2001 Chevrolet Lumina Base Sedan 4-door 3.1l on 2040-cars

Waldorf, Maryland, United States

|

This is 2001 Green Chevy Lumina. Other than the minimal clear coat peel, it is in great condition. It runs excellent and is an extremely reliable vehicle with only 90K miles. It has one original owner and a clean Carfax. This was a Montgomery County Government Owned Vehicle regularly serviced. I am asking 3200$ for it which is a steal!! Payment will be accepted in the form of cash or check. Preferably would not like to ship but, if necessary, buyer would have to pay for this process.

|

Chevrolet Lumina for Sale

Very decent first car for a teen or daily driver

Very decent first car for a teen or daily driver 1996 chevrolet lumina ls sedan 4-door 3.1l(US $5,500.00)

1996 chevrolet lumina ls sedan 4-door 3.1l(US $5,500.00) 1994 chevrolet lumina 4 door low miles(US $2,195.00)

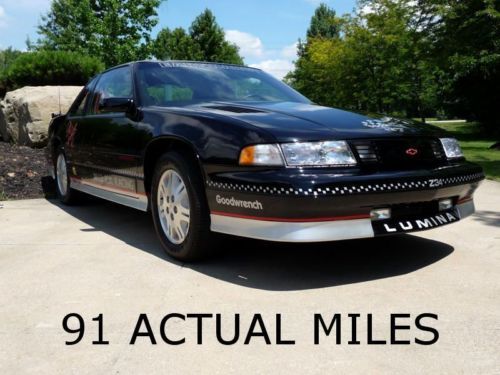

1994 chevrolet lumina 4 door low miles(US $2,195.00) 91 original miles!! rare 5-speed, dale earnhardt limited edition #25 of 25 wow!

91 original miles!! rare 5-speed, dale earnhardt limited edition #25 of 25 wow! 1999 chevrolet lumina ls sedan 4-door 3.8l

1999 chevrolet lumina ls sedan 4-door 3.8l 1997 chevrolet lumina auto green great mechanical condition 128k

1997 chevrolet lumina auto green great mechanical condition 128k

Auto Services in Maryland

Starting Gate Servicenter ★★★★★

Square Deal Garage ★★★★★

Sir Michael`s Auto Sales ★★★★★

Sedlak Automotive, LLC ★★★★★

Mr. Tire Auto Service Centers ★★★★★

Milford Automotive Servicenter ★★★★★

Auto blog

Recharge Wrap-up: Ford HQ gets giant solar array, Chevy City Express gets 24 MPG city

Sat, Aug 16 2014Ford will be building Michigan's largest solar array at its Dearborn headquarters. With funding from DTE Energy, the solar carport will provide covered parking, as well 30 charging stations for electric vehicles. The array is expected to generate 1.13 million kWh per year for Ford's operations, and offset 794 metric tons of carbon emissions. Read more in the press release below. Chevrolet announced the fuel economy for the 2015 City Express, at 25 mpg combined. The cargo van is rated at 24 mpg in the city, and 26 mpg on the highway. Chevy credits the van's inline four-cylinder engine and continuously variable transmission for its impressive city mileage. For its customers - which are mainly businesses - "The fuel economy of the City Express will help stretch their dollar at the pump and give them the flexibility to invest the savings back into their business," says Chevrolet's Ed Peper. The City Express starts at $22,950. Read more in the press release below. Engineers at the University of Wisconsin have developed an efficient engine that runs on a diesel-gas blend. The engine, which uses a computer to control the blend proportions, is about 15 percent more efficient than the any diesel engine according to mechanical engineering professor Rolf Reitz. The team has put the experimental reactivity controlled compression ignition (RCCI) engine in a demonstration car - a 2009 Saturn. "This vehicle can do 50 miles per gallon," says Reitz, who believes the system could be improved further. Read more at Wisconsin Public Radio. The Southeast Alternative Fuel Conference and Expo will take place in October in Raleigh, North Carolina. Held at the NC Clean Energy Technology Center from October 22-24, the event will feature a variety of exhibitors, speakers and, most importantly, alternatively powered vehicles. "The three day conference will be a one-stop shop for fleet and transportation related decision makers to learn about return on investment, efficiency and alternative transportation fuels such as biodiesel, electricity, ethanol, propane and natural gas," says Anne Tazewell of the NC Clean Energy Technology Center. If you can't make it to Raleigh for the Expo, you can still enter to win a free two-year lease of a Nissan Leaf at the Center's website. Learn more about the event in the press release, below.

