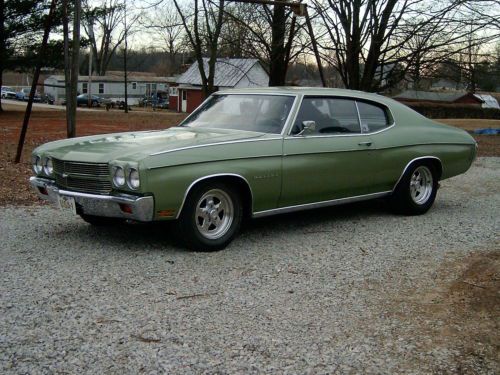

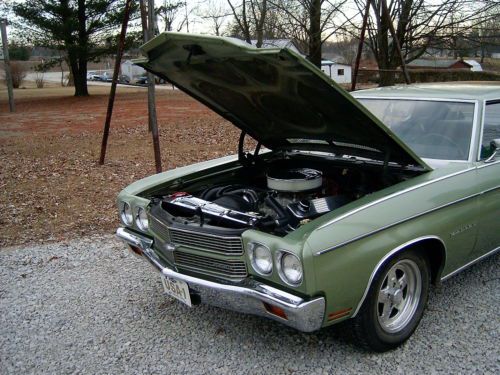

1970 Chevelle Malibu Bbc Conversion Survivor Type Car Sell Or Trade on 2040-cars

Loogootee, Indiana, United States

| ||

Chevrolet Malibu for Sale

1972 chevelle project chevrolet 350 original(US $4,500.00)

1972 chevelle project chevrolet 350 original(US $4,500.00) 2011 chevrolet malibu lt sedan 4-door 2.4l(US $10,000.00)

2011 chevrolet malibu lt sedan 4-door 2.4l(US $10,000.00) 1976 chevrolet malibu classic(US $3,500.00)

1976 chevrolet malibu classic(US $3,500.00) 1975 chevy malibu with new 396 big block

1975 chevy malibu with new 396 big block 2007 chevrolet malibu ls sedan 4-door 2.2l(US $8,000.00)

2007 chevrolet malibu ls sedan 4-door 2.2l(US $8,000.00) 1999 chevrolet malibu ls sedan 4-door 3.1l

1999 chevrolet malibu ls sedan 4-door 3.1l

Auto Services in Indiana

western metals ★★★★★

Webb Ford Inc ★★★★★

Weatherford Auto & Truck Service ★★★★★

Watson Automotive ★★★★★

Wagner`s Auto Service ★★★★★

Tom O`Brien Chrysler Jeep Dodge -Greenwood ★★★★★

Auto blog

Deep discounts — $12K, $13K, $16K — are fueling a pickup price war

Mon, Jun 4 2018Heavy discounts of up to $16,000 per vehicle are fueling a "truck war" among full-size pickups sold in the United States by the Detroit Three, a Reuters analysis shows. Strong U.S. sales this year of the highly profitable big trucks have helped offset lagging passenger car sales. But it is not clear how much of the truck demand is linked directly to ample factory incentives and dealer discounts, or how far sales might decline without those subsidies. A Reuters survey of Ford, General Motors Co's Chevrolet and Fiat Chrysler Automobiles's Ram truck dealers across the United States indicates stores are offering deep discounts the country's bestselling full-size pickup trucks. "The walls are not crashing down on full-size trucks," said Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions in Chester Springs, Pennsylvania. Detroit-based automakers want to keep cranking out their high-margin trucks, he added, and "giving up a little of the profit is the cheapest way to do it." Stores are offering discounts of up to $12,000 on the 2018 Ford F-150, which remains the best-selling vehicle in the country, recording more than 80,000 sales in May. Discounts run up to $13,000 on the 2018 Chevrolet Silverado and as high as $16,000 on the Ram 1500. Average transaction prices for full-size pick-ups range from around $42,000 to $45,000, industry analysts and automakers say. All three companies are spending furiously - GM and Fiat Chrysler to help sell off carryover 2018 trucks to prepare for redesigned 2019 models, and Ford to sustain its long-held sales crown. A supplier fire that temporarily shut down production of the F-150 last month "changed the game," said Jeff Schuster, senior vice president of forecasting at LMC Automotive in Troy, Michigan said. The supply halt nudged Ford's crosstown rivals "to ratchet up incentives on the current models to go after weakness at Ford," he said. Deals advertised on the companies' official websites range from rebates and low-interest loans to ultra-cheap lease rates, but they are not telling the whole story. Ford, for instance, advertises a $2,000 rebate and a $500 financing credit on sales of certain F-150 models. But James Collins Ford in Louisville, Kentucky, is offering discounts of up to $12,215 on the 2018 F-150 XLT SuperCrew 4x4. The price cuts are even steeper at a number of GM and Fiat Chrysler dealers. Quirk Chevrolet is selling the 2018 Silverado 1500 Double Cab at $13,000 off sticker.

