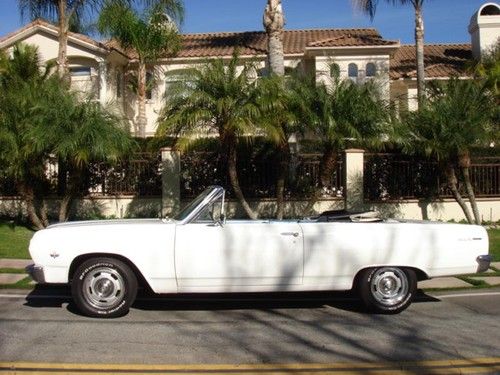

Chevelle Convertible, Body Off Frame Restoration, Drives Like A New Car! on 2040-cars

La Habra, California, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:350

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chevrolet

Model: Chevelle

Trim: Malibu

Options: Convertible

Drive Type: Rear

Exterior Color: White

Mileage: 19,728

Interior Color: Blue

Chevrolet Chevelle for Sale

1968 chevelle with new frame on restoration(US $14,900.00)

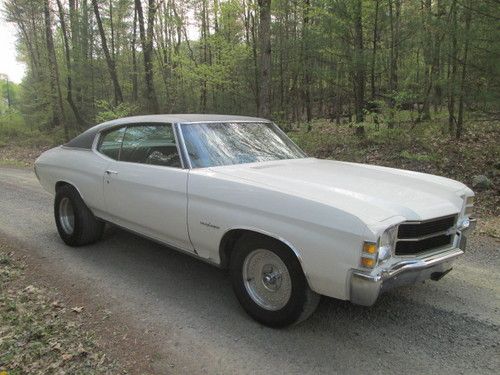

1968 chevelle with new frame on restoration(US $14,900.00) 71 chevelle coupe 350 a/c posi rear pa inspected, drive anywhere no reserve

71 chevelle coupe 350 a/c posi rear pa inspected, drive anywhere no reserve Rare 1969 california chevelle concours estate v8 wagon third row seat no reserve

Rare 1969 california chevelle concours estate v8 wagon third row seat no reserve 1972 chevelle project car(US $3,500.00)

1972 chevelle project car(US $3,500.00) Frame off restored 1967 chevelle convertible

Frame off restored 1967 chevelle convertible 1970 chevelle zz4 350 - custom build(US $17,750.00)

1970 chevelle zz4 350 - custom build(US $17,750.00)

Auto Services in California

Your Car Valet ★★★★★

Xpert Auto Repair ★★★★★

Woodcrest Auto Service ★★★★★

Witt Lincoln ★★★★★

Winton Autotech Inc. ★★★★★

Winchester Auto ★★★★★

Auto blog

Here are 12 electric pickups in the works

Wed, Oct 21 2020With the unveiling of the GMC Hummer EV, the list of planned electric pickups is expanding. Legacy automakers like Ford and Chevy have theirs coming, as do startups like Tesla, Rivian and Bollinger, as well as some lesser known brands. Here are all the electric pickup trucks we know to be in the works, along with a few that are being discussed or mulled over. GMC Hummer EV The 2022 GMC HUMMER EV is a first-of-its kind supertruck develop View 40 Photos We’ve seen it now, and itÂ’s the business. The GMC Hummer EV comes out swinging with 1,000 horsepower from GMÂ’s new Ultium electric powertrain program, a wealth of off-road features, a removable roof, Super Cruise and the revival of the Hummer name. WeÂ’ll see the first ones on the road next fall. Tesla Cybertruck Tesla Cybertruck at the Petersen Museum View 14 Photos Tesla revealed the Cybertruck last year with, ahem, unique styling, a number of powertrain options and a claimed range of up to 500 miles. It has a compressed paper dash, a ramp for the bed, and “shatterproof” windows. It has already racked up hundreds of thousands of reservations. It will be built in Texas. Rivian R1T 2021 Rivian R1T View 15 Photos EV startup Rivian revealed its R1T electric pickup toward the end of 2018 with a claimed 0-60 time of 3 seconds and a towing capability of 11,000 pounds. Preproduction began in September 2020 at RivianÂ’s factory in Normal, Illinois. Bollinger Motors B2 Bollinger Motors B2 side outdoors View 31 Photos BollingerÂ’s B2 electric pickup is a Class 3 off-roader with retro styling, removable roof panels, and a unique “frunkgate” with a pass-through down the center of the vehicle. It was created with both enthusiasts and workers in mind, with features that can get it to remote places (portal axles, hydro-pneumatic suspension) and to get things done (room for 40 2x4s, equipped with eight 110-volt outlets and one 220-volt outlet). Bollinger also plans to make the B2 Chassis Cab available for fleet customization. Ford F-150 Electric Electric Ford F-150 Towing View 9 Photos WeÂ’ve known this to be in the works since early 2019. Since then, details have trickled out. Back in June, Ford announced its F-150 Electric would be coming within two years. WeÂ’ve seen it pull a million pounds worth of train and trucks, heard it will have more power than any other F-150, and seen its LED-laden front end.

