2011 Chevy Impala Ltz on 2040-cars

Alburnett, Iowa, United States

Chevrolet Impala for Sale

Chevy impala police cruiser

Chevy impala police cruiser 2006 chevrolet impala - police pkg - 3.9l v6 - 422789

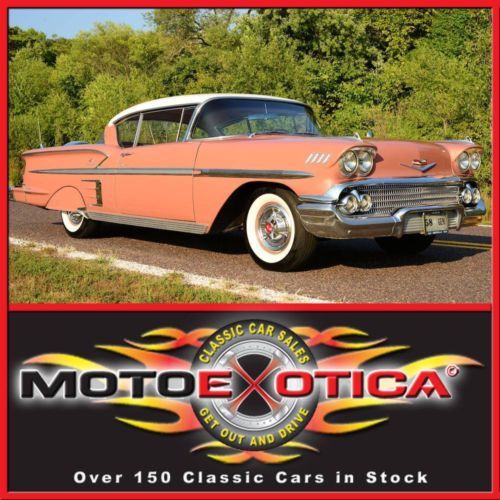

2006 chevrolet impala - police pkg - 3.9l v6 - 422789 1958 chevrolet impala, incredibly clean, numbers matching, 348ci tri-power(US $52,900.00)

1958 chevrolet impala, incredibly clean, numbers matching, 348ci tri-power(US $52,900.00) 2008 chevrolet impala - police pkg - 3.9l v6 - 276899

2008 chevrolet impala - police pkg - 3.9l v6 - 276899 1964 chevrolet impala 2 door hardtop sport coupe 283 v8 auto nice rust-free body

1964 chevrolet impala 2 door hardtop sport coupe 283 v8 auto nice rust-free body 1964 chevrolet impala 2dr hard top 350 manual trans

1964 chevrolet impala 2dr hard top 350 manual trans

Auto Services in Iowa

Woody`s Auto Repair Service ★★★★★

Stew Hansen Dodge Ram Chrysler Jeep ★★★★★

Scotty`s Body Shop ★★★★★

Priority 1 Automotive Services ★★★★★

Perfection Auto Repair ★★★★★

Osborne Oil ★★★★★

Auto blog

Which of these five plug-ins should win the 2017 Green Car of the Year?

Tue, Nov 8 2016It's going to be a competitive race for the 2017 Green Car Of The Year. With a minivan in the running for the first time in ages, the five finalists announced by Green Car Journal today include five very different plug-in vehicles. As Ron Cogan, the editor and publisher of Green Car Journal, said in a statement, "electrification is now considered by most automakers an essential technology for current and future high-efficiency models." Let's check out the list: Toyota Prius Prime, the updated plug-in version of the world's best-selling hybrid. Chevy Bolt, GM's all-new entry into the long-range EV game. Chrysler Pacifica, a family hauler with the ability to go 30 miles on electric power. Kia Optima. The nomination is for the full line-up, but really the hybrid and plug-in hybrid models are the green stars here. BMW 330e iPerformance, one of the automaker's many new plug-in hybrids that bring battery power to models outside the i sub-brand. Green Car Journal will announce the winners at the Los Angeles Auto Show on November 17th, along with some, "other green transportation announcements," whatever that means. Last year, the winner was the 2016 Chevy Volt, the first model to snatch up two wins. Which do you think should win this year? Related Video: News Source: Green Car JournalImage Credit: REUTERS/Kevork Djansezian Green LA Auto Show BMW Chevrolet Chrysler Kia Toyota Chevy Bolt chrysler pacifica green car of the year toyota prius prime bmw 330e

China's rise, global restructuring wither GM's Korea division

Wed, Jan 7 2015An article in the Daily Kanban suggests the sun is setting on GM Korea, and it could already be well into dusk. GM Korea came about when General Motors, along with co-investors SAIC and Suzuki, bought Daewoo Motors from parent company Daewoo Group in 2001; it had a previous tie-up with GM, a joint venture that ended in 1992, although Daewoo cars were based on GM cars until 1996. Over the decade following the purchase, it became such an important part of operations that it was renamed GM Korea in 2011, "to reflect its heightened status in [the] global operations of GM." Just two years later, the printed rumors were that the subsidiary responsible for a fifth of Chevrolet's global production could be shutting down. The division's sales were down almost 21 percent through November of last year, counting domestic South Korean sales, exports, and CKD – Complete Knock Down – products. That makes the labor strife, already an issue for four years, even more acute, reports say the subsidiary will lose $36 million a year if it can't get the job and wage cuts it wants, and government concessions can't make up for the losses. And it gets worse, so head over to Daily Kanban to read the rest of the story.

Texas cops pull armed suspect from burning car

Fri, Jul 29 2016A high-speed chase through Fort Worth, Texas ended in dramatic fashion earlier this month when FWPD pulled armed burglary suspects from the burning wreckage of their escape vehicle. According to NBC DFW, Fort Worth police were dispatched to Avington Way on the evening of July 16 to investigate reports of a burglary. The burglary victim told police he had arrived home to find three individuals hauling his property out of his house. When he approached them, one of the suspects pointed a handgun at him and told him to stay back. Then all three suspects climbed into a silver Dodge Avenger and sped away. FWPD officers spotted the Avenger a short time later on Sycamore School Road and, after the car refused to pull over, the chase was on. Police chased the burglary suspects through the city at speeds approaching 100 mph until the Avenger blew a red light and was t-boned by an oncoming pickup at the intersection of California Parkway and James Avenue. As the pursuing officers closed in on the disabled car, it suddenly caught fire. One suspect bailed out and ran for it, but the remaining two were trapped inside with the flames quickly mounting. Despite the spreading fire and the threat of armed suspects in the vehicle, police officers rushed to pull the men from the wreck. The driver was removed easily, but the passenger was unconscious and trapped behind a crushed passenger door. The scene was caught on the officers' body cameras as they pried the door open with their bare hands. Eventually the officers got the semi-conscious man out of the passenger seat just as the car was completely engulfed in flames. "It was pretty dramatic. We recruit people that can think on the fly, think quickly, and perform under pressure," FWPD Sergeant Marc Povero told WFAA. All three suspects are facing charges for burglary, and the driver was charged with evading arrest. News Source: WFAA, NBC DFW Auto News Chevrolet Dodge Driving Safety Truck Police/Emergency Sedan fire car fire burglary