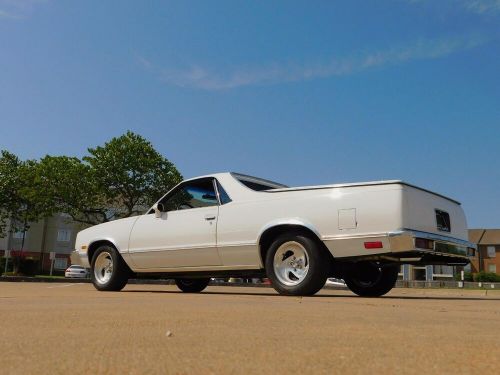

1984 Chevrolet El Camino on 2040-cars

Wilson, North Carolina, United States

Vehicle Title:Clean

VIN (Vehicle Identification Number): 1GCCW8092ER125741

Mileage: 180000

Model: El Camino

Make: Chevrolet

Number of Seats: 3

Chevrolet El Camino for Sale

1971 chevrolet el camino(US $26,995.00)

1971 chevrolet el camino(US $26,995.00) 1984 chevrolet el camino(US $3,050.00)

1984 chevrolet el camino(US $3,050.00) 1969 chevrolet el camino(US $11,500.00)

1969 chevrolet el camino(US $11,500.00) 1959 chevrolet el camino(US $5,100.00)

1959 chevrolet el camino(US $5,100.00) 1970 chevrolet el camino ss 454(US $20,698.50)

1970 chevrolet el camino ss 454(US $20,698.50) 1987 chevrolet el camino 2dr standard cab(US $1,275.00)

1987 chevrolet el camino 2dr standard cab(US $1,275.00)

Auto Services in North Carolina

Xpress Lube ★★★★★

Wrightsboro Tire & Auto ★★★★★

Wilburn Auto Body Shop - Lake Norman ★★★★★

Wheeler Troy Honda Car Service ★★★★★

Truck Alterations ★★★★★

Troy`s Auto & Machine Shop ★★★★★

Auto blog

Chevy Spark EV will go on sale in Maryland

Thu, Jan 22 2015The single-charge range of a Chevrolet Spark electric vehicle may not blow away anyone who's used to driving on a topped off tank of gas. But a full charge will actually get a Spark EV about halfway across the state of Maryland. Which is good because that state will be the first on the East Coast to sell the battery-electric model. General Motors said this week that Chevy Spark EV sales will start in Maryland this spring, and that federal and Maryland tax credits will get the out-of-pocket price of the Spark EV below the $18,000 threshold. GM took the opportunity to tout the Spark EV's 119 miles per gallon equivalent rating and says Maryland has sufficient charging infrastructure for drivers to welcome the EV without too much trouble. Last June, Spark EV distribution was reported to be ready to extend beyond the Pacific Coast. Specifically, Ohio was thought to be next in line to get Spark electric vehicles after four state car dealerships listed the model on their websites. GM's Randy Fox, however, quashed that real quick, saying only California and Oregon had sufficient infrastructure to support the Spark EV. GM first announced the Spark EV for public (or at least American) consumption back in 2011. Last year, the General sold 1,145 Spark EVs, up 87 percent from 2013. For more on the Maryland expansion, take a look at GM's press release below. Chevrolet Spark EV Plugs into Maryland Customer demand drives addition of East Coast; features locally sourced drive unit 2015-01-22 WASHINGTON, D.C. – Chevrolet will start selling the Spark EV in Maryland this spring, expanding the pure electric mini-car's "range" to the East Coast. The Spark EV is the most efficient U.S. retail electric vehicle on the market, delivering an EPA-estimated combined city/highway 119 MPGe fuel economy equivalent and 82 miles of EPA-estimated combined city/highway range. It is priced as low as $17,845, after federal and Maryland tax credits – and it features a locally sourced electric motor and drive unit, manufactured at General Motors' Baltimore Operations facility in White Marsh, Md. "The Spark EV has been one of the most well-received electric vehicles in the industry and customer demand helped make the decision to expand its availability to Maryland," said Steve Majoros, Chevrolet director of car marketing.

GM reportedly developing 2.5-liter turbo four-cylinder

Mon, May 15 2023General Motors is allocating a massive amount of resources to developing electric technology, but it's not forgetting about the gasoline-powered cars that make up the bulk of its sales. It's reportedly designing a new 2.5-liter turbocharged four-cylinder engine based on its 2.7. Citing "sources familiar with the matter," enthusiast website GM Authority wrote that the 2.5-liter four is "in [the] final stages of development," meaning it should be announced sooner rather than later (assuming the report is accurate). Technical details are few and far between as of writing. The publication learned that the 2.5 will be part of the Cylinder Set Strategy (CSS) family of engines and that it will be mechanically related to the 2.7-liter currently found in the Chevrolet Silverado 1500, among several other models. It will feature dual overhead camshafts. It's too early to tell which models the 2.5-liter four-cylinder will end up in, or how much power it will generate. The output will likely depend on the application. For context, the 2.7 delivers 310 horsepower at 5,600 rpm and 348 pound-feet of torque between 1,500 and 4,000 rpm in the Silverado. In the smaller Colorado, it provides anywhere between 237 and 310 horsepower depending on the trim level selected. While this is pure speculation, our crystal ball tells us the engine will end up powering crossovers. It's an easy deduction to make. We can't imagine it will be offered in the Silverado, and seeing it in the Colorado is unlikely because its entry-level engine develops 237 horsepower; there's likely not much of a market for a midsize truck with 200 or so horsepower. Putting it in the Corvette wouldn't make sense and the Camaro has nearly reached the end of its life cycle without a successor planned. This leaves us with Chevrolet's range of crossovers, like the Equinox, as well as their GMC-, Buick-, and Cadillac-branded counterparts. We're not discounting the possibility that the cars set to receive the 2.5 haven't been unveiled, but those are likely crossovers, too; the odds of seeing another big Chevy sedan are very, very low. General Motors hasn't commented on the report, and it hasn't publicly announced plans to expand its CSS family of engines. If the report is accurate, we should learn more about the new turbocharged, 2.5-liter four-cylinder engine in the not-too-distant future. Featured Gallery 2022 Chevrolet Equinox RS View 56 Photos Buick Chevrolet GM GMC

800k car names trademarked globally, suddenly alphanumerics seem reasonable

Tue, 01 Oct 2013What's in a name? This cliched phrase probably gets tossed out at every marketing meeting that happens when a new car gets its nomenclature. We know the answer, though: everything. The name of a car has all the potential to make or break it with fickle customers that are more conscious than ever about what their purchases say about them.

That's giving headaches to marketing folks across the automotive industry. "It's tough. In 1985 there were about 75,000 names trademarked in the automotive space. Today there are 800,000," Chevrolet's head of marketing, Russ Clark, told Automotive News. Infiniti's president, Johan de Nysschen, echoed Clark's sentiment, saying, "The truth of the matter is, across the world, there is hardly a name or a letter that hasn't already been claimed by one car manufacturer or another. You can go through the alphabet - A, B, C and so forth - and you will quickly see that almost all available letters are taken."

What has that left automakers to do? Get creative. In the case of Infiniti, it made the controversial move to bring all of its cars' names into a new scheme, classifying them as Q#0 for cars and QX#0 for SUVs and crossovers. So the Infiniti G, which was available as the G25 and G37, is now the Q50. The FX37 and FX50 are now the QX70.