04 Chevy Monte Carlo Ls Black, 113k Miles, Rims on 2040-cars

Troy, New York, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:3.4L 207Cu. In. V6 GAS OHV Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chevrolet

Model: Monte Carlo

Trim: LS Coupe 2-Door

Options: CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 113,000

Exterior Color: Black

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 6

Hi I Have a clean 04 Chevy Monte Carlo LS black with 18 rims 75% tread and brand new all season tires on stock everything work all service is been done frequently as I work in a shop have new tires clean title in hand.

Chevrolet Monte Carlo for Sale

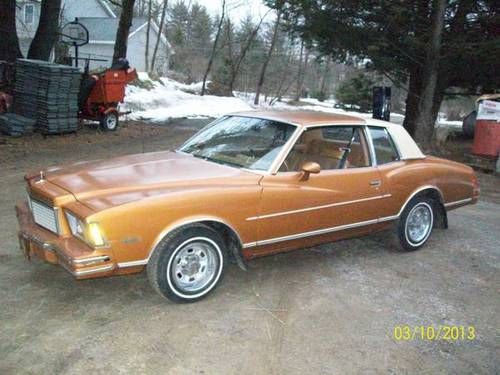

1978 monte carlo original

1978 monte carlo original 1987 chevrolet monte carlo aero coupe(US $7,443.00)

1987 chevrolet monte carlo aero coupe(US $7,443.00) 2001 chevrolet monte carlo ss coupe / one of a kind dale earnhardt jr edition

2001 chevrolet monte carlo ss coupe / one of a kind dale earnhardt jr edition 1983 chevrolet monti carlo for parts only no eng/trans no title for parts only

1983 chevrolet monti carlo for parts only no eng/trans no title for parts only 2000 chevrolet monte carlo nice clean only 95000mi

2000 chevrolet monte carlo nice clean only 95000mi White 1986 ss chevy monte carlo(US $4,000.00)

White 1986 ss chevy monte carlo(US $4,000.00)

Auto Services in New York

YMK Collision ★★★★★

Valu Auto Center (ORCHARD PARK) ★★★★★

Tuftrucks and Finecars ★★★★★

Total Auto Glass ★★★★★

Tallman`s Tire & Auto Service ★★★★★

T & C Auto Sales ★★★★★

Auto blog

Conquest and controversy conclude the 2014 Rolex 24 at Daytona [spoilers]

Sun, 26 Jan 2014If you don't wish to know who won the 2014 Rolex 24 at Daytona, you should avert your eyes right now. We'll even give you a double-space to skedaddle...

For those of you still with us, the first race in the United SportsCar Championship (USCC) is done, but the discussions about it certainly won't end for a while. Daytona Prototypes claimed the first four overall places, the top spot taken by the No. 5 Action Express Coyote-Chevrolet Corvette DP driven by Joao Barbosa, Christian Fittipaldi, Sebastien Bourdain and Burt Friselle. The 16th and final caution of the race bunched the field up for an eight-minute sprint to the flag, so the first place getter finished just 1.4 seconds ahead of the No. 10 Wayne Taylor Racing Dallara-Chevrolet Corvette DP driven by Max Angelelli. Third place went to Brian Friselle in the No. 9 Action Express Chevrolet Corvette DP, 20 seconds down. Chevrolet power hasn't taken the overall win since 2003, eleven years later it scores a one-two-three-four. The No. 6 Muscle Milk/Pickett Racing ORECA-Nissan 03 scored fifth place, the top LMP2 finisher.

The Prototype Challenge class win went to the No. 54 CORE Autosport team of Colin Braun, Jon Bennett, Mark Wilkins and James Gue.

Nissan Leaf keeps plug-in vehicle sales crown for 6th straight month

Thu, May 1 2014And Nissan makes it 14 in a row. For the 14th straight month, the all-electric Leaf has had "record sales," according to Nissan's marketing team. What that means is that for that particular month (in this case, April) no matter what year you look at, the car sold more than it ever did before. For April 2014, the 2,088 Leafs sold represents a 7.8-percent increase from 2013. Nissan's director of EV sales and marketing, Toby Perry, said in a statement that the "new market" of Cincinnati made the top 25 list for Leaf sales areas in April, so the car's popularity continues to ebb and flow across the US. Over at Chevy, the Volt sold 1,548 units in April, reaching a year-to-date total of 5,154. The Leaf is outpacing that with 7,272 YTD sales. In 2013, the Volt outsold the Leaf by about 500 vehicles, but Leaf sales are up 33 percent year-over-year while Volt is down 7.1 percent. The Leaf has also outsold the Volt for six straight months. But we're excited for every eco-car sale, and that's why we'll have our monthly detailed write-up of the rest of the plug-ins, hybrids and diesel vehicles available soon. Until then, discuss. Green Chevrolet Nissan Electric Hybrid PHEV ev sales

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.