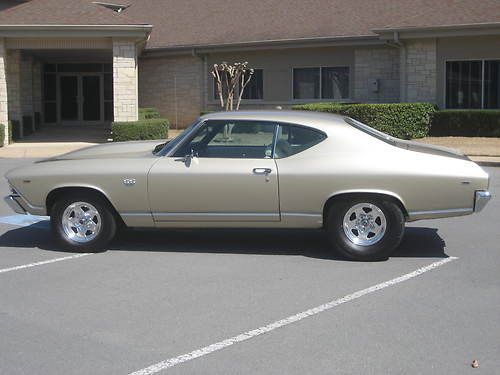

1971 Chevelle Malibu on 2040-cars

Glenville, West Virginia, United States

Body Type:2DSD

Vehicle Title:Clear

Engine:307

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Chevrolet

Model: Chevelle

Trim: 2DSD

Options: Sunroof

Drive Type: RWD

Mileage: 114,000

Sub Model: Malibu

Number of Doors: 2

Exterior Color: White

Warranty: none

Interior Color: Blue

Up for auction is a 1971 Chevelle Malibu.... the body is "unmolested" other than a moonroof installed, it does have the original transmission but the engine had been changed prior to 1986 with a 305 (355909) ... so the story with the car is its been garage kept parked on carpet and owned by an 80 year man and his wife. He purchased it from his brother-in-law in 1987 with 59,710 miles on it.. it now has 114,657 miles .. the body is great with a few minor surface places... the trunk is perfect with the original jack etc.. there are two primered places around the passenger door handle and the passenger front right due to the fact the man's wife backed it out of the garage and cut the wheels to soon and clipped the garage, also a ding in the drivers side chrome molding, the vinyl top is in pretty good shape has a minor place or two but hardly noticable. The steering wheel has a couple of cracks in it like they all do. The Malibu emblems weren't on the car when I bought it, but the Chevelle emblem on the trunk is. The carpet is in great shape, there are tears in the drivers seat, none on the passenger and the back seat looks like its never been sit in... it has the 8 track player, cigarette lighter works great, radio and speakers work great, horn works, lights and brake lights work...the dash is also in great shape!! this is a coast to coast car.. rides awesome! I would drive it anywhere.. the owners manuel is even still in the glove box in good shape! This isn't a show car as it sits, but believe me it wouldn't take a lot to get it there.. or wouldn't take a lot if someone wanted to SS clone it... Buy it and drive it home!

Chevrolet Chevelle for Sale

1969 chevelle ss clone

1969 chevelle ss clone '72 chevelle 350 4 door, (restore proj.)(US $1,700.00)

'72 chevelle 350 4 door, (restore proj.)(US $1,700.00) 1971 chevrolet chevelle base hardtop 2-door 7.4l(US $29,500.00)

1971 chevrolet chevelle base hardtop 2-door 7.4l(US $29,500.00) 1972 chevelle malibu satin charcoal/satin black stripes. bucket seats, stereo.

1972 chevelle malibu satin charcoal/satin black stripes. bucket seats, stereo. 1967 chevrolet chevelle ss 396 true 138(US $60,000.00)

1967 chevrolet chevelle ss 396 true 138(US $60,000.00) 1965 chevrolet chevelle malibu v-8 72k miles california survivor

1965 chevrolet chevelle malibu v-8 72k miles california survivor

Auto Services in West Virginia

Stewart`s Collision Center ★★★★★

Rockland Auto Repairs ★★★★★

Premier Pre Owned ★★★★★

Jones Automotive ★★★★★

G & G Tire Service ★★★★★

Steve`s Auto Service Center ★★★★

Auto blog

We really want to use an eCrate to restomod an old GM car. Here's what we'd build