2014 Chevy Corvette Stingray order guide hits the web

Mon, 15 Apr 2013The official debut of the 2014 Chevrolet Corvette Stingray is only part of the excitement for fans of Chevy's virtuoso sportscar. Although we got to see the car and some of its preliminary specs in Detroit and Geneva, there is still no word on pricing and some of the juicier data points we've been waiting for - such as confirmed power output, EPA estimated mileage figures and performance numbers. Until then, CorvetteBlogger has gotten its hands on the order guide for the coupe version of the car - in both base and Z51 iterations - revealing tidbits like standard and optional features and available color combinations.

Some other new details made it onto the order guide, such as our first interior specs for the coupe including slightly less hip room and headroom, more shoulder room and the same amount of legroom. To see the full order guide, head on over to CorvetteBlogger. From what we can gather, it sounds like more information will be revealed on April 25 during a party at the Corvette Museum, and for those sun worshipers patiently waiting for a convertible, it would appear you've got another model year to wait through.

Hybrid, Plug-in Hybrid and EV Buyer's Guide: Which one do you want?

Fri, Nov 10 2017If you're shopping for a new vehicle these days, there's a litany of acronyms, buzzwords, and technobabble to further complicate an already difficult decision. But if you're looking at a green powertrain, you have three basic choices to compare: hybrid, plug-in hybrid and "EV" or, electric vehicle. So what are they and which one — if any — is right for you? Research your next new vehicle using Autoblog's Car Finder. Gasoline-Electric Hybrids By now, most people are familiar with the concept of a hybrid car. Thank Toyota's Prius for that. At its most basic, a hybrid vehicle has two powertrains, one gasoline and one electric, which work together for maximum efficiency. At low speeds, the engine can shut off entirely, relying solely on the battery for propulsion. The battery is either charged as you drive by converting kinetic energy into potential energy via a complex regenerative braking system, or directly off of the gas motor. This is a very hands-off, behind-the-scenes system as all the driver has to is put in gas and drive as normal. Hybrids come in all shapes and sizes and, according to the EPA, range in fuel economy from 58 mpg for the Hyundai Ioniq Blue all the way down to 13 mpg for the Ferrari LaFerrari Aperta. Best For: Anyone who want to see their fuel consumption go down without many sacrifices. You can easily find a hybrid sedan, hatchback, crossover, SUV or even a pickup truck (i f you can find one). Best of all, a hybrid requires no special equipment to be installed at home, or added work for the driver. Hybrids do cost more than traditionally-powered competitors, so make sure to compare projected fuel savings with how much extra a hybrid will cost – it may take a surprisingly long time to break even. The EPA provides a handy calculator for this very purpose. Our Favorite Hybrids: 2017 Toyota Prius 2018 Hyundai Ioniq Hybrid 2017 Ford Fusion Hybrid Plug-In Hybrids Sometimes referred to as a PHEV, or plug-in hybrid electric vehicle, this is a baby-step towards full electrification. Armed with a much larger battery pack than a hybrid, PHEVs can go between 12 ( Mercedes-Benz GLE550e) and 97 ( BMW i3 w/Range Extender) miles on electricity alone depending on the model and your driving style. Like a normal hybrid, the driver is largely unaware of which power source is currently in use, even as they switch over — either because the battery is drained, or the driving circumstances require more power.