1964 Chevy Impala Station Wagon Fresh Paint,airride And 20''&22'' Rims Must See! on 2040-cars

East Lansing, Michigan, United States

Engine:283 V8

Body Type:Wagon

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Red

Model: Impala

Number of Cylinders: 8

Trim: Station Wagon

Drive Type: Rear

Mileage: 68,675

Exterior Color: White

Chevrolet Impala for Sale

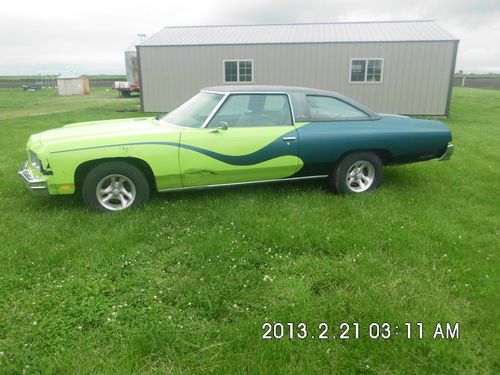

1973 impala caprice sport coupe

1973 impala caprice sport coupe All new!!!! buy for invoice*sport wheels*heated seats*back up camera*safety pkg(US $32,104.00)

All new!!!! buy for invoice*sport wheels*heated seats*back up camera*safety pkg(US $32,104.00) 1976 chevrolet impala custom coupe 2-door project

1976 chevrolet impala custom coupe 2-door project 1964 chevrolet impale convertible 75000 original miles(US $25,000.00)

1964 chevrolet impale convertible 75000 original miles(US $25,000.00) 2000 chevrolet impala ls sedan 4-door 3.8l

2000 chevrolet impala ls sedan 4-door 3.8l 1963 chevrolet impala, 383 stroker motor, power disk breaks, flowmaster

1963 chevrolet impala, 383 stroker motor, power disk breaks, flowmaster

Auto Services in Michigan

Xpert Automotive Repair ★★★★★

White`s Muffler & Brakes ★★★★★

Westwood Auto Parts ★★★★★

West Michigan Collision ★★★★★

Wells-Car-Go ★★★★★

Ward Eaton Towing ★★★★★

Auto blog

Pure Vision Design TT Camaro has 1,400 reasons to want it

Wed, 06 Nov 2013We've talked about Pure Vision Design before, a California-based company that made waves at last year's SEMA show with its Martini-liveried, Indy-car-powered Ford Mustang. That same car later starred in a Petrolicious video we showed you just a few weeks back. The company's latest creation is a menacing car it calls the Pure Vision Design TT Camaro. Based on a 1972 model, this car shares the Martini Mustang's clean styling and obsession with details.

Unlike the Mustang, which draws its power from a mid-60s Lotus-Ford Indycar engine, the "TT" in this Camaro's name implies something far more potent. The Nelson Racing Engines 427-cubic-inch V8 has been fitted with a pair of turbochargers, with a claimed output of 1,400 horsepower. That's almost 1,000 more than the Martini Mustang.

A six-speed Magnum transmission dispatches that power to the ground, while Pirelli PZero tires are tasked with (somehow) trying to grip the road. Baer brakes hide behind those HRE rims, while JRI coilovers and HyperTech springs bless the Camaro with some degree of competency in the bends.

Travis Kvapil tells Twitter his Sprint Cup car was stolen

Fri, Feb 27 2015There's a bizarre story coming out of Atlanta today, as NASCAR racer Travis Kvapil is reporting that his Sprint Cup Car was stolen from a lot at the Drury Inn in Morrow, GA. Kvapil announced the theft, which included the black pickup that was hauling the trailer and the #44 Chevrolet SS Sprint Cup Car – shown above, with driver JJ Yeley at the wheel – on Twitter. According to Kvapil, the car wasn't going to be ready for the Thursday test session at Atlanta Motor Speedway, although forecasts of snow forced the team to dispatch their main trailer and tools to the track ahead of the car, which left for Atlanta later yesterday. According to ESPN, police in Morrow have video of the "incident," which happened at 5:34 AM Friday, with police investigating it as as criminal in nature. "Sometimes what happens when thieves see trailers, they might just assume there's something in the trailer they can go off and sell," Sgt. Larry Oglesby, of the Morrow PD, told USA Today. "Sometimes when things like this occur, they will drop off the items in a parking lot somewhere – like a Walmart parking lot – once they realize what they have." "All we know is it was a silver jeep," team owner John Cohen told USA Today. "One guy got out and they pulled off together." Earlier, Cohen told ESPN that the theft will force the team out of this weekend's race at the Folds of Honor QuikTrip 500, at Atlanta Motor Speedway. Kvapil, meanwhile, has taken to Twitter to appeal to his followers to be on the lookout for the truck, trailer and race car. Here's hoping it turns up all together. Check out the driver's tweets, below. Wow. Anyone near Atlanta find my stolen Cup car let me know! Unreal - Travis Kvapil (@TravisKvapil) February 27, 2015 I bet when whoever has it, opens the trailer and is going to be like 'oh snap' - Travis Kvapil (@TravisKvapil) February 27, 2015 Ok, to clarify. @Teamxtreme44 transporter is @amsupdates. The guys stayed and worked on the car Thursday at the shop in NC. They drove.... - Travis Kvapil (@TravisKvapil) February 27, 2015 down last night in a Ford dually and enclosed trailer with racecar inside. That was stolen out of hotel parking lot this am in Morrow, GA - Travis Kvapil (@TravisKvapil) February 27, 2015 Black Ford dually, white enclosed tag behind trailer. New Jersey plates - Travis Kvapil (@TravisKvapil) February 27, 2015 Dang.... I'm wishing we had LoJack or something on it!

Next-gen GM SUVs caught wearing new boxy bodies [w/video]

Wed, 15 May 2013We recently drove the brand-new 2014 Chevrolet Silverado and found it to be vastly improved compared to the outgoing model. And now that The General's pickup trucks have been squared away, it's time to focus our attention onto their passenger-friendly companions, the Chevrolet Tahoe and GMC Yukon (above).

Our spy photographers have passed along a huge smattering of photos (and a video), showing the new SUVs out testing. Both the short- and long-wheelbase models were spied, and while the overall shape of the vehicles hasn't changed all that much, we expect the updates to be substantial. In addition to new powertrain options, like GM's new small-block V8, we expect the interiors of both SUVs to get massive makeovers, providing better materials throughout their cabins and quieter, more refined environments. We even hear that some trick new suspension developments may be in store for upper-end models.

Visually, these spy shots allow us to see a couple of new details on the SUVs' front and rear fascias, including LED running lamps on the Yukon and some interesting LED taillamp treatments. Of course, the obvious third party missing from this set of photos is the Cadillac Escalade, but as we reported earlier, GM is working to further differentiate the 'Slade from the rest of the fullsize SUV lineup, and is working to make the new model "much less ostentatious."