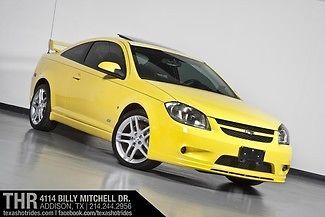

2009 Cobalt Ss Turbocharged! G85! Rpd Display! Xtra Clean! Rare Color! Must See! on 2040-cars

Addison, Texas, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:2.0L 1998CC 122Cu. In. l4 GAS DOHC Turbocharged

Body Type:Coupe

Fuel Type:GAS

Year: 2009

Make: Chevrolet

Model: Cobalt

Trim: SS Coupe 2-Door

Transmission Description: TRANSMISSION, 5-SPEED MANUAL

Number of Doors: 2

Drive Type: FWD

Drivetrain: Front Wheel Drive

Mileage: 93,048

Sub Model: Chevrolet Cobalt

Number of Cylinders: 4

Exterior Color: Yellow

Interior Color: Black

Chevrolet Cobalt for Sale

2007 chevrolet cobalt lt coupe 2-door 2.2l(US $4,000.00)

2007 chevrolet cobalt lt coupe 2-door 2.2l(US $4,000.00) 2009 chevy cobalt ss coupe turbo 5-speed spoiler 63k mi texas direct auto(US $11,980.00)

2009 chevy cobalt ss coupe turbo 5-speed spoiler 63k mi texas direct auto(US $11,980.00) 2006 chevy cobalt, very clean, one owner

2006 chevy cobalt, very clean, one owner 2006 chevy cobalt, red w/ grey interior,

2006 chevy cobalt, red w/ grey interior, 2010 chevrolet cobalt base coupe 2-door 2.2l

2010 chevrolet cobalt base coupe 2-door 2.2l 2008 chevrolet cobalt sport sedan 4-door 2.4l ohio salvage title(US $4,900.00)

2008 chevrolet cobalt sport sedan 4-door 2.4l ohio salvage title(US $4,900.00)

Auto Services in Texas

Zepco ★★★★★

Z Max Auto ★★★★★

Young`s Trailer Sales ★★★★★

Woodys Auto Repair ★★★★★

Window Magic ★★★★★

Wichita Alignment & Brake ★★★★★

Auto blog

No diesels in the running for 2016 Green Car Of The Year

Thu, Oct 15 2015It's a new era for the Green Car Of The Year. In the past, the theme of the award was to take a broad look at alternative powertrains and pick the best among them. "Clean diesels" from the Volkswagen group were often among the finalists and won the award twice. For the 2016 edition - which will be handed out at the LA Auto Show next month - not a single diesel made the list. There's little wonder why. Green Car Journal, which names the winner with a panel of experts, had to strip two VW brand vehicles of their past wins. The 2009 VW Jetta TDI, which won in 2008, and the 2010 Audi A3 TDI, which won in 2010, have both lost their titles now that the world knows about the "defeat devices" that VW installed in many of its TDI vehicles around the world. So, what does that leave us with for 2016? Two plug ins, a hybrid, and two gas vehicles. The two electric vehicle are the Audi A3 e-tron and the Chevy Volt, while the all-new Toyota Prius (which will come with a plug-in version later) is the lone pure hybrid. Rounding out the pack are two efficient gas models: the Hyundai Sonata and the Honda Civic. This is the tenth year for the Green Car Of The Year, and it will be interesting to see if diesels can come back into the award's good graces (for the record, no diesels were among the finalists in 2013, either) in the future. For now, we'd like to know who you think should win. You can read more about the finalists in the press release below and then cast your vote in our poll. Show full PR text FINALISTS ANNOUNCED FOR 2016 GREEN CAR OF THE YEAR Green Car Journal to Reveal Winner of 11th Annual Award at LA Auto Show Press & Trade Days, November 19 LOS ANGELES, CA (October 15, 2015) – Green Car Journal has announced its five finalists for the magazine's prestigious 2016 Green Car of the Year® award. The 2016 models include the Audi A3 e-tron, Chevrolet Volt, Honda Civic, Hyundai Sonata, and Toyota Prius. An increasing number of vehicle models are considered for the Green Car of the Year® program each year, a reflection of the auto industry's expanding efforts in offering new vehicles with higher efficiency and improved environmental impact. Green Car Journal has been honoring the most important "green" vehicles every year at the LA Auto Show, since its inaugural award announced at the show in 2005.

Chevy Volt outsells Nissan Leaf for first time since October 2013

Mon, Aug 3 2015It's been a rough summer so far for both the Chevy Volt and the Nissan Leaf, the first two plug-in vehicles from major automakers that ushered in the modern plug-in era. In June 2015, sales were down from their 2014 levels. The Leaf was down 11.6 percent and the Volt was down 31.1 percent. For July 2015, things didn't get much better. July 2015's Volt sales of 1,313 were down 35 percent from July 2014 and are down 34.8 percent for the year-to-date. Nissan, on the other hand moved only 1,174 Leafs last month, down 61.1 percent. So far this year, Leaf sales are down 30.2 percent. What's interesting with this steep decline in Leaf sales is that allowed the Volt to outsell the Leaf for the first time since October 2013. Back then, the Volt sold 2,022 compared to the Leaf's 2,002 units. So far, Nissan has sold 83,312 Leafs in the US since the EV went on sale in late 2010. Chevy has sold 80,292 Volts. Even though Tesla doesn't release monthly sales figures, there's a good chance that the pricey Model S was once again the best-selling EV in the US in July, as it was in the first three months of 2015. At that time, Tesla delivered an average of just under 2,000 Model S EVs a month. We might get some insight into more recent numbers during the quarterly investor call on Wednesday. As we've said before, the low sales for the aging plug-ins can be explained by the fact that both the Leaf and the Volt are due for upgrades. The second-gen Volt is coming in a few months. Nissan is being cagey about when the updated Leaf will arrive, but given these latest sales figures, we wouldn't be surprised if the undisclosed timetable gets move up somehow. Related Video: The video meant to be presented here is no longer available. Sorry for the inconvenience.

Automakers score 8 out of top 20 most-watched ads on YouTube [w/videos]

Fri, 14 Dec 2012Who would have ever thought there'd be a day where people are able to skip television commercials only to go to websites to watch them later? Such is the joy of a DVR and YouTube. AdWeek tabulated the 20 most-watched ads on YouTube, and found that nine were car-related including eight coming from automakers.

Volkswagen continued its Star Wars theme with two ads in the top 20, including the highest-ranking car commercial The Bark Side spot at number three with almost 18 million views, which doesn't even have a single car in it. Some of our favorites are from Chrysler with Clint Eastwood in It's Halftime in America and House Arrest with Charlie Sheen for the Fiat 500 Abarth. Chevrolet, Honda, Audi and Toyota were the other automakers in the top 20, but we'd be remiss if we didn't at least mention one of the coolest ads on the list, the Hot Wheels corkscrew jump.

Of all the car videos, only the Fiat ad wasn't played during a Super Bowl. Check out all eight videos - in order - after the jump. Nike took the top spot with its My Time is Now ad that has been seen online more than 20 million times with Pepsi's Uncle Drew posted up in the runner-up; some of the other videos include four Old Spice commercials and an ad in which Snoop Dogg is pedaling Hot Pockets.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.049 s, 7971 u