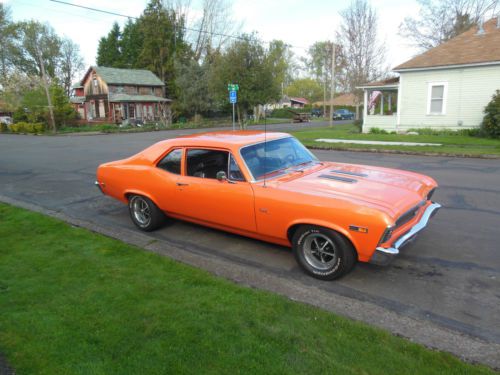

1966 Chevy Nova Pro Touring Air Ride Susp 4 Speed 17 + 18'' Wheels Disc Brakes on 2040-cars

North Jackson, Ohio, United States

Chevrolet Nova for Sale

1970 nova ss 396 l-78

1970 nova ss 396 l-78 1974 chevrolet nova 2 door roller with pdb ps look!(US $3,500.00)

1974 chevrolet nova 2 door roller with pdb ps look!(US $3,500.00) 1965 nova, all steel. would make a great street car or vintage gasser(US $15,900.00)

1965 nova, all steel. would make a great street car or vintage gasser(US $15,900.00) 1965 chevy nova(US $10,900.00)

1965 chevy nova(US $10,900.00) 1969 nova ss clone(US $18,500.00)

1969 nova ss clone(US $18,500.00) 1966 chevy nova ii wagon

1966 chevy nova ii wagon

Auto Services in Ohio

Yocham Auto Repair ★★★★★

Williams Auto Parts Inc ★★★★★

West Chester Autobody ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Sweeting Auto & Tire ★★★★★

Auto blog

GM claims it's first to sell million 30+ mpg vehicles

Fri, 04 Jan 2013As we continue to put together all the data for the year-end edition of By The Numbers, General Motors has announced that it sold more than a million vehicles in the US last year that achieved at least 30 miles per gallon on the highway. More impressively, GM managed this feat using multiple strategies including small vehicle size, turbocharged engines and hybrid or plug-in technologies across four brands (Buick, Cadillac, Chevrolet and GMC) accounting for 13 separate models. This number will grow even more in 2013 thanks to cars like the all-electric Spark, the diesel Cruze, the range-extended Cadillac ELR and the Buick Encore compact CUV.

GM's small car sales were up 39 percent last year helping to attain this million-sales mark for 30-mpg models, and almost 40 percent of all GM sales consisted of cars with fuel-efficient I4 engines. In regards to more advanced means of improving fuel economy, GM says that it plans on having 500,000 vehicles with "some form of electrification" on the road by 2017.

Scroll down for the full list of GM's million 30+ mpg cars as well as an informative press release.

These cars are headed to the Great Crusher In The Sky

Fri, 24 Aug 2012It happens every year. We bid adieu to some cars and trucks that will be missed, and say good riddance to others wondering how they stayed around so long. Whether they're being killed off for slow sales or due to a new product coming along to replace them, the list of vehicles being discontinued after 2012 is surprisingly long and diverse.

CNN Money has compiled a list of departing vehicles, to which we've added a few more of our own. In the slow sales column, cars like the Lexus HS 250h, Mercedes-Benz R-Class and the full Maybach lineup appear, while the Ford Escape Hybrid, Mazda CX-7 and Hyundai Veracruz are all having their gaps filled with more modern and more fuel-efficient alternatives. Obvious exceptions to the rule include models that still sell in decent numbers like the Jeep Liberty and the Chrysler Town & Country (which will eventually be replaced by a crossover-like vehicle).

Check out our gallery of discontinued cars above, then scroll down for more information.

VW Finds CO2 'Irregularites', SEMA Recap, and More | Autoblog Minute

Sat, Nov 7 2015Volkswagen's diesel emissions scandal gets a new wrinkle, US regulators hit Takata Corporation with a substantial fine, and we head to Vegas for a look at tuner paradise at the 2015 SEMA show. Autoblog Senior Editor Greg Migliore reports on this edition of Autoblog Minute Weekly Recap. Acura Chevrolet Honda Mazda Mitsubishi Toyota Autoblog Minute Videos Original Video Acura Legend