1981 Chevrolet Corvette Coupe Only 11,126 Miles! Excellent Condition L81 on 2040-cars

Lansing, Michigan, United States

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: Chevrolet

Model: Corvette

Warranty: Unspecified

Mileage: 11,126

Sub Model: 2dr Coupe

Exterior Color: Tan

Interior Color: Tan

Chevrolet Corvette for Sale

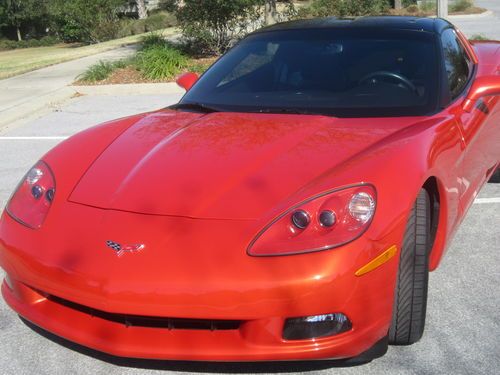

2002 custom z06 corvette(US $22,000.00)

2002 custom z06 corvette(US $22,000.00) 1969 corvette

1969 corvette Low miles

Low miles 2010 zr1 3zr rare museum delivery(US $95,500.00)

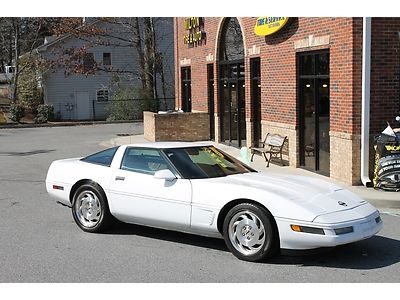

2010 zr1 3zr rare museum delivery(US $95,500.00) Last year c4 corvette no reserve !!!!

Last year c4 corvette no reserve !!!! 2012 corvette(US $45,800.00)

2012 corvette(US $45,800.00)

Auto Services in Michigan

Z Tire Center Of Grand Haven ★★★★★

Williams Volkswagon & Audi ★★★★★

Warren Auto Ctr ★★★★★

Warehouse Tire Stop ★★★★★

Van Dam Auto Sales & Leasing ★★★★★

Uncle Ed`s Oil Shoppe ★★★★★

Auto blog

C7 Corvette makes inaugural ad appearance in Chevy's first spot with new slogan

Mon, 11 Feb 2013Chevrolet's "Runs Deep" tagline has finally been run into the ground, replaced with the Bowtie brand's "Find New Roads" slogan that's part of parent General Motors' plan to unify its everyday brand's marketing efforts worldwide. The new Chevrolet campaign was ushered in on prime time last night during the Grammy Awards on CBS, and the first spot, a 90-second full-line ad, also marks the first appearance of the 2014 Corvette Stingray in a commercial.

Being a full-line ad, the commercial is composed of vignettes centered on different vehicles in the brand's lineup. The all-new 2014 Impala also makes its first commercial appearance in dapper fashion, and time is spent on a skateboarding Sonic and a bouquet of brightly colored Spark hatchbacks driven by fashionable women. The ad starts and ends with Chevy's green halo car, the Volt, along with a young girl with her robotic dog (yes, really).

Chevrolet's "Runs Deep" campaign got off to a rocky start in the fall of 2010, but it did last for a couple of years with some tweaks. This new one, "Find New Roads" seems more intent on drawing new customers into the fold than the outgoing tagline, which seemed to play more toward the brand faithful. It admittedly reminds us more than a little the short-lived "Find Your Own Road" Saab motto (which, we note, was conceived while the Swedish brand was under GM's control), but no matter, we still think it's got more long-term potential than "Runs Deep."

Former Fisker CEO has some advice for Tesla Motors

Wed, Oct 22 2014Former Fisker Automotive CEO and ex-Chevrolet Volt vehicle-line director Tony Posawatz has some words of caution for Tesla Motors. The long-time automaker executive questions the California automaker's long-term viability – and gives some praise – in a talk with Benzinga, which you can listen to below. While the all-wheel-drive D that Tesla unveiled earlier this month in Southern California wowed a packed crowd, Posawatz (starting at around minute 4:45 in the interview) says Tesla would've been better off taking the resources it expended toward that Model S upgrade and directed them towards speeding up the development of a more affordable plug-in. Perhaps a number of investors agreed, since the company's stock fell the day after the D was announced. Posawatz says Tesla has been over-reliant on the sale of ZEV credits. Posawatz also says that Tesla has been over-reliant on the sale of zero-emissions vehicle credits in California for its earnings and questions whether the automaker will ever work at a large enough scale to sufficiently drive down costs and make consistent profits. Tesla CEO Elon Musk would take issue with this characterization. Posawatz first made his mark in the plug-in vehicle world when he was the vehicle-line director at General Motors for the Volt extended-range plug-in from 2006 to 2012. Later that year, he joined extended-range plug-in maker Fisker Automotive as its CEO, though quit that job during the summer of 2013 as the company was descending into insolvency. He joined the Electrification Coalition this past March. News Source: Benzinga Green Chevrolet Fisker Tesla Electric PHEV Tony Posawatz

Recharge Wrap-up: Tesla P85D upgrades coming soon, lease a Chevy Volt for $149 a month

Wed, Dec 31 2014CarCharging has raised $6 million from shareholders and has restructured to save cash. The EV charging company plans to expand further in 2015 - with an eye toward achieving profitability - in part by investing in technology and "unlocking the value of our significant equipment inventory," says CarCharging CEO Michael D. Farkas. The group expects to reduce administrative costs by 40 percent, and has hired an interim Chief Financial Officer to help carry out its plans for growth. CarCharging raised the cash through offering convertible preferred stock to its shareholders, whom Farkas thanked "for their passion and patience." Read more in the press release below. Rydell Chevrolet in Los Angeles is offering Chevrolet Volt leases for $149 per month. In a video ad, Rydell offers the Volt for $169 a month with $3,390 due at signing, but another ad shows the offer at $149 a month with $3,550 down or $248 per month with $0 down. Rydell Chevrolet will ship the car anywhere in the lower 48 states. It also appears they offer cupcakes. See Rydell's video below, or read more at Inside EVs. Tesla will upgrade the Model S P85D with higher performance and top speed. The free update, which is due "in the next few months" according to a statement from Tesla, will raise the electronically limited top speed from 130 to 155 miles per hour. "Additionally, an over-the-air firmware upgrade to the power electronics will improve P85D performance at high speed above what anyone outside Tesla has experienced to date," Tesla says. The update will be available for the lifetime of the car, which includes subsequent owners. Read more at Green Car Reports. Car Charging Group Completes $6 Million Capital Raise Concurrently Enacts Restructuring Actions to Reduce Cash Burn MIAMI BEACH, Fla., Dec. 29, 2014 /PRNewswire/ -- Car Charging Group, Inc. (OTCQB: CCGI) ("CarCharging" or the "Company"), the largest owner, operator, and provider of electric vehicle (EV) charging services, today announced that it has closed an offering (the "Offering") and raised net proceeds of up to $6 million with current institutional shareholders. The Offering consisted of convertible preferred securities with a conversion price of $0.70 and warrants exercisable at $1.00. Proceeds will be used to: - Strengthen CarCharging's balance sheet; - Build on the past year's progress; and - Provide growth capital for expanding the Company's network.