2016 Chevy Volt sneak peek at CES

Mon, Jan 5 2015Here it is, folks – your first real glimpse at the 2016 Chevrolet Volt. The gasoline-electric sedan will officially debut at the Detroit Auto Show next week, but Chevy gave us a sneak peek of its redesigned Volt at a media event in Las Vegas late Sunday, as part of its CES festivities. There isn't a ton to see here, and sorry about the low quality video (and for us not standing front and center during the reveal). But we can clearly see the car's redesigned front fascia – something recently previewed at a fan event in Los Angeles. For another view, check out a high-res photo of the new Volt from our friends at The Verge, here. Chevy even tweeted a photo of the Volt's new nose on its official Volt Twitter account, which you can see below. The automaker didn't divulge any details about its new Volt, but we already know quite a bit. For starters, the Volt will use a new, 1.5-liter gasoline engine and won't require premium fuel. It'll have more EV range and a bigger battery, too. We'll have a whole mess of information when the 2016 Volt is fully revealed in Detroit in about one week's time. In the meantime, here are some more looks at the Volt, courtesy of the Twitterverse. We're so excited about #NextGenVolt we brought it out early at #CES2015! Full details on 1/12 at #NAIAS. pic.twitter.com/hPCbTFGSV4 - Chevrolet Volt (@ChevyVolt) January 5, 2015 Take a look at the new Chevy Volt http://t.co/laCvWLRMXk pic.twitter.com/uOzRh5XCrP - Engadget (@engadget) January 5, 2015 The very first look at the 2016 Chevy Volt doesn't disappoint: http://t.co/PM0HcnyQOo pic.twitter.com/WFtoyd0utH - Gizmodo (@Gizmodo) January 5, 2015 Chevy just gave @Tim_Stevens a very quick look at the next-gen Volt at #CES2015. #CNETatCES http://t.co/3n6EK1yOrC pic.twitter.com/7KDYh0VSg0 - CNET (@CNET) January 5, 2015 Related Gallery 2016 Chevy Volt at CES Related Gallery 2016 Chevrolet Volt Teaser Images Green CES Detroit Auto Show Chevrolet GM Alternative Fuels Green Automakers Electric Hybrid Videos Sedan 2015 Detroit Auto Show CES 2015

GM tells owners not to use SUV wipers due to fire risk

Sun, Oct 11 2015General Motors is recalling 31,685 examples of the 2016 Buick Enclave, Chevrolet Traverse, and GMC Acadia because a short circuit in the windshield wiper motor can potentially lead to a fire. Due to the danger, the company is asking owners not to use the wipers until the problem is fixed, according to The Detroit Free Press citing the Associated Press. A manufacturing defect in the wiper motor cover means that the electrical terminals can come into contact and cause a short. The part could "melt, smoke, or catch fire," according to a statement from GM. The company will get them fixed immediately, and dealers will replace the cover. If there's bad weather at the time the owner specifies to get the recall work completed, the automaker will come pick up the crossovers. Depending on parts availability, the automaker will supply a rental car for customers, as well. The issue was discovered at the factory. According to the company's statement, only 6,405 actually made it to customers, and they were notified immediately by overnight letter. The rest were in dealer stock. The affected crossovers carry build dates between August 18, 2015 and September 24, 2015. Of those, there are 29,295 in the US and 1,073 in Canada. GM Statement: General Motors has told the National Highway Traffic Safety Administration that it will recall approximately 29,295 2016 model year Chevrolet Traverse, Buick Enclave and GMC Acadia SUVs in the U.S. because the front windshield wiper motor may overheat when in use because of a manufacturing defect. In some cases, the front windshield wiper motor cover may melt, smoke or catch fire. The approximately 6,405 customers who have taken delivery of these vehicles were notified by overnight letter and are urged to contact a GM dealer as soon as possible to arrange a service appointment. These customers should not use the front windshield wipers until they have been repaired. If weather conditions prevent driving the vehicle without using the windshield wipers, GM will arrange to pick up the vehicle for servicing. If repair parts are unavailable, GM will provide a rental car at no cost until parts become available. The total population, including Canada, Mexico and exports, is approximately 31,685. About 25,280 of these vehicles are in dealer stock and will not be sold until repairs are made.