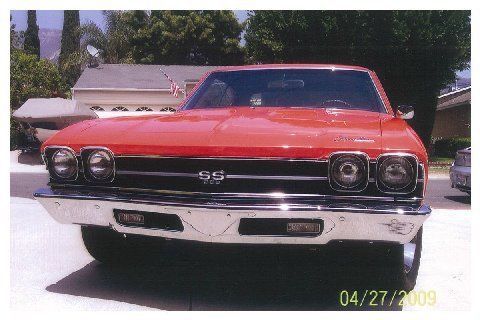

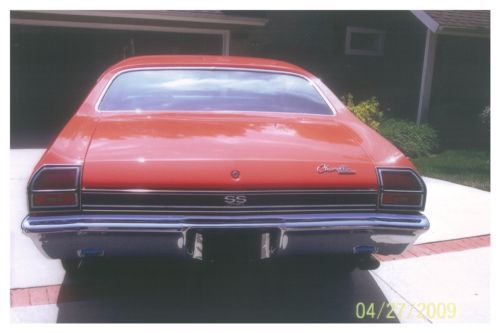

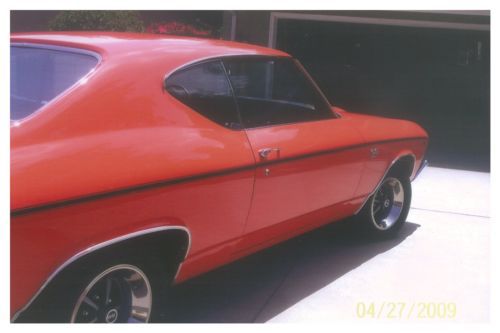

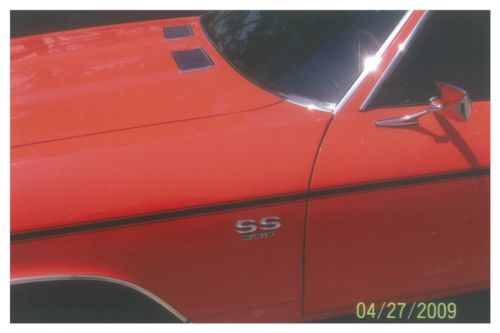

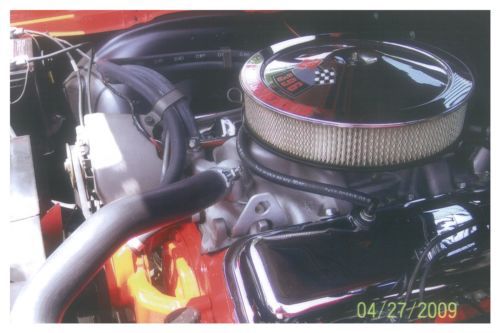

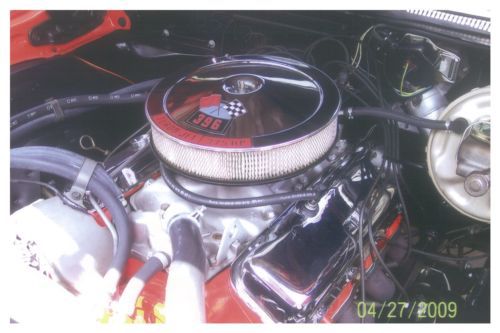

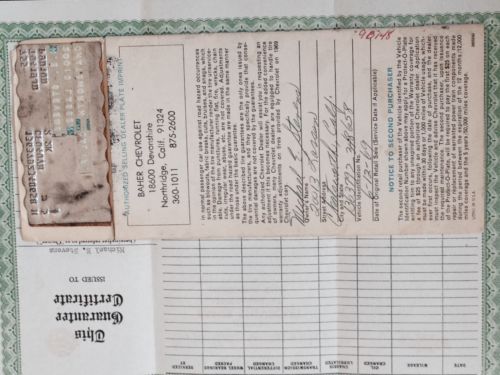

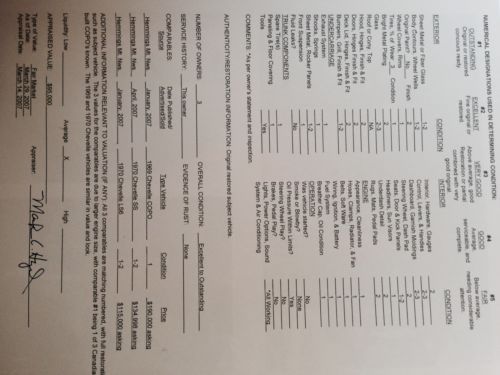

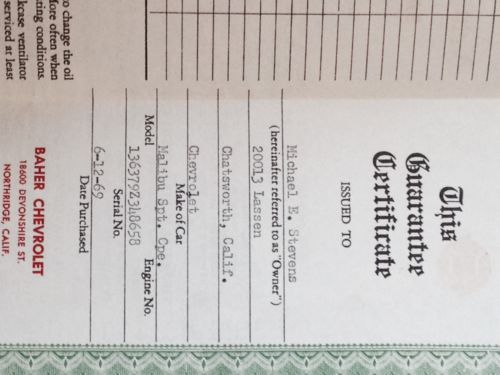

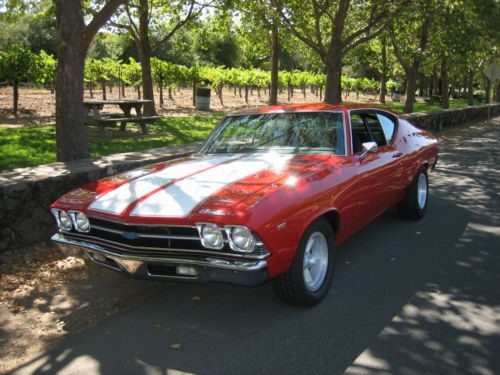

1969 Chevelle Ss 396ci/375hp M-22 Original-owner-docs Matching # Off-frame-resto on 2040-cars

Montrose, California, United States

Chevrolet Malibu for Sale

4dr sdn ltz sedan automatic gasoline 3.6l v6 cyl black granite metallic(US $7,944.00)

4dr sdn ltz sedan automatic gasoline 3.6l v6 cyl black granite metallic(US $7,944.00) 2009 chevrolet malibu 4dr sdn ltz leather sun roof look at the miles

2009 chevrolet malibu 4dr sdn ltz leather sun roof look at the miles 1969 chevelle ss tribute car big block very clean

1969 chevelle ss tribute car big block very clean 2011 chevrolet malibu lt 52k no reserve salvage rebuildable hail damaged

2011 chevrolet malibu lt 52k no reserve salvage rebuildable hail damaged 2008 chevrolet malibu lt sedan 4-door 2.4l(US $9,995.00)

2008 chevrolet malibu lt sedan 4-door 2.4l(US $9,995.00) 2011 chevy malibu lt2 htd leather chrome wheels 48k mi texas direct auto(US $13,780.00)

2011 chevy malibu lt2 htd leather chrome wheels 48k mi texas direct auto(US $13,780.00)

Auto Services in California

Z & H Autobody And Paint ★★★★★

Yanez RV ★★★★★

Yamaha Golf Cars Of Palm Spring ★★★★★

Wilma`s Collision Repair ★★★★★

Will`s Automotive ★★★★★

Will`s Auto Body Shop ★★★★★

Auto blog

2015 Chevrolet SS Review [w/video]

Mon, Jul 27 2015The Chevrolet SS is one of the best cars no one's buying. It's a Bowtie-badged version of the Australian Holden Commodore with a 6.2-liter LS3 V8 under the hood. It's got a six-speed manual transmission, General Motors' sophisticated Magnetic Ride Control suspension, and rear-wheel drive. It's a fullsize sedan that comes with every possible amenity you could want. And it's