2012 Chevrolet Malibu 1lt on 2040-cars

200 Professional Parkway, Troy, Missouri, United States

Engine:2.4L I4 16V MPFI DOHC

Transmission:6-Speed Automatic

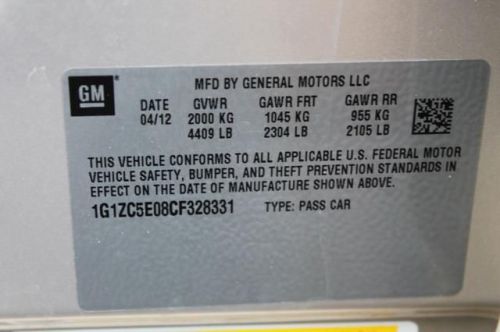

VIN (Vehicle Identification Number): 1G1ZC5E08CF328331

Stock Num: T9492A

Make: Chevrolet

Model: Malibu 1LT

Year: 2012

Exterior Color: Gold Mist Metallic

Interior Color: Cocoa / Cashmere

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 36499

Ask for Internet Sales (Jason and Travis) for additional Discounts! Ask for JASON and Travis in Internet Sales for ADDITIONAL DISCOUNTS! Plenty of power and up to 32 MPG! This great looking vehicle needs a new home now! Have peace of mind knowing you still have plenty of Factory Warranty on this vehicle! Looking for something that is great on gas? Well here it is! Looking for the absolute best price on this vehicle? Call and ask for THE INTERNET SALES DEPT. (JASON and Travis) Online or at the Dealership, ask for our Internet Sales Team! Jason and Travis!

Chevrolet Malibu for Sale

2013 chevrolet malibu 1ls

2013 chevrolet malibu 1ls 2006 chevrolet malibu maxx ss(US $6,311.00)

2006 chevrolet malibu maxx ss(US $6,311.00) 2008 chevrolet malibu classic lt(US $9,990.00)

2008 chevrolet malibu classic lt(US $9,990.00) 2014 chevrolet malibu 1ls(US $23,455.00)

2014 chevrolet malibu 1ls(US $23,455.00) 2014 chevrolet malibu 1ls(US $23,255.00)

2014 chevrolet malibu 1ls(US $23,255.00) 2014 chevrolet malibu 1ls(US $23,455.00)

2014 chevrolet malibu 1ls(US $23,455.00)

Auto Services in Missouri

Wyatt`s Garage ★★★★★

Woodlawn Tire & Auto Center ★★★★★

West County Auto Body Repair ★★★★★

Tiger Towing ★★★★★

Straatmann Toyota ★★★★★

Scott`s Auto Repair ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Callaway debuts its new C7 Stingray at National Corvette Museum

Fri, 02 May 2014Callaway showed off its first tuned version of the 2014 Corvette Stingray at the National Corvette Museum last week, giving the rampant enthusiasts of America's sports car a look at the roughly 620-horsepower, supercharged rocket.

Unlike the Corvette SC610 we showed you back in January, this Stingray packs a fair bit more oomph. Horsepower is only up ten ponies, but torque has jumped from 556 pound-feet to "at least" 600 pound-feet. Neither horsepower nor torque is official quite yet, although Callaway is expecting to know just what its creation can do once testing and validation is completed later this month.

The 6.2-liter, supercharged V8 now boasts a new, three-element intercooler, which Callaway claims only allowed the inlet air temperature to increase by ten degrees Fahrenheit during dyno runs. Previous designs saw a 35-degree-Fahrenheit jump. The exhaust system has also been fettled with, and now is even less restrictive.

Nissan Leaf sets another monthly sales record, Chevy Volt remains steady

Mon, Nov 3 2014Here we go again. Another month in the books and another month of record sales by the Nissan Leaf in the US. For October, the world's best-selling pure EV sold 2,589 units, which is 29.3 percent more than October 2013. That makes it 20 times in a row that Nissan can say that last month sales were better than the same month a year before. All told, Nissan has sold 24,411 Leafs in the US this year, a new record, reflecting an overall Leaf sales rate that is up 35 percent, year-to-date. Nissan isn't stopping, either. A new TV ad, one that, "encourages consumers to kick gas" by saving money on fuel will start airing today in major markets, according to Toby Perry, director of Nissan's EV marketing. You can watch it below. As for the Chevy Volt, things remained steady last month in the face of a new model that's coming in the second half of 2015. Chevy sold 1,439 Volts last month, which is about the same as September (1,394) but down 28.8 percent from the October 2013 despite GM having its best overall US October sales this year since 2007. So far, 2014 Volt year-to-date sales are down 14.9 percent through the end of October compared to 2013. And that wraps up the flash report on monthly sales for these two long-standing plug-in vehicles in the US market. As always, we'll have our in-depth write-up of US green car sales available soon. For now, we await your comments, below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.