2014 Chevrolet Equinox 2lt on 2040-cars

127 Regency Park, OFallon, Illinois, United States

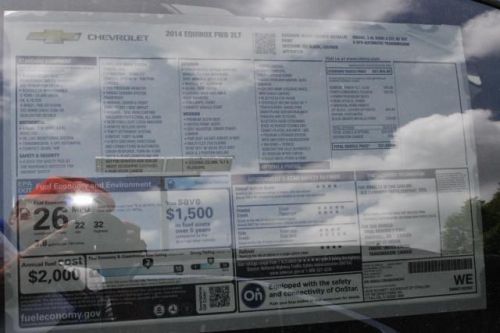

Engine:2.4L I4 16V GDI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 2GNALCEK8E6346343

Stock Num: 35909

Make: Chevrolet

Model: Equinox 2LT

Year: 2014

Exterior Color: Black Granite Metallic

Interior Color: Jet Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 6

All prices include all rebates and dealer discounts. Prices do not include tax, title or license. If you don't know Big City Selection and Savings with Hometown Service, you don't know Jack Schmitt!

Chevrolet Equinox for Sale

2014 chevrolet equinox 1lt(US $24,299.00)

2014 chevrolet equinox 1lt(US $24,299.00) 2014 chevrolet equinox 1lt(US $24,452.00)

2014 chevrolet equinox 1lt(US $24,452.00) 2014 chevrolet equinox 1lt(US $24,452.00)

2014 chevrolet equinox 1lt(US $24,452.00) 2014 chevrolet equinox 1lt(US $25,947.00)

2014 chevrolet equinox 1lt(US $25,947.00) 2014 chevrolet equinox 2lt(US $28,862.00)

2014 chevrolet equinox 2lt(US $28,862.00) 2014 chevrolet equinox ltz(US $30,402.00)

2014 chevrolet equinox ltz(US $30,402.00)

Auto Services in Illinois

X Way Auto Sales ★★★★★

Twins Auto Body Shop ★★★★★

Trevino`s Transmission & Auto ★★★★★

Thompson Auto Supply ★★★★★

Sigler`s Auto Ctr ★★★★★

Schob`s Auto Repair ★★★★★

Auto blog

VW, Rivian, Nissan, BMW, Genesis, Audi and Volvo lose EV tax credits starting tomorrow

Mon, Apr 17 2023The U.S. Treasury said Monday that Volkswagen, BMW, Nissan, Rivian, Hyundai and Volvo electric vehicles will lose access to a $7,500 tax credit under new battery sourcing rules. The Treasury said the new requirements effective Tuesday will also cut by half credits for the Tesla Model 3 Standard Range Rear Wheel Drive to $3,750 but other Tesla models will retain the full $7,500 credit. Vehicles losing credits Tuesday are the BMW 330e, BMW X5 xDrive45e, Genesis Electrified GV70, Nissan Leaf , Rivian R1S and R1T, Volkswagen ID.4 as well as the plug-in hybrid electric Audi Q5 TFSI e Quattro and plug-in hybrid (PHEV) electric Volvo S60. The Swedish carmaker is 82%-owned by China’s Zhejiang Geely Holding Group. The rules are aimed at weaning the United States off dependence on China for EV battery supply chains and are part of President Joe Biden's effort to make 50% of U.S. new vehicle sales by 2030 EVs or PHEVs. Hyundai said in a statement it was committed to its long-range EV plans and that it "will utilize key provisions in the Inflation Reduction Act to accelerate the transition to electrification." Rivian declined to comment and the other automakers could not immediately be reached for comment. Treasury also disclosed General Motors electric Chevrolet Bolt and Bolt EUV will qualify for the full $7,500 tax credit. GM said earlier it expected at least some of its EVS would qualify for the $7,500 tax credit under the new rules, including the 2023 Cadillac Lyriq and forthcoming Chevrolet Equinox EV SUV and Blazer EV SUV. Treasury said all GM EVs will qualify. Earlier, Ford Motor and Chrysler-parent Stellantis said most of their electric and PHEV models would see tax credits halved to $3,750 on April 18. Treasury confirmed the automakers' calculations. The rules were announced last month and mandated by Congress in August as part of the $430 billion Inflation Reduction Act (IRA). The IRA requires 50% of the value of battery components be produced or assembled in North America to qualify for $3,750, and 40% of the value of critical minerals sourced from the United States or a free trade partner for a $3,750 credit. The law required vehicles to be assembled in North America to qualify for any tax credits, which in August eliminated nearly 70% of eligible models and on Jan. 1 new price caps and limits on buyers income took effect.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM already raising prices on 2014 Silverado and Sierra pickups

Mon, 14 Oct 2013General Motors must be pretty pleased with sales of its two newest pickups, the GMC Sierra and Chevrolet Silverado, as it's announced price hikes for both models, as part of a planned price tweak.

Prices will be bumped by as much as $1,500, although weirdly, they'll be offset by as much as $1,500 in cash-back offers through the end of October. Fox Business reports that GM spokesman Jim Cain said of the price hike, "With the sell down of the '13 models nearly complete, this price adjustment was planned and is a normal part of business."

The move, as Fox is quick to point out, is an interesting one, as sales of the twin pickups struggled last month relative to the Ford F-Series, while both of GM's crosstown competitors have been aggressively undercutting Silverado and Sierra prices. The F-150 starts at $24,070 and the Ram 1500 comes in at $23,600, not counting any cash on the hood. A base Silverado, meanwhile, retails at $25,575.