less than $50,000. Chevrolet sold 2,479 SS sedans in 2014. That means it was outsold by every other vehicle the automaker offers, even the police fleet-only Caprice. (I'm only talking about cars that were on sale for the full 2014 calendar year, of course.) The aforementioned manual transmission and MRC suspension were added for 2015, but it's not clear if that's helping. The SS is down 7.7 percent through June of this year, compared to 2014's numbers. But hey, at least it's finally outselling the Caprice. What a damn shame. Granted, GM only planned to sell a few thousand of these each year, but as enthusiasts, this a car we should be gobbling up. It's the closest we'll get to a four-door Corvette, and with the 2015 model year updates, that statement is more true than ever. People often mistook the SS for a Malibu. "Is that a rental car?" Yikes. Aside from the manual gearbox and magnetorheological suspension, the SS is largely unchanged through its year and a half of sales. But that's no bad thing – we were thoroughly impressed with the SS when we first tested it at the end of 2013. Outside, the SS looks the same, which is a bummer. It is not an attractive car, and the chrome brightwork on the side vents and wheels doesn't help. That said, the sedate styling puts it under the radar – more so than competitors like a Dodge Charger 392, anyway. But maybe it's too under the radar. Even in the new, "Some Like It Hot Red" color (yes, really), photographer Drew Phillips reports that people often mistook the SS for a Malibu. "Is that a rental car?" Yikes. Exterior styling is our only gripe with the SS. Moving inside, there's a lot to like. This is easily one of Chevy's nicest, well thought-out interiors (thanks, Holden), with premium materials and tons of equipment. The Chevy MyLink infotainment system carries over, and now features 4G LTE and wifi connectivity. The touchscreen is a bit slow to respond, but otherwise, it's bright, well organized, and packed with functionality. This is easily one of Chevy's nicest, well thought-out interiors.

