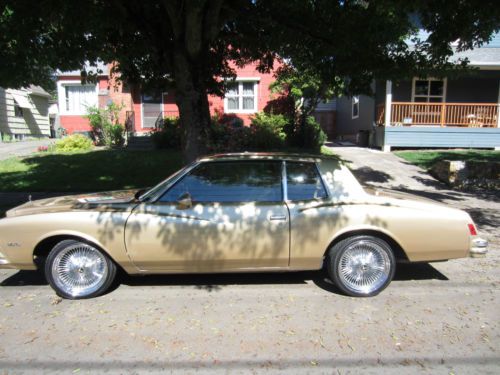

1978 Chevy Monte Carlo Landau White Leather Interior V8 Automatic on 2040-cars

Olympia, Washington, United States

|

1978 Chevrolet Monte Carlo Landau - in excellent shape. Only 50,000 miles!

5.0L V8, Leather, Automatic, Bucket seats, tilt steering, cruise control, power brakes, power door locks, power windows, intermittent wipers, power antenna, tinted glass, white wall tires. Purchased originally in Southern California so it has California emissions. Built at the Fremont California assembly plant. (I have the original build list) Nothing has been modified except for a new headliner and body moldings were replaced when the car was repainted in 2011. Only 2 owners (same family) Looks and runs great. Drives like a boat! As with any car that's a classic a few things don't work perfectly. So in the interest of full disclosure and to save everyone's time here's what I know: A/C needs recharging Passenger electric window intermittent Drive selector doesn't display - always shows in park. Electric clock inop. Drivers bucket seat has a couple of minor cracks - the rest of the leather is in very very good condition. Center console lid needs reattaching (cosmetically o.k.) Power antenna is disconnected Drivers window visor is missing I hate to get rid of this car as it's been in the family so long. But I don't have space to garage it any longer and it just doesn't get driven. It needs a new home to someone that wants to take care of a classic automobile. This is a great car that runs good and would make a good show car if given a little tlc. |

Chevrolet Monte Carlo for Sale

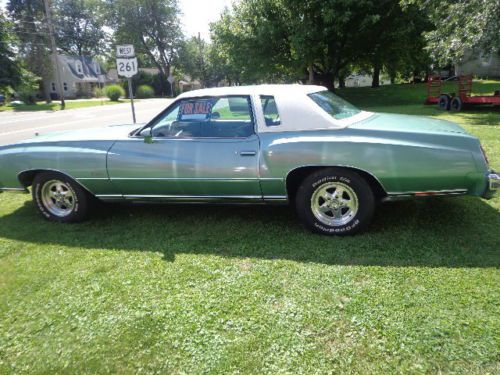

1973 chevrolet monte carlo landau 5.7l excellent condition(US $13,500.00)

1973 chevrolet monte carlo landau 5.7l excellent condition(US $13,500.00) 1974 monte carlo great condition(US $3,500.00)

1974 monte carlo great condition(US $3,500.00) 1978 monte carlo(US $4,700.00)

1978 monte carlo(US $4,700.00) Silver 2002 chevrolet monte carlo ls 3.4l v6 clean coupe fwd financing available

Silver 2002 chevrolet monte carlo ls 3.4l v6 clean coupe fwd financing available 1984 chevrolet monte carlo base coupe 2-door 5.0l

1984 chevrolet monte carlo base coupe 2-door 5.0l Super clean 1977 chevy monte carlo-automatic-v8-73.000 original miles-great car

