2003 Chevrolet Corvette 50th Anniversary Edition on 2040-cars

Kings Mountain, North Carolina, United States

Engine:5.7L 350Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

For Sale By:Dealer

Interior Color: Black

Make: Chevrolet

Number of Cylinders: 8

Model: Corvette

Trim: 50th Anniversary Edition Hatchback 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: RWD

Options: Cassette Player, Leather Seats, Clear Removeable Targa Top

Mileage: 87,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Silver

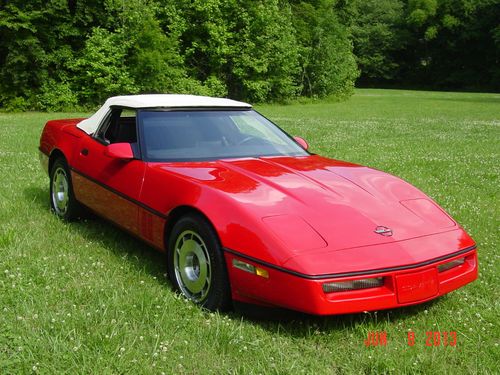

2003 Chevrolet Corvette 50th Anniversary Edition

Automatic trans mission Silver with black leather interior. Does have the removable targa top. Power everything. Around 87,000 miles, and I do still drive it so the miles will go up a little but not much. Well over half tread left on all four tires. The wheels are factory chrome with 17" in the front and 18" in the rear. Drives and runs great, no issues. All stock. Memory seats with 2 memory keys. This car is super clean inside and out. Has the headsup display that comes up on the windshield. The steering wheel is a tilt/telescopic. Am/Fm cassette player with Bose sound. It is garage kept and leaks no fluids.

I can have vehicle shipped any where in the continental United States

If you have any questions please ask all before bidding.

A $500 deposit is due with Paypal no later than 24 hours after auction ends.

The full amount of payment is due no later than 5 days after auction ends.

If you need more pics just email me and let me know which part and I wil get them to you asap.

I am open to trades also.

Call with any questions. (704) 692-8261

Chevrolet Corvette for Sale

2003 50th anniv. corvette conv. 6 speed(US $31,000.00)

2003 50th anniv. corvette conv. 6 speed(US $31,000.00) 1987 chevrolet corvette base convertible 2-door 5.7l(US $13,500.00)

1987 chevrolet corvette base convertible 2-door 5.7l(US $13,500.00) 1993 chevrolet corvette 40th anniversary edition convertible 2-door 14,451 miles

1993 chevrolet corvette 40th anniversary edition convertible 2-door 14,451 miles White/black unrestored original 327/250 4spd manual numbers matching both tops

White/black unrestored original 327/250 4spd manual numbers matching both tops 1966 chevrolet corvette convertible 427/425hp blue/blue

1966 chevrolet corvette convertible 427/425hp blue/blue 1965 corvette roadster l76 327 365hp 4 speed pw nice

1965 corvette roadster l76 327 365hp 4 speed pw nice

Auto Services in North Carolina

Wright`s Transmission ★★★★★

Wilburn Auto Body Shop Belmont ★★★★★

Whitaker`s Auto Repair ★★★★★

Trull`s Body & Paint Shop ★★★★★

Tint Wizard ★★★★★

Texaco Xpress Lube ★★★★★

Auto blog

Driving the 2021 Chevy Tahoe and big news from Hyundai | Autoblog Podcast #640

Fri, Aug 14 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by News Editor Joel Stocksdale. They discuss some of the big trucks Joel drove: the 2021 Chevy Tahoe and a Mil-Spec-modified Ford F-150. After that is a look at the latest car news including Trofeo versions of Maserati's sedans, Hyundai's new electric brand called Ioniq, and the BMW M3 Touring station wagon and Hyundai Elantra N-Line. They wrap things up with some musings on anniversary of the 19th Amendment to the Constitution and how cars played a role in it. Autoblog Podcast #640 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Reviews2021 Chevy Tahoe Mil-Spec Ford F-150 Maserati Ghibli and Quattroporte Trofeo models revealed Ioniq becomes EV brand for Hyundai 2021 Hyundai Elantra N Line revealed BMW finally announces an M3 station wagon The 19th Amendment and how cars fit in Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Government/Legal Green Podcasts BMW Chevrolet Ford Hyundai Maserati

Nissan sells 3,117 Leaf EVs in May, climbs over 3,000 for first time ever

Tue, Jun 3 2014Chalk up a big win for the Nissan Leaf. In May, the world's most popular electric vehicle sold a record 3,117 units, the first time any pure electric vehicle has sold over 3,000 units in a month in the US (unless Tesla managed that feat but rolled the number into a quarterly report). This marks the 15th month in a row of record Leaf sales and the seventh where the Leaf was the top EV seller in the US. The challenge bar is set for someone to step up to compete with this all-electric wunderkind. Chevrolet did sell over 3,000 Volts once, in August 2013. The Leaf's one long-standing competitor, of a sort, is the Chevy Volt, which used to regularly outsell the Leaf but moved only 1,684 units in May. That's still an increase of 4.8 percent over 2013 but is part of a 4.5 percent decline in year-to-date Volt sales for 2014 compared to last year. The last time the Volt outsold the Leaf was October 2013. Chevrolet did sell over 3,000 Volts once, when it moved 3,351 in August 2013. Let's take another look at those 3,117 Leafs sold last month. They represent a 45.8 percent increase over May 2013, when 2,138 Leaf EVs were sold, so someone is doing something right in Japan and Tennessee. So far, Leaf sales in the US are up 36.4 percent year-to-date, to 10,389 EVs. That's just under half of the 2013 total, and it was accomplished in five months. In 2013, Nissan sold a total of 22,610 Leafs. Anyone want to hazard a guess where the total will be at the end of the year? As always, we'll have our detailed monthly sales write-up including other plug-in vehicles as well as hybrids and diesel car, up soon. For now, though, the big news is big Leaf sales. Read Nissan's press release below. Nissan Group reports May 2014 U.S. sales May 2014 May 2013 % Change Nissan Group Total sales (units) 135,934 114,457 +18.8 Nissan Division May sales 125,558 106,558 +17.8 Infiniti May sales* 10,376 7,899 +31.4 NASHVILLE, Tenn. – Nissan Group today announced total U.S. sales for May 2014 of 135,934 units, an increase of 18.8 percent over the prior year and a May record. Nissan highlights: Nissan Division set a May record at 125,558 sales in the month, an increase of 17.8 percent. This marks a monthly record for Nissan division in 14 of the last 15 months. May was the best-ever month for Nissan LEAF with 3,117 sales, an increase of 45.8 percent over the prior year. In May, LEAF passed 50,000 total U.S. sales since launch, further establishing it as the leader among electric vehicles.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.