Fri, Oct 30 2020You hopefully saw the news today of GM's introduction of its Connect and Cruise eCrate motor and battery package, which effectively makes the Bolt's electric motor, battery pack and myriad other elements available to, ah, bolt into a different vehicle. It's the same concept as installing a gasoline-powered crate motor into a classic car, but with electricity and stuff. This, of course, got us thinking about what we'd stuff the eCrate into. Before we got too ahead of ourselves, however, we discovered that the eCrate battery pack is literally the Bolt EV pack in not only capacity but size and shape. In other words, you need to have enough space in the vehicle to place and/or stuff roughly 60% of a Chevy Bolt's length. It's not a big car, but that's still an awful lot of real estate. There's a reason GM chose to simply plop the pack into the bed and cargo area of old full-size SUVs. Well that, and having a rear suspension beefy enough to handle about 1,000 pounds of batteries. So after that buzz kill, we still wanted to peruse the GM back catalog for classics we'd love to see transformed into an electric restomod that might be able to swallow all that battery ... maybe ... possibly ... whatever, saws and blow torches exist for a reason. 1971 Buick Riviera Consumer Editor Jeremy Korzeniewski: If you’re going to build an electric conversion, why not do it with style? ThatÂ’s why IÂ’m choosing a 1971-1973 Buick Riviera. You know, the one with the big glass boat-tail rear end that ends in a pointy V. Being a rather large vehicle with a big sloping fastback shape, IÂ’m hoping thereÂ’s enough room in the trunk and back seat to pack in the requisite battery pack. That would likely require cutting away some of the metal bulkhead that supports the rear seatback, but not so much that a wee bit of structural bracing couldnÂ’t shore things up. The big 455-cubic-inch Buick V8 up front will obviously have to go. Remember, this was the 1970s, so despite all that displacement, the Riviera only had around 250 horsepower (depending on the year and the trim level). So the electric motorÂ’s 200 horsepower and 266 pound-feet of torque ought to work as an acceptable replacement.  1982 Chevrolet S10 Associate Editor Byron Hurd: OK, so the name "E-10" is already taken by a completely different truck, but let's not let labels get in the way of a fun idea.

The story of the 2014 Chevrolet SS: "Luxury, power, refinement, handling"

Thu, 07 Mar 2013Not including the women and men who built it, the 2014 Chevrolet SS has only been seen in person by a piddling number of people - fewer humans than would fill the gymnasium at a high school volleyball game. Not including the men and women who built it, no one has driven it. Even so, it is already saddled with two controversies: the way it looks and the way it shifts.

First to that shifting. Did we love the last Americanized Holden, the awesomely sportsome Pontiac G8 GXP, and its six-speed manual? Of course. Do we wish the SS came with a six-speed manual? Of course. But we'd like a toboggan to come with a manual transmission. We'd put a manual transmission on a weasel if we could because we're just wired that way; if it moves, it should come with a stick and a clutch. Or at least the option.

Let's climb down off the ledge, though. We haven't driven the SS and we have no idea how good (or not) the automatic is. And the Hobson's Choice in transmissions when it comes to sport sedans like the BMW M5, Mercedes-Benz E63 AMG and Jaguar XFR-S and, oh yeah, cars-that-really-should-have-manuals like the Audi R8 and Nissan GT-R and Porsche 918 and every single Lamborghini and Ferrari, for instance, hasn't stopped us from enjoying what is clearly the gruesome, dual-clutched demise of Western automotive civilization. Because in spite of our ululations at the dying of the six-speed light, we understand.

Is this GM's next electric crossover?

Thu, Nov 16 2017GM made headlines this week when CEO Mary Barra presented the company's electrification and automation plans at the Barclays Global Automotive Conference in New York. "We are committed to a future electric vehicle portfolio that will be profitable," Barra said, which could be taken as a jab at Tesla. In the presentation ( PDF here), though, we see a new vehicle in a slide titled "Leveraging existing BEV platform to expand in near term." The vehicle, seen above, accompanied the captions "New CUV entries" and "two entries by 2020." Is this a sneak preview of an upcoming electric crossover from GM? The image seems too realistic and intentional to be a random placeholder. If this is, indeed, an upcoming battery-electric CUV based on the Bolt, the question remains: Will it be a Chevy or a Buick? It has no visible badging, but it shares DNA from both brands. As Inside EVs points out, though, it does bear a resemblance to the Chevrolet FNR-X concept unveiled in Shanghai earlier this year. With two CUVs on the way, it's not unthinkable that there could be a version for each brand. In addition to this slide, the presentation includes plans for an "All new multi-brand, multi-segment platform" launching in 2021. The all-new modular battery system will cost less than $100 per kWh, providing higher energy density and faster charging. The platform will host at least nine different vehicles, including a compact crossover, seven-seat luxury SUV and a large commercial van. GM has said it will launch 20 new EVs by 2023, and that it targets 1 million EV sales per year by 2026. Many of those sales will be in China. Related Video: