Body Type:Pickup Truck

Vehicle Title:Clear

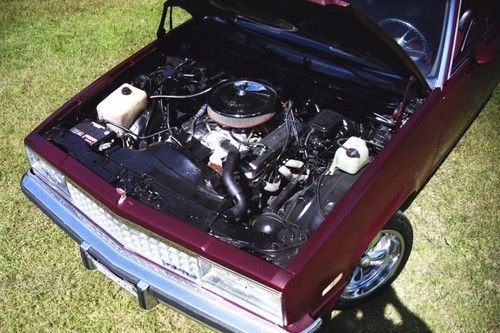

Engine:5.0L 305 V8

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chevrolet

Model: El Camino

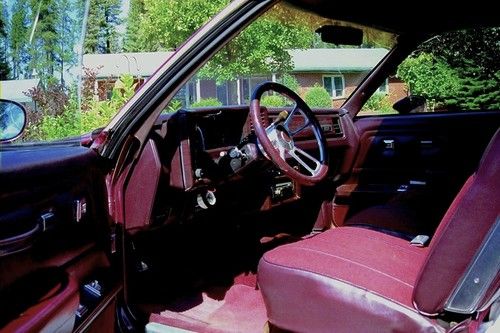

Options: CD Player

Drive Type: RWD

Power Options: Power Windows

Mileage: 112,000

Exterior Color: Burgundy

Interior Color: Burgundy

Disability Equipped: No

Number of Cylinders: 8

Warranty: Vehicle does NOT have an existing warranty

1979 Chevrolet El Camino- 305HP V8 Body

Chevrolet El Camino for Sale

El camino 61000 miles(US $12,000.00)

El camino 61000 miles(US $12,000.00) 1987 elcamino all re done(US $14,500.00)

1987 elcamino all re done(US $14,500.00) 1986 el camino ss super sport beauty garage kept(US $8,500.00)

1986 el camino ss super sport beauty garage kept(US $8,500.00) 1984 chevrolet el camino conquista standard cab pickup 2-door 5.0l(US $2,600.00)

1984 chevrolet el camino conquista standard cab pickup 2-door 5.0l(US $2,600.00) 1969 chevy el camino ss 396 bbc project has build sheet & dealer window sticker

1969 chevy el camino ss 396 bbc project has build sheet & dealer window sticker El camino ss, 1983 resto-mod(US $12,950.00)

El camino ss, 1983 resto-mod(US $12,950.00)

Auto blog

Chevy Volt sales drop in June, Nissan Leaf inches upwards

Tue, Jul 1 2014Different month, same story. That's the gist of the monthly US sales numbers from the Chevy Volt and the Nissan Leaf. These were the first two mass-market plug-in vehicles to go on sale in the US and we've been comparing their sales numbers for what seems like ages now. So far, the 2014 tale of the tape shows the all-electric once again trumping the plug-in hybrid. The last time the Volt outsold the Leaf was in October 2013. Chevrolet sold 1,777 Volts in June. That was good enough to be the Volt's best sales month of the year, but it's down 34 percent from the 2,698 units sold in June 2013. In fact, it's on par with the 1,760 Volts sold in June 2012. Given the steady sales, General Motors might need to push up the release of the next-gen Volt to gin up excitement, especially if it also offers some of the things that current Volt drivers say they want improved: more range, a lower price and a fifth seat. GM also said it sold 85 Spark EVs in June, an increase of 215 percent over June 2013 Nissan sold 2,347 Leafs last month. The good news continues for Nissan, which says it sold 2,347 Leafs last month. That's an increase of 5.5 percent over 2013 numbers and makes 2014 the best June ever for Leaf sales. Let's credit Texas. Toby Perry, Nissan's director of EV sales and marketing, said in a statement that, "Since the Texas state incentive went into effect in May, we've seen a big jump in Leaf sales in the Austin, Dallas and Houston markets. Our dealers are telling us that they saw more traffic in their stores, and they had their best Leaf sales performance in the last weekend in June." Even with that increase, Atlanta remains the top Leaf market. Nissan has sold 12,736 Leafs in the US so far this year; Chevy 8,615 Volts. Our detailed monthly sales write-up of green cars in the US, including plug-in vehicles, hybrids and diesel cars, is coming soon. For now, we invite you to discuss these numbers in the Comments. Related Gallery 2013 Nissan Leaf View 55 Photos News Source: GM, Nissan Green Chevrolet Nissan Electric Hybrid PHEV ev sales

Next-gen Chevy Volt will get 1.5-liter, four-cylinder engine

Tue, Oct 28 2014As General Motors gets ready to unveil the new Chevy Volt at the Detroit Auto Show in January, it's starting to reveal a few more details about the updated plug-in hybrid. Today should be fruitful on that front, thanks to an event GM is hosting today that focuses on the new Volt, and we've just had the first bit of new: a bigger engine is coming. Since the beginning, the Volt has used a 1.4-liter, four-cylinder engine as a range extender when the battery runs dry. The second-generation model will instead get a slightly larger 1.5-liter, four-cylinder engine that will be built in Flint, MI. That's a step up from the various engines that have been a part of the 2016 Volt's rumored mills, everything from a 1.0-liter or 1.2-liter three-cylinder to a 2.0-liter turbo. The confirmation about the new 1.5-liter powerplant was found in Automotive News, where we also heard again that GM is going to start building the new Volt's electric drive unit in Detroit, moving production up from Mexico. We will have more information on the 2016 Chevy Volt later today.

eBay Find of the Day: 1990 Chevy 1500 454 SS with just 7 miles

Sun, Jan 4 2015When trawling the classifieds either on a buying mission or merely a time-wasting mission, we spend a lot of time poring over photographs comparing the seller's idea of "Like New!" with our idea of it. It's hard to argue with seven original miles on the odometer, though, which is what this 1990 Chevrolet 1500 454 SS has. It's being sold by Country Chevrolet on eBay, the same dealer who sold the truck to its one and only owner 25 years ago. The purchaser bought two of them and left this one in a garage under a car cover, said garage being less than seven miles away from the showroom floor. Better yet, you can buy with confidence because the seller "has collected all records," which we expect would be the slimmest manilla folder in the history of receipt-keeping. For those unfamiliar, the 454 SS was a half-ton, regular cab, 2WD pickup powered by a 454 cubic inch (7.4-liter) V8 with 230 horsepower and 385 pound-feet of torque shifting through a three-speed transmission. This was at the same time the Chevrolet Corvette used a 5.7-liter V8 producing 250 hp and 350 lb-ft. The pickup rode on exclusive wheels and only came in black with red cloth inside. The only extra-cost option on this example is an $18 locking fuel filler cap, which, according to the 454ss forum, means it should have cost about $18,460 out the door, the equivalent of about $34,000 today. At the time of writing there are zero bids, but proceedings open at $45,000 and Country Chevrolet wants $49,000 if you have to have your time capsule right now.