Recharge Wrap-up: Tesla sells Model S 85 and 70D in Malaysia, Chevy Spark EV built using clean energy

Mon, May 18 2015Tesla will send Model S 70D and Model S 85 EVs to Malaysia for leasing to government-linked companies. Only those companies will have access to the models as a two-year lease, which will be imported and leased by Malaysian Green Technology Corporation. The plan is part of an initiative by the Ministry of Energy, Green Technology and Water to allow government officials and other influential people to get to know the electric vehicles and the benefits that come along with them. Most of the 120 vehicles available will be the 70D model, and the lessee companies will have the option to purchase the cars at the end of the two years. Read more from Paul Tan's Automotive News. Wanxiang is hosting students from Delaware in China as part of a program to learn Mandarin and visit schools and science and technology sites. Wanxiang, the auto parts company that acquired Fisker (which had manufacturing based in Delaware) and battery maker A123 Systems, will give the students tours of its solar technology facilities, among other places, and see what daily life is like for families in the region. The program helps students interested in science and technology to foster marketable skills — like learning a foreign language — that will help them get jobs in industries around the world. Read more at Delaware Online. The Chevrolet Spark EV's electric motor (pictured) and drive unit are manufactured using clean energy. The e-motors building of the General Motors Baltimore Operations complex has a new rooftop solar array and uses LED and CFL lighting, helping the building recently earn LEED Silver certification. The landfill-free facility also takes advantage of the 1.23-megawatt solar array on the grounds, helping it source six percent its energy from renewable sources. The plant has reduced its energy intensity by 15.5 percent in three years, and continues to work toward reducing consumption and sourcing clean energy. "We believe reducing our environmental footprint is good for the climate and good for our business," says GM Executive Director of Global Public Policy Greg Martin. Read more in the press release below. Spark EV Motor Plant Fueled by Green, Clean Energy ENERGY STAR®, USGBC and Maryland state agency recognize facility's efforts WHITE MARSH, Md. – Chevrolet recently began selling the Spark EV to Maryland commuters able to take advantage of the state's robust charging infrastructure.

Camaro-based Trans Am SE Bandit Edition borrows Burt Reynolds

Tue, Mar 29 2016For some reason, modifying modern Chevrolet Camaros into the lurching, reincarnated shells of the Pontiac brand is still a thing. If you're the perverse sort that likes this kind of thing, you should check out the latest product from the Trans Am Depot, which comes complete with an endorsement from the star of Smokey and the Bandit, Burt Reynolds. Yes, the new Trans Am SE Bandit Edition has been signed and endorsed by the man himself, but what's important here is not the signature on the dash, it's the bits of Camaro that have been modified. Aesthetically, that means a Bandit-and-Frog-approved set of T-tops, a front-opening hood with a very large, prominent shaker scoop, an equally large and prominent screaming chicken, and Trans Am-inspired front and rear fascias. And naturally, Burt Reynolds' signature adorns the dash. There are plenty of reminders in the cabin about this car's Hollywood inspiration, too. Bandit decals can be found on the front headrests and center console lid, there are chicken wings on the Camaro-spec plastic door inserts, and the black-and-tan color scheme matches nicely with the exterior look. And power? Well, Sheriff Buford T. Justice would have a lot more trouble keeping up with this Trans Am than he did with the original. The 7.4-liter LSX V8 has been paired with a 2.9-liter supercharger which is good for 840 horsepower. It's fast and loud, and even if you can't get behind the look (we can't), at least this Camaro-in-Trans Am's clothing can impress with its performance. The Bandit Edition is limited to just 77 units with prices starting around $115,000. You can check out the official video from Trans Am Depot, which comes with a decent helping of Burt Reynolds, up top. Related Video: