the GM press release states: "Unsold vehicles have been placed on a stop delivery until development of the solution has been completed and parts are available." Finally, the third recall affects 63,900 Cadillac XTS luxury sedans from model years 2013 and 2014. A brake booster pump may be susceptible to corrosion by way of the relay, potentially causing and electrical short, overheating, melting of plastic components and even engine fires. GM says it is aware of two engine fires in unsold XTS models and two cases of melted parts. Repairs for the issues affecting the XTS have not not mentioned by GM in the release. The Detroit News is also reporting that along with news of the triple-recall, GM is taking a $300-million credit to help pay for the repair costs, and to deal with the ongoing costs associated with the ignition switch recall. In an attempt to explain just what GM has been doing in the face of these very serious issues, newly minted CEO Mary Barra has addressed the issues in a new video.

2014 Chevrolet Corvette Stingray priced from $51,995*

Fri, 26 Apr 2013After months of speculation, Chevrolet has finally revealed the official starting price of the 2014 Corvette Stingray. The base MSRP for the 450-horsepower Stingray Coupe will be $51,995, while the Stingray Convertible will go for $56,995 (*both prices include a $995 destination fee). This means that the price increase from 2013 to 2014 is just $1,400 for the coupe and $2,395 for the convertible - pretty modest increases considering the upgrade in specifications. Of course, neither price accounts for the sort of dealer markup that might grace early C7 window stickers, especially since less than a third of all Chevrolet dealers will be allocated Corvette models to sell at the car's launch.

Now, these prices are for the base car, so if you're wondering how much a fully loaded Stingray will run, Chevy has given us a good indication of that as well. The coupe we saw on display at the Detroit Auto Show (shown above), for example, would run $73,360 including options such as the $2,800 Z51 Performance Package, $2,495 competition sport seats and the $1,795 Magnetic Ride Control option - just to name a few. Stepping up to the 3LT trim level that brings a full leather interior will run an extra $8,005 over the base price.

While $20,000 in options may seem like a lot, this "as-tested" price still has the C7 competitively priced against rival coupes like the Porsche 911 and Nissan GT-R. Speaking of price comparisons, Chevrolet also points out that the C7 Stingray Z51 costs $2,200 less than the C6 Grand Sport while delivering better acceleration (0-60 mph in less than four seconds) and improved track performance (including more than 1 g in cornering).

Cars with the most reckless drivers are full of surprises

Wed, Oct 13 2021Insurify is a site for comparing auto insurance quotes. Because insurance shoppers need to submit information like the vehicles they're driving and the infractions they've compiled while driving those vehicles, Insurify has quite the database of correlations tying certain models to a habit of breaking certain laws. When the site's data analysts decided to compile a list of the top ten models for reckless driving citations in the decade from 2010 to 2019, the ranking contained a few wild entries. The Dodge Challenger making the countdown will surprise precisely zero people. But the Saturn L200? First, a definition: USLegal.com defines reckless driving as "driving with a willful or wanton disregard for safety. It is the operation of an automobile under such circumstances and in such a manner as to show a willful or reckless disregard of consequences." So this list is a caution about particular drivers more than the cars. For a baseline, according to Insurify data, for any random model, 15 out of 10,000 people who drive that model have picked up one citation for reckless driving. Back to that Challenger, then. No shocker for being here, but it's actually number 10, with 44 out of 10,000 Challenger drivers nabbed for a willful disregard of consequences on the road. That's better than the first surprise entry, the Saturn L200, a sedan only on sale for six years, with the least horsepower on the list, and out of production since 2005. The data set put drivers of GM's extraterrestrial sedan at 45 reckless pilots per 10,000 drivers. There are two pickups on the list, the only modern one being the Ram 1500 at eighth, with a rate of 46 in 10,000. Somehow, drivers of the third-best-selling pickup in the U.S. outrun the overwhelming numerical superiority of the best-selling vehicle in the States, the Ford F-150. The other pickup is the Chevrolet K1500 at number five, with a rate of 56 in 10,000. This is not only the oldest vehicle on the list, it went out of production in 2002, before any other vehicle on the list. Between the trucks, the Volkswagen CC slotted in at seven with 47 in 10,000 reckless driving chits, the Cadillac ATS slipped into sixth with 48 in 10,000. The top four is a bag of unexpected. The Nissan 370Z is the first hardcore sports car on the list at number four, with 61 in 10,000 Z drivers flaunting their Fairladys in the face of Johnny Law.