2000 Chevrolet Silverado 1500 Base Extended Cab Pickup 3-door 5.3l on 2040-cars

Hiram, Ohio, United States

Engine:5.3L 323Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Body Type:Extended Cab Pickup

Fuel Type:GAS

For Sale By:Private Seller

Exterior Color: Gold

Make: Chevrolet

Interior Color: Gray

Model: Silverado 1500

Trim: Base Extended Cab Pickup 3-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: 4WD

Options: CD Player

Number of Cylinders: 8

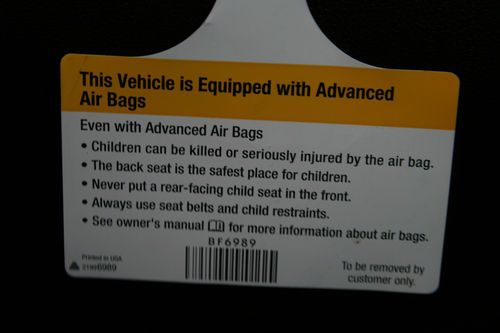

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Air Conditioning

Mileage: 204,000

Chevrolet Silverado 1500 for Sale

Silverado 1500 regular cab 4.8 liter lt 20 inch chrome wheels v8 automatic(US $18,995.00)

Silverado 1500 regular cab 4.8 liter lt 20 inch chrome wheels v8 automatic(US $18,995.00) Custom 1992 chevy silverado

Custom 1992 chevy silverado 2010 chevrolet silverado 1500 crew cab- 4wd(US $32,000.00)

2010 chevrolet silverado 1500 crew cab- 4wd(US $32,000.00) Chevy truck red v6 auto clear title 2wd bed cover like new a/m wheels tires

Chevy truck red v6 auto clear title 2wd bed cover like new a/m wheels tires 2011 chevy 1500 2wd pick-up we finance lifetme warranty one owner new tires

2011 chevy 1500 2wd pick-up we finance lifetme warranty one owner new tires Chevrolet: : silverado 1500 4wd ext cab 20 in wheels no reserve

Chevrolet: : silverado 1500 4wd ext cab 20 in wheels no reserve

Auto Services in Ohio

Zink`s Body Shop ★★★★★

XTOWN PERFORMANCE ★★★★★

Wooster Auto Service ★★★★★

Walker Toyota Scion Mitsubishi Powersports ★★★★★

V&S Auto Service ★★★★★

True Quality Collision ★★★★★

Auto blog

2016 Chevy Malibu exhaustively tested with four decades of data

Fri, Mar 13 2015Chevy is preparing to unveil its new Malibu sedan at the upcoming New York Auto Show next month. But when it does, it's not like it will have appeared overnight. The development of any new vehicle – especially one as widely produced by a major automaker as the Malibu – involves rigorous and relentlessly punishing tests. In the Malibu's case, that meant 1.5 million miles of driving from the scorching heat of Arizona in July to the frigid cold of northern Canada in January and everything in between. The Bowtie brand also says it incorporated four decades' worth of data taken from vehicles driving in locations around the world since 1972 in order to make the Malibu the best it could be. We'll have to wait to find out the results of all that exhaustive testing, but you can catch a sneak peek at the new sedan in the video above. Four Decades of Data Used to Test 2016 Chevrolet Malibu Recorded customer use drives durability testing for next-generation midsize sedan 2015-03-11 DETROIT – Data collected over decades from across the globe is helping ensure the 2016 Chevrolet Malibu can handle the world's worst roads even if the all-new midsize sedan never drives on them. Data collection boxes are placed in cars in real-world driving conditions around the world. Since 1972, these devices have accurately recorded the harshness and frequency of every jounce, bump and shudder inflicted on the car on roads in the U.S., Russia, Saudi Arabia and developing markets. "Although most Malibu owners will never put their car through similar abuse, we test all new vehicles in extreme climates, inclement weather and on punishing road surfaces," said Dan Devine, Malibu validation engineer. "The 2016 Malibu is definitely up to these challenges." Tests like these ensured the current generation Malibu was dependable and durable, two qualities that in turn helped Malibu stand out from its rivals in important quality surveys, such as J.D. Power's Initial Quality Study and Vehicle Dependability Study. General Motors engineers analyze the data to calculate the precise amount of damage potholes and other hazards create over 150,000 miles. Then the conditions are replicated at GM's Milford Proving Ground in Michigan on three unique road courses, each riddled with simulated potholes of increasing severity. Engineers run preproduction cars through the course up to hundreds of times.