GM sees 'strong year' in 2018, then gold in Chevy Silverado for 2019

Tue, Jan 16 2018DETROIT — General Motors said on Tuesday it expects earnings in 2018 to be largely flat compared with 2017, but that profits should pick up pace in 2019 as its revamped line of high-margin pickup trucks hits the U.S. market. The 2018 earnings outlook was above market expectations, sending GM shares up more than 3 percent in premarket trading. "GM had a very good 2017 as we continued to transform our company to be more focused, resilient and profitable," GM Chief Executive Mary Barra said in a statement. "We are positioned for another strong year in 2018 and an even better one in 2019." GM and its Detroit rivals, Ford and Fiat Chrysler Automobiles, are bringing on new trucks at a time when overall U.S. new vehicle sales have been falling, but truck sales continue to grow as consumers abandon passenger cars in favor of pickups, SUVs and crossovers. GM on Saturday fired a new round in the battle for profits from one of the U.S. auto industry's most lucrative segments when it showed a new generation of its Chevrolet Silverado pickup truck at the Detroit auto show. The new Silverado, a highlight of the event, is the successor to GM's best-selling vehicle in North America. Sales of the current Silverado rose nearly 2 percent to 585,000 vehicles in 2017. In the coming months, the company will also reveal a revamped GMC Sierra pickup truck. U.S. new vehicle sales fell 2 percent in 2017 after hitting a record high in 2016, and are expected to drop further in 2018 as interest rates rise and more late-model used cars return to dealer lots to compete with new ones. GM said on Tuesday that while it retools a factory in Ft. Wayne, Indiana, to make the new pickup trucks, it will shift some production to an Oshawa, Ontario, plant in order to avoid missing sales in a hot market for the vehicles. The No. 1 U.S. automaker said it will record a $7 billion non-cash charge for its fourth-quarter 2017 earnings related to deferred tax assets. GM said it expects capital expenditure in 2018 of around $8.5 billion, about $1 billion of which will go toward funding self-driving car technology. Last week, the company said it is seeking U.S. government approval for a fully autonomous car — one without a steering wheel, brake pedal or accelerator pedal — to enter the automaker's first commercial ride-sharing fleet in 2019. GM said it expects 2017 earnings per share at the high end of its previously forecast range of $6 to $6.50.

Car Club USA: Louisiana Mudfest

Tue, Jun 16 2015There's nothing quite like mudding. Big tires, huge power, and crazy-wild gearheads that like to throw down on a mud pit almost as much as a thirty rack of Coors. In the latest, and some might argue greatest yet episode of Car Club USA, we head to Louisiana to throw some dirt at Mudfest. As Louisiana's one and only Mouth of the South puts it, "If you don't mud ride... go to Texas I guess." Joining The Mouth and friendly rivals The Most Hated Mud Sluts, we dive in. Beyond the obvious V8 blasting and tractor-tire spinning, those who know best describe Mudfest as, "Good cooking, good friends, good fun, and a lot of partying." It's a motorsport spectacle unlike any you're likely to find up North or out West, though no less impressive to behold. Follow along with the fun, the impromptu drag racing, the trash talking, and the mechanical madness. And find out why, at Mudfest, "if we don't tear it up, we ain't done it right." Each Car Club USA episode features a different car club or event from across the US, where passionate owner communities gather to share automotive experiences and embark on incredible adventures. From Main Street cruises to off-road trails, catch all the latest car club activity on Autoblog. Chevrolet Ford Jeep RAM Truck Off-Road Vehicles Car Club USA Videos autoblog black