1967 Corvette Coupe 4 Speed on 2040-cars

Charlevoix, Michigan, United States

Body Type:Coupe

Engine:327/350

Vehicle Title:Clear

For Sale By:Private Seller

Exterior Color: Lyndale Blue

Make: Chevrolet

Interior Color: Teal Blue

Model: Corvette

Trim: Coupe

Drive Type: 4 Speed

Mileage: 67,400

This is a third owner, rust free, rotisserie restoration of the last year for the C2s. I have owned the car for 20 years and the body off restoration was done the year after I bought it. The 327/350 engine was professionally rebuilt, and a new clutch was installed. The block and heads are date coded early August 1966 and the car was built on Wednesday, September 7, 1966, No. 433. The carburator is a new Holly 650 carb (not original), setup for efficiency. The 4 speed is original GM and shifts smoothly. The original owners manual and protecto plate, along with 2 sets of original keys, are included with the sale.

Chevrolet Corvette for Sale

1991 chevrolet corvette

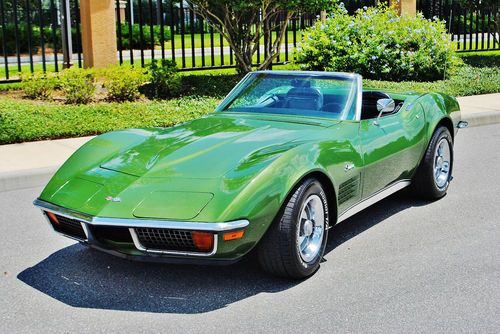

1991 chevrolet corvette Simply beautiful 1972 chevrolet corvette convertible must see drive very rare.

Simply beautiful 1972 chevrolet corvette convertible must see drive very rare. 1962 - 2003 chevy corvette convertible resto rod

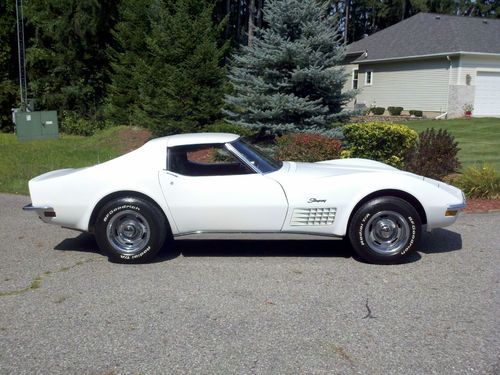

1962 - 2003 chevy corvette convertible resto rod Corvette stingray 1972 #'s matching with many factory options(US $15,000.00)

Corvette stingray 1972 #'s matching with many factory options(US $15,000.00) 2007 chevy corvette(US $32,995.00)

2007 chevy corvette(US $32,995.00) Former accident, reconstructed title, runs and drives perfectly, ready to enjoy

Former accident, reconstructed title, runs and drives perfectly, ready to enjoy

Auto Services in Michigan

Wohlford`s Brake Stop ★★★★★

Wilder Auto Service ★★★★★

Valvoline Instant Oil Change ★★★★★

Trend Auto Sales ★★★★★

Transmission Authority ★★★★★

The Collision Shop ★★★★★

Auto blog

Helicopter crashes on Top Gear Korea set while chasing Corvette ZR1

Mon, 11 Feb 2013The formula of Top Gear Korea is seemingly about the same as it is everywhere else in the world, including the flagship British original: involve interesting cars in fantastical situations with charismatic hosts. That prescription has proved to be pretty reliable over the years, and has lead to some truly memorable and exciting pieces of television.

Something like that was undoubtedly what the Korean producers were after when they lined up this segment - a drag race between a Chevrolet Corvette ZR1 and an AH1 Cobra military helicopter. The planners almost certainly did not expect the filming of the segment to go quite as wrong as it actually did, with the helicopter actually crashing into the dirt after the "drag race" had been completed. Thankfully, we're told that no one was seriously injured in the crash, but the footage, in the video below, is pretty damn chilling to watch, nevertheless.

Junkyard Gem: 1988 Chevrolet Spectrum Sport Coupe

Wed, Aug 23 2023Before General Motors created the Geo brand for cars built or designed by its overseas partners, the Chevrolet Division put its badges on U.S.-market versions of the Toyota Corolla Sprinter, the Suzuki Cultus and the Isuzu Gemini. Those cars were known as the Nova, the Sprint and the Spectrum, and all became Geos starting with the 1989 model year. Today's Junkyard Gem is one of the last Chevy Spectrums ever sold, found in a Denver self-service yard a few months ago. Midway through 1988, the Chevrolet Spectrum abruptly became the Geo Spectrum and was assigned to the 1989 model year. This car was built in May 1988, making it one of the very last of the pre-Geo Spectrums. The Chevrolet/Geo Spectrum was available as a four-door sedan and as a three-door hatchback, from the 1985 through 1989 model years. For 1988 only, a Spectrum Sport Coupe package, featuring some trim upgrades and these rad decals, could be had on the hatchback. This car was essentially identical to its Isuzu-badged counterpart, the I-Mark. In 1988, the MSRP for the cheapest possible Chevy Spectrum hatchback (the stripped-down Spectrum Express) was $6,495, while its somewhat better-equipped I-Mark twin started at $7,439 (that's $17,128 and $19,617 in 2023 dollars). Meanwhile, the base Hyundai Excel hatchback listed at $5,295 and the Yugo GV cost a hilarious $4,199 ($13,963 and $10,941 in today's money). Power came from this 1.5-liter SOHC four-cylinder, rated at 70 horsepower. A turbocharged version with 110 horsepower was available as well. You could get an automatic transmission in the Spectrum, but this car has the base five-speed manual. This car didn't get the optional air conditioning, but at least it has the traditional Isuzu HVAC control icons featuring blow-dried hair and high-heeled dominatrix boots. Just over 170,000 miles on the odometer. Someone installed a pretty good (for the 1980s) Blaupunkt Charlotte CR148 cassette deck in the dash. This was a necessity if you wanted to enjoy full appreciation of the music of the era. The Spectrum is special! It's as slick as city rain. "I didn't spend a lot of money but with my Spectrum it looks like I did." Joe Isuzu mocked Toyota salesmen when pitching the I-Mark. As was nearly always the case during the 1980s, the JDM ads for the same car were much more fun. They should have recreated this commercial with Spectrums.

Canada opens probe into 250,000 GM pickups, SUVs over brake performance

Sun, Jun 23 2019Transport Canada, the auto safety regulator, has opened a probe into braking issues in nearly 250,000 General Motors full-size pickups and SUVs after U.S. officials launched a similar probe last year, the agency said on its website. The U.S. National Highway Traffic Safety Administration (NHTSA) in November into 2.73 million U.S. 2014-2016 model year SUVs and pickups after receiving 487 reports of hard brake pedal effort accompanied by extended stopping distance that were attributed to deterioration of the engine-driven brake assist vacuum pump. Transport Canada's probe covers 249,700 2015 through 2017 model year vehicles including the Cadillac Escalade, Chevrolet Suburban, Chevrolet Tahoe and GMC Yukon as well as 2014-2017 Chevrolet Silverado LD and GMC Sierra LD vehicles. The U.S. agency said it had reports of nine incidents of vehicles incurring damage as a result of colliding with another vehicle or fixed object at low speeds and reports of two injuries. NHTSA said if the pump fails to operate, the amount of brake power assist can be significantly reduced, extending vehicle stopping distance. The NHTSA sent GM an information request in a Feb. 7 letter. A GM spokesman said he had no update on the investigation. Reporting by David Shepardson; editing by Jonathan Oatis