1971 Monte Carlo (good Condition) on 2040-cars

Sacramento, California, United States

|

CONDITION/ FEATURES:

Body in good condition /no dents there is a little rust under the veinal top and left door engine runs good new tires new shocks interior is in good shape air conditioner works great new fm/am cd player new tilt steering wheel HISTORY: Im not the original owner SHIPPING AND PAYMENT: Buyer is responsible for shipping DEPOSIT: $500(PAYPAL) FULL PAYMENT: is required within 7 days of auction close (PAYPAL) |

Chevrolet Monte Carlo for Sale

Auto Services in California

Yuki Import Service ★★★★★

Your Car Specialists ★★★★★

Xpress Auto Service ★★★★★

Xpress Auto Leasing & Sales ★★★★★

Wynns Motors ★★★★★

Wright & Knight Service Center ★★★★★

Auto blog

2015 Chevy Colorado takes Motor Trend Truck of the Year calipers [w/videos]

Wed, Dec 3 2014The final winner of Motor Trend's prestigious Golden Calipers has been named, with the 2015 Chevrolet Colorado taking the title of 2015 Truck of the Year, likely shocking those who thought Ford's all-aluminum, next-generation F-150 would take the crown. But win the Colorado did, beating not only the new Ford, but two other brutish Blue Ovals in the F-450 and Transit. The midsize pickup also bested its brethren from General Motors, beating the heavy-duty Chevy Silverado 3500, GMC Sierra Denali 2500 and the GMC Canyon, the Colorado's fraternal twin. After an unprecedented two-year stint with the Golden Calipers, Ram sat this year's awards out. Most impressive about the Colorado's victory isn't that it simply beat the US market's other trucks, it did so with a unanimous vote. Praise from MT's editors focused on the trucklet's price, spacious interior, fit and finish and performance. Former Autoblog staffer Jonny Lieberman called the Colorado's steering the best he'd "ever experienced on any truck, full stop," in MT's awards article. "After days of testing, hundreds of miles on the road, and our most rigorous truck testing program to date, our editors unanimously selected the Chevy Colorado as our 2015 Truck of the Year," said MT boss Edward Loh. "Colorado is a smart, capable, and refreshingly honest truck that makes a strong value and efficiency statement. It's perfectly sized and suited for the needs of many of today's truck users." The Colorado joins the 2015 Volkswagen Golf and 2015 Honda CR-V among Motor Trend 2015 award winners. Scroll down for video commentary from General Motors CEO Mary Barra, Loh and a clip of the Golden Calipers being handed over. Also, check out GM's full press release on its big win. The video meant to be presented here is no longer available. Sorry for the inconvenience. The video meant to be presented here is no longer available. Sorry for the inconvenience. The video meant to be presented here is no longer available. Sorry for the inconvenience. MOTOR TREND Names Chevrolet Colorado 2015 Truck of the Year Midsize pickup outclasses competition in design, engineering, efficiency, safety and more 2014-12-03 EL SEGUNDO, Calif. – After its most comprehensive truck evaluation program in history, MOTOR TREND has selected the Chevy Colorado as its 2015 Truck of the Year®. MOTOR TREND's Truck of the Year program is only open to all-new or significantly updated trucks and vans for the upcoming model year.

2014 Corvette Stingray meets Tesla Model S in drag strip showdown

Wed, Jan 29 2014They come from two different worlds and have little in common. The Tesla Model S P85 is the sportiest version of this paradigm-punching sedan from California, while the 2014 Corvette Stingray Z51 is a performance-enhanced version of Michigan's recently-updated sports car stalwart. The West Coast car seats five adults and eats electrons like Popeye eats spinach, the Easterner has two passenger places and, surprisingly, sips gasoline like one might bourbon. An attribute they do happen to share is extreme quickness. This similarity is all the excuse Drag Times needed to set the vehicles beside each other at the Palm Beach International Raceway for a bit of mano-a-mano quarter-mile combat. Fortunately enough, cameras were rolling for each of two bouts down the blacktop and the results recorded for our edification and enlightenment. The winner? We won't spoil it for you, but let's just say it's really, really close. How close? Scroll below and watch the video for yourself. Just be warned, the results may surprise you. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Mother's Day Suggestion No. 2,506

Thu, 02 May 2013With Mother's Day coming up, we're always looking for new gift ideas to celebrate the occasion, but hot laps around a track might not be the best suggestion for Darius Khashabi. In a video posted on YouTube, Khashabi straps his mom into the passenger seat of his C6 Corvette Z06 for some laps around Sonoma Raceway (formerly Infineon Raceway) at "60 percent" with comical results.

Now this isn't the first time Mama Khashabi has gotten seat time in her son's car around a track, as his YouTube page shows him pulling a similar stunt - with similar results - around Mazda Raceway Laguna Seca last year. Scroll down for the video, but know that the action really gets going at around the 1:40 mark.

1988 chevrolet monte carlo ss

1988 chevrolet monte carlo ss 1970 monte carlo

1970 monte carlo 1988 chevrolet monte carlo ss coupe 2-door 5.0l

1988 chevrolet monte carlo ss coupe 2-door 5.0l Monte carlo ss 83

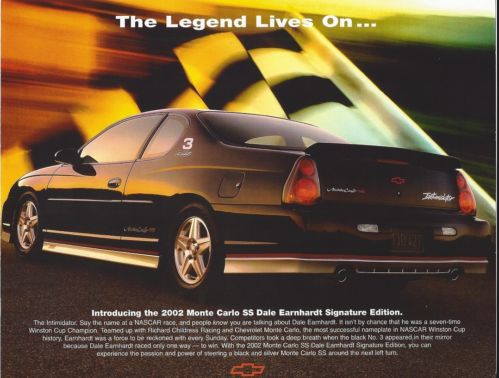

Monte carlo ss 83 2002 chevrolet monte carlo ss coupe 2-door 3.8l

2002 chevrolet monte carlo ss coupe 2-door 3.8l 350 cid, 2-speed powerglide, factory-original paint color, classic 70's ride!

350 cid, 2-speed powerglide, factory-original paint color, classic 70's ride!