Super clean 1977 chevy monte carlo-automatic-v8-73.000 original miles-great car

Auto Services in Washington

Xtreme Car Audio & Tint ★★★★★

West Seattle Brake Service ★★★★★

United Battery Systems Inc ★★★★★

Skys Auto Repair & Detailing ★★★★★

Setina Manufacturing Co. ★★★★★

Salvage Yard Guru ★★★★★

Auto blog

Plug In 2014: VIA makes the case for 'free' plug-in hybrid work vans, trucks

Fri, Aug 1 2014If you're a fleet manager who's been waiting anxiously for the chance to buy a plug-in hybrid van from Via Motors, your wait is almost over. If you work for the right fleet, anyway. David West, the chief marketing efficer for VIA Motors, took AutoblogGreen for a ride around the San Jose Convention Center in a Via van sporting an Electric Blue paint job as part of the Plug In 2014 Conference this week and gave us an update on how things are coming along. The big news is that the Via PHEV van production is going to start by the end of September. Via can currently build two vans an hour at its production plant in Mexico, or about 16 a day and could easily double that. "That would get us to 20,000 a year with two full lines running," West said. "We have the capacity." "There is no way gas can compete with electric." – David West, Via Motors But they can't sell that many quite yet. By the end of December, around 350 Vans will be made, mostly for a $20-million program from the Department of Energy (DOE) and the South Coast Air Quality Management District that will see the vehicles used by fleets that will report energy data to the Idaho National Lab. Via is also finishing up CARB certification for both the van and the company's plug-in hybrid pick-up truck. About 50 percent of Via's technology in the truck will not need to be tested again, since it's the same as what's in the van, but things like crash tests will need to be done twice. Despite the progress, this is not where Via hoped it would be today. The bankruptcy of battery supplier A123, "took about a year off our timeline," West said. "It's been getting a little slow getting it to market, there have been some challenges, particuarly since we had the country's worst recession right in the middle of this wrap up, but it's inevitable in my mind. There is no way gas can compete with electric." Maybe that's why FedEx has expressed an interest in buying around 5,000 units, West said. FedEx already has some pilot vehicles, just like Verizon does, and PG&E wants to replace all of their gas trucks with electric vehicles, which would be another 3,000 sales, he said. Besides the fuel savings, vehicles like these, with easy on-site power generation, could also work wonders in post-disaster situations, he said, since they could replace the need for generators.

Autoblog Podcast #376

Wed, Apr 16 2014Episode #376 of the Autoblog podcast is here, and this week, Dan Roth, Chris Paukert and Brandon Turkus talk about the New York Auto Show, internet criticism of the Ram Runner, and the 2014 Ward's 10 Best Interiors. We start with what's in the garage and finish up with some of your questions, and for those of you who hung with us live on our UStream channel, thanks for taking the time. Check out the new rundown below with times for topics, and you can follow along down below with our Q&A. Thanks for listening! Autoblog Podcast #376: The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics: New York Auto Show preview Ram Runner criticism Ward's 10 Best interiors for 2014 In the Autoblog Garage: 2014 Chevrolet Camaro 2SS 2014 Chevrolet Camaro 1SS 1LE 2014 Audi Q7 TDI Hosts: Dan Roth, Chris Paukert, Brandon Turkus Runtime: 01:37:18 Rundown: Intro and Garage - 00:00 New York Auto Show - 24:07 Ram Runner - 45:57 Ward's 10 Best Interiors - 57:00 Q&A - 01:14:02 Get the podcast: [UStream] Listen live on Mondays at 10 PM Eastern at UStream [iTunes] Subscribe to the Autoblog Podcast in iTunes [RSS] Add the Autoblog Podcast feed to your RSS aggregator [MP3] Download the MP3 directly Feedback: Email: Podcast at Autoblog dot com Review the show in iTunes Auto News Podcasts New York Auto Show Audi Chevrolet Off-Road Vehicles chevy camaro 1le wards 10 best interiors

GM profit dips on truck changeover, but beats estimates

Thu, Apr 26 2018DETROIT — General Motors on Thursday reported a higher-than-expected quarterly profit despite a drop in production of high-margin pickup trucks, as it gears up for new models that are expected to boost profits next year. Like rivals Ford and Fiat Chrysler Automobiles, GM is banking on highly-profitable Chevy Silverado and GMC Sierra pickup trucks to lift profits, as consumers shift away from traditional passenger cars in favor of these larger, more comfortable trucks, SUVs and crossovers. During the first quarter, the process of changing over to GM's new pickups resulted in a drop in production of 47,000 units. GM Chief Financial Officer Chuck Stevens said the production drop had resulted in a drop in pre-tax profit of up to $800 million. Earlier this year, GM said its 2018 profits would be flat compared with 2017, but expected its all-new pickup trucks would boost margins starting in 2019. On Thursday, GM reiterated its full-year 2018 forecast for adjusted earnings in a range from $6.30 to $6.60 per share. The automaker said capital expenditures were more than $500 million higher in the quarter because of investments its new pickup trucks and a family of low-cost vehicles under development with Chinese partner SAIC Motor Corp. On Wednesday, rival Ford said it would stop investing in most traditional passenger sedans in North America. CFO Stevens told reporters on Thursday that GM has "already indicated that we will make significantly lower investments on a go-forward basis" in sedans. 2019 GMC Sierra View 21 Photos GM benefited from a lower effective tax rate in the quarter, but adjusted pre-tax margin fell to 7.2 percent from 9.5 percent a year earlier. Stevens said the company's profit margin should hit 10 percent or higher in the second quarter and for the full year. GM said material costs were $700 million higher in the first quarter, and it expects those costs to continue rising. The automaker said it would counter those increases with cost cutting measures. "It is a more difficult environment than it was three or four months ago," Stevens said when asked about rising commodity prices from potential steel and aluminum tariffs announced by the Trump administration. "But we are confident we can continue to offset that." The company reported quarterly net income of $1.05 billion or $1.43 per share, a drop of nearly 60 percent from $2.61 billion or $1.75 per share a year earlier. Analysts had on average expected earnings per share of $1.24.