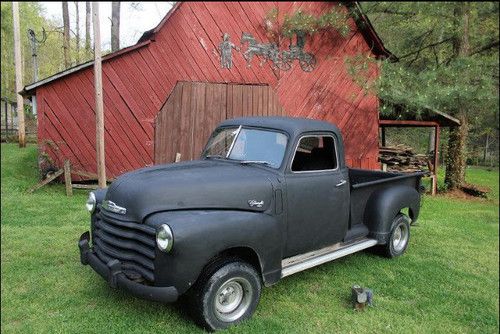

1969 Chevrolet C10 - Restored!! on 2040-cars

Raleigh, North Carolina, United States

Body Type:Pickup Truck

Engine:V8

Vehicle Title:Clear

Fuel Type:Gasoline

Number of Cylinders: 8

Make: Chevrolet

Model: Other Pickups

Trim: 2 door

Cab Type (For Trucks Only): Regular Cab

Drive Type: Automatic

Options: CD Player

Mileage: 0

Exterior Color: Black

Warranty: AS-IS

Interior Color: Black

Chevrolet Other Pickups for Sale

Auto Services in North Carolina

Whitey`s German Automotive ★★★★★

Transmission Center ★★★★★

Tow-N-Go LLC ★★★★★

Terry Labonte Chevrolet ★★★★★

Sun City Automotive ★★★★★

Show & Pro Paint & Body ★★★★★

Auto blog

GM under fire from safety advocates over braking problem caused by recall fix

Thu, Feb 6 2020Safety experts are lambasting General Motors over what they say is the automaker’s slow notification of owners of certain 2019 sedans and trucks that a recall fix could cause power braking to fail and increase the risk of a crash, the Detroit Free Press reports. GMÂ’s original recall in December targeted about 550,000 Cadillac CT6 sedans and Chevrolet Silverado 1500 and GMC Sierra 1500 pickups, all from the 2019 model year, over potentially defective electronic stability control and antilock brakes. In that case, GM said the errors would not show up as a diagnostic warning on the instrument cluster. But after GM had done recall work on 162,000 vehicles, about 1,700 owner have complained that their power brakes didnÂ’t work after they had the recall done and then used the OnStar app to start their vehicle. GM then issued a supplemental fix for customers whoÂ’d already had their vehicles serviced. In this case, a diagnostic warning should illuminate saying either “Service Brake Assist” or “Service ECS,” which GM says is a signal that a customer should not drive the vehicle and instead call their dealer, which will tow the vehicle and have it repaired. Safety advocates say the automaker hasnÂ’t gone far enough to protect customers. “The fact that you could potentially start a vehicle and not have brakes is a pretty risky proposition,” Sean Kane, president of the Safety Research and Strategies, which works on auto issues for plaintiffs and governmental organizations, told the Freep. “The fact that they wouldnÂ’t notify owners (sooner) is pretty stunning.” GM told the Freep it was required to notify the National Highway Traffic Safety Administration and file paperwork before it notified customers about the original recall, which was made Dec. 12. It then had to investigate and resolve the problem created by its original recall fix before alerting customers. GMÂ’s call center and dealers are contacting the remaining 900 customers who havenÂ’t yet had the update made to the original recall repair. GM also hired a vendor to send recall letters to the 550,000 customers affected by the original recall notifying them about the update. There are no known injuries or deaths related to the problem. Read the Freep story here.

Buick Encore, Chevy Trax earn Top Safety Pick from IIHS [w/video]

Thu, Feb 12 2015The Buick Encore has been a massive sales success practically from the moment it debuted, and Buick recently decided to increase production to keep up with demand for the premium compact crossover. The Insurance Institute for Highway Safety recently put one to the test again, and the Encore earned a Top Safety Pick award. It's the first model from the brand to score the nod since 2013, according to the IIHS, and the rating also carries over to the 2015 Chevrolet Trax. The 2015 Encore scored a Good rating in all of the IIHS' evaluations, including the 40-mile-per-hour, small overlap front crash test. That was a big improvement over the previous model the institute tested, which scored a Poor result in the overlap test. In the first test, about 13 inches of the lower door hinge pillar came into the passenger compartment, and the steering wheel airbag moved too far to protect the dummy's head. Improvements for the latest model year showed six inches of intrusion this time, and the airbags caught the dummy's head well. The dummy's sensors also indicated a low risk of injury. The two CUVs missed out on the full Top Safety Pick+ because the IIHS scored the Encore as only having a basic front crash prevention system, and there was no such equipment for the Trax. To earn the highest mark, models need at least an advanced rating by the institute for this technology. Buick Encore, Chevrolet Trax earn 2015 TOP SAFETY PICK award ARLINGTON, Va. - A small SUV is the first vehicle from the Buick brand to qualify for a TOP SAFETY PICK award from the Insurance Institute for Highway Safety since 2013. The Buick Encore's newly introduced, lower-priced twin, the Chevrolet Trax, also qualifies for the honor. The Encore's award follows improvements to the SUV's structure for better small overlap front protection. The 2015 model earns a good rating in the small overlap test. In contrast, the 2013-14 Encore rated poor in the test. The driver's space was seriously compromised with intrusion measuring as much as 13 inches at the lower door hinge pillar. The dummy's head barely contacted the front airbag before sliding off the left side, as the steering column moved to the right. The side curtain airbag deployed too late and didn't have sufficient forward coverage to protect the head. In the latest test, the driver space was maintained reasonably well, with maximum intrusion of 6 inches at the door hinge pillar and instrument panel. The dummy's movement was well-controlled.

GM laying off 500 workers to slow Chevy Sonic production

Sat, Oct 24 2015Due to slow sales of the Chevrolet Sonic and Buick Verano, General Motors is cutting a shift at the Orion Township plant that builds the pair. The move lays off about 500 workers, but most of them are expected to get offers to transfer to other factories, Automotive News reports. The move came just a day after GM announced adding 1,200 employees to the Detroit-Hamtramck plant. GM has been trying all year at the Orion Township factory to align production of the Sonic and Verano with their demand. The automaker first attempted idling the plant several times and eventually resorted to laying off about 100 workers. It also reduced the production rate there. With the huge rise in popularity of crossovers, demand for the plant's small cars is on the downturn. According to Automotive News, there's currently a 116-day supply of Sonics and 100 days of Veranos to sell. Delivers tell a similar tale because the Chevy is off 35.2 percent from January to September, and the Buick does little better with a 27.2 percent drop from the same period last year. While the situation at Orion Township might look rough now, big things are on the horizon. Soon, the new Chevy Bolt electric vehicle will be built there when it hits the market around 2017. Plus, the plant will also get a $245-million upgrade and 300 new jobs for another, unannounced vehicle.

1969 chevy c10 pickup

1969 chevy c10 pickup Black 1977 chevy luv modified show truck (very rare)!!

Black 1977 chevy luv modified show truck (very rare)!! 1950 chevy 3100 pickup truck...classic, rat rod

1950 chevy 3100 pickup truck...classic, rat rod 1952 chevy pickup hot rod project truck

1952 chevy pickup hot rod project truck 1952 chevrolet 3100 stake side farm truck fully restored

1952 chevrolet 3100 stake side farm truck fully restored 1956 chevy truck

1956 chevy truck