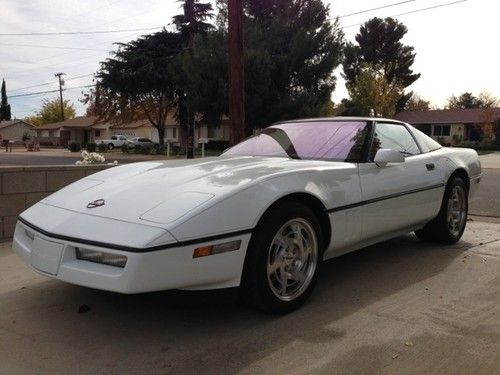

1985 Doug Nash Corvette on 2040-cars

Oakdale, California, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:5.7 liter tuned port

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chevrolet

Model: Corvette

Trim: black

Options: Leather Seats, CD Player

Safety Features: Anti-Lock Brakes

Drive Type: GAS

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 79,000

Exterior Color: Red

Interior Color: GREY

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 8

Im selling this car due to the economy.This car has never been wrecked or has it been in an accident.Very nice car, will only appreciate in value So if you have any questions feel free to call my name is Greg my # is (209) 534-6647

Chevrolet Corvette for Sale

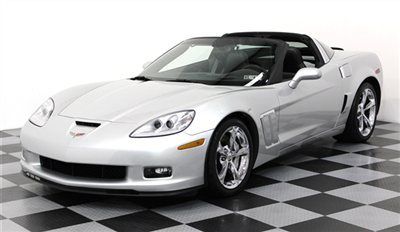

2006 2lz c6 z06 corvette 600 rwhp naturally aspirated

2006 2lz c6 z06 corvette 600 rwhp naturally aspirated 1990 corvette zr1 king of the hill(US $18,500.00)

1990 corvette zr1 king of the hill(US $18,500.00) 2012 chevy corvette z16 grand sport convertible nav hud texas direct auto(US $53,980.00)

2012 chevy corvette z16 grand sport convertible nav hud texas direct auto(US $53,980.00) Lt3 grand sport 6 speed super low original miles one owner hud 2tops xenons bose

Lt3 grand sport 6 speed super low original miles one owner hud 2tops xenons bose 2008 chevy corvette 4lt 6spd 2-tone leather hud nav 21k texas direct auto(US $35,980.00)

2008 chevy corvette 4lt 6spd 2-tone leather hud nav 21k texas direct auto(US $35,980.00) 1972 c3 chevrolet corvette stingray coupe project parts car - clear title

1972 c3 chevrolet corvette stingray coupe project parts car - clear title

Auto Services in California

Windshield Repair Pro ★★★★★

Willow Springs Co. ★★★★★

Williams Glass ★★★★★

Wild Rose Motors Ltd. ★★★★★

Wheatland Smog & Repair ★★★★★

West Valley Smog ★★★★★

Auto blog

Chevrolet considering midsize crossover to slot between Traverse and Equinox

Mon, Jan 9 2017Crossovers are the new hotness, and automakers are looking to cash in by offering a size and shape for every customer. With Chevrolet's debut of the new 2018 Traverse in Detroit, which grew ever so slightly compared to the first-generation model, there is now a midsize-crossover-sized hole between the three-row Traverse and the compact Equinox. When asked about that obvious space, a Chevrolet spokesperson told us the company is looking into the possibility of expanding its crossover lineup. It should be a relatively simple thing to do, since all it would take is reskinning and rechristening the GMC Acadia with a bow tie, and we all know how much GM loves platform sharing. Although they're now different sizes, the new Acadia and Traverse still use the same platform; the Acadia is now on a short-wheelbase version of the C1XX while the Traverse uses long-wheelbase C1XX parts. A short-wheelbase Chevy built on the C1XX likely would be differentiated visually from both the Acadia and the larger Traverse. It may seem like flooding the lineup with more and more models would cannibalize sales of existing ones, but Chevrolet said it would rather have customers stay within the brand rather than going to another automaker. There have been whispers that some form of the Blazer name (possibly TrailBlazer) may make a return on a midsizer, but if it does don't expect an old-school body-on-frame SUV like the old one. In the end, if Chevy builds it, customers will come. Related Video:

2014 Chevrolet Corvette Stingray convertible headed for Geneva debut

Mon, 28 Jan 2013While most of the world is still coming down from all the hype surrounding the debut of the 2014 Chevrolet Corvette Stingray at the Detroit Auto Show earlier this month, we're already looking to the future. And according to Autoweek, the next chapter in the C7 story will unfold at the Geneva Motor Show in March. That's right, General Motors is reportedly using the Swiss stage as its venue to debut the Corvette Stingray convertible.

If this strikes you as odd, you aren't alone. After all, with a car that's such an American icon, we'd fully expect Chevrolet to unveil it here on our shores in either Chicago or New York. But according to Autoweek, GM is looking to boost export sales of its halo car, and since the C7 was engineered to compete with the world's best and brightest, showing it off in Geneva is somewhat of a smart move. What's more, those with sharp memories will recall that GM used the Geneva expo to debut the sixth-generation C6 Corvette convertible back in March 2004, so there's also a precedent.

Details surrounding the Corvette Stingray convertible are still slim, though we fully expect the 6.2-liter V8 and choice of either six-speed automatic or seven-speed manual transmissions to carry over unchanged. Prototypes spotted on the road showed the car fitted with a cloth convertible roof, as well.

Car cocktails and Risky Business Porsches with Brett Berk | Autoblog Podcast #502

Fri, Feb 3 2017On this week's podcast, Mike Austin and David Gluckman are joined by a special guest, Autoblog contributor Brett Berk. The three discuss cars in film and TV as well as Brett's series on car-themed cocktails. There is of course a recap of what they've all been driving lately, and the episode wraps up with Spend My Money buying advice to help you, our dear listeners. The rundown is below. Remember, if you have a car-related question you'd like us to answer or you want buying advice of your very own, send a message or a voice memo to podcast at autoblog dot com. (If you record audio of a question with your phone and get it to us, you could hear your very own voice on the podcast. Neat, right?) And if you have other questions or comments, please send those too. Autoblog Podcast #502 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics and stories we mention 2017 Chevrolet Bolt EV - Autoblog's 2017 Technology of the Year Car award winner 2017 Ford Shelby Mustang GT350R 2016 Kia Soul EV 2017 Audi A4 sedan The story of the Risky Business Porsche 928 The Taxi Cocktail took us for a ride The myth and mystery of The Bentley Cocktail Used cars! Rundown Intro - 00:00 What we're driving - 01:50 Brett Berk interview - 21:12 Spend My Money - 39:44 Total Duration: 54:02 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show on iTunes Podcasts Audi Bentley BMW Chevrolet Maserati Mercedes-Benz Porsche kia soul ev Chevrolet Bolt porsche 928 ford shelby mustang gt350r cocktails