Camo'd Chevy Camaro ZL1 is one bad boy

Tue, Sep 15 2015Thanks to a fresh gallery of spy shots, we're getting a much better look at the next Chevrolet Camaro ZL1 during its development, and this machine is looking seriously mean. Unlike the last photos, the heavy cladding is gone from the body this time and is replaced by a camouflage wrap. That switch makes checking out the details a whole lot easier. The first thing you'll notice at the front is the massive grille that looks ready to devour anything that gets in the way. To add a little more menace, the lower air dam appears to jut out a bit more, as well. While harder to see in these latest shots, our spies say the hood still boasts an extractor similar to what's found on the Cadillac CTS-V. The big, double spoke wheels look great in black and really dominate the styling in profile. Look past them, and you notice some tweaked side sills, as well. At the very back, you can also spot some styling adjustments to the rear bumper. There's an unmissable wing back there, too. The powerplant for the ZL1 is still a mystery, but it's rumored to use the LT4 6.2-liter supercharged V8. The similar hood design as the CTS-V is one piece of evidence to support that. Even with the same engine, Chevy's engineers could tweak the output higher or lower than the Caddy. The wait to find out isn't too long because the ZL1 is anticipated to launch for the 2017 model year. Related Video:

Diesel-powered 2020 Chevrolet Silverado, GMC Sierra get big price cuts

Tue, Sep 8 2020General Motors is reducing the price difference between its diesel-powered light-duty pickups and their gasoline-burning counterparts, according to a recent report. As of September 3, 2020, the Chevrolet Silverado 1500 and the GMC Sierra 1500 benefit from a $1,500 price cut when they're ordered with a turbodiesel under the hood. Enthusiast website GM Authority first reported the news after looking at internal documents sent to dealers across the nation. It wrote the discount applies to in-stock and in-transit units of the Silverado and the Sierra (pictured), and it added dealers will begin receiving amended window stickers on September 8. And, it's not just a quick, easy way for General Motors stores to clear out 2020 inventory. Incoming 2021 models will benefit from it, too. Chevrolet's cheapest diesel-slurping 2020 Silverado, a double-cab LT with two-wheel drive, now starts at $44,000 once a mandatory $1,595 destination charge enters the equation. For context, the same configuration costs $38,795 including destination when it's ordered with the 2.7-liter turbocharged four-cylinder, which is the smallest and cheapest engine on the roster. Selecting the more efficient engine option costs buyers $5,205. At the other end of the spectrum, the crew-cab High Country with a standard cargo box and four-wheel drive is now priced at $59,690. Walk a block to the GMC store, and you'll need to spend between $44,470 (double-cab SLE with two-wheel drive) and $61,685 (crew-cab Denali with a regular cargo box and four-wheel drive) for a diesel-powered Sierra. It doesn't sound like either company is making major mechanical changes to the trucks for 2021. Both are powered by a 3.0-liter straight-six Duramax engine, which makes 277 horsepower and 460 pound-feet of torque. Rear-wheel drive and a 10-speed automatic transmission come standard, and four-wheel drive is offered at an extra cost. In its most efficient configuration, the Silverado returns 23 mpg in the city, 33 mpg on the highway, and 27 mpg in a mixed cycle, impressive numbers for a body-on-frmae pickup that's as heavy as it is capable. Ram's diesel-powered 1500 posts EPA estimates of 22, 32, and 26, respectively. Ford pledged the recently-unveiled 14th-generation F-150 will offer a turbodiesel engine, too, but its fuel economy figures are not available yet.