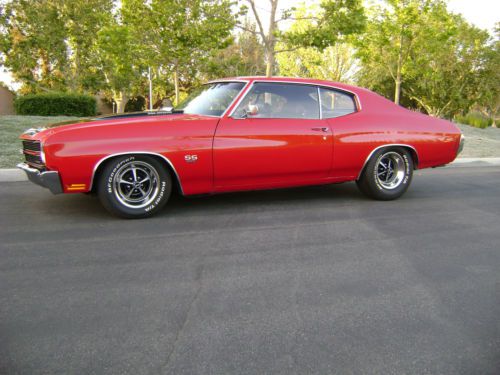

1971 Chevelle 454ss on 2040-cars

Ponchatoula, Louisiana, United States

|

1971 Chevelle 454 ss. Has a brand new 498ci bbc with a new 2spd powerglide. It has been completely rewired. No passes have been made yet. 4.88 gears with a GM 12 bolt rear end. Moser axles and components in the rear with strange breaks in the front. Car should run high 9's. It has fiberglass bumpers and hood. New carpet and a new trans tunnel. Car is turn key and ready to run. $22,000 obo. Will take trades. Vehicle does not have a title. Bill of sale is all I have. |

Chevrolet Chevelle for Sale

1970 chevelle ss 396 4 speed with buildsheet

1970 chevelle ss 396 4 speed with buildsheet 1969 chevrolet chevelle complete restoration 396/325hp automatic(US $49,900.00)

1969 chevrolet chevelle complete restoration 396/325hp automatic(US $49,900.00) 1972 chevy chevelle ss

1972 chevy chevelle ss 1969 chevelle ss 396 low miles build sheet posi nice driver low reserve

1969 chevelle ss 396 low miles build sheet posi nice driver low reserve 1965 malibu ss pro touring style build by national car builder(US $54,900.00)

1965 malibu ss pro touring style build by national car builder(US $54,900.00) 1964 chevrolet chevelle ss 5.3l

1964 chevrolet chevelle ss 5.3l

Auto Services in Louisiana

Westlake Auto Sales ★★★★★

Wayne`s Detailing ★★★★★

Walker Automotive ★★★★★

Transmission Depot Inc ★★★★★

Team Toyota ★★★★★

Sams Audio ★★★★★

Auto blog

Chevy Corvette gets Valet Mode with Performance Data Recorder [w/video]

Mon, 18 Aug 2014For the 2015-model-year, Chevrolet introduces Valet Mode for the Corvette, an enhancement to the Performance Data Recorder (PDR) already available and to your peace of mind. The PDR already captures 720p HD video with a windshield-mounted camera, records interior audio with a cabin microphone and gathers telemetry data using GPS, saving the data to an SD card in the glovebox. You can then watch your track-day antics with various information overlays on the center console screen.

Valet Mode will let you hit 'Replay' when your car gets pulled up front smelling vaguely of fricasseed clutch. Turned on by entering a four-digit code, it also locks the interior storage spaces and turns off the infotainment system. It can't be turned off until the code is re-entered. There's a press release below with more information as well as a video that explains how it works, with the obligatory dig at the 'Vette's biggest foe.

Next-gen Chevy Volt gets Corvette looks, adjustable regen levels

Sat, Dec 20 2014The hood may say "full speed ahead." The regenerative braking system says "slow down a bit." One person's automotive improvements is another's identity crisis, all in a day's work analyzing the new Chevrolet Volt. The next-generation version of General Motors' first extended-range plug in will include design touches taken from to the new Chevrolet Corvette, GM's iconic sports car. Hexagonal taillights and a "taut" hood will be part of the new package, Automotive News says, citing General Motors design chief Ed Wilbur. But does that mean the Volt is shedding any of its green-car cred? Not at all, if one considers that the Volt will also let the driver adjust the degree of regenerative braking using steering-wheel paddles to dial up and recapture as much energy as possible and engage in "one-pedal" driving or turn it down for easier coasting. Check out the 55-second video below featuring GM executives Mark Reuss and Andrew Farah trying out the Volt's new regenerative-braking system that was first used on the Cadillac ELR. GM will have more details for us when it unveils the 2016 Chevy Volt at the North American Auto Show in Detroit next month. The new version is said to have a larger battery, a longer all-electric driving range and more power, but Chevy's been fairly mum on those sorts of performance details so far. Green Chevrolet Electric volt cadillac elr corvette regenerative braking

Cruze Diesel Road Trip reveals the good and bad, but no ugly

Tue, Mar 31 2015Most of us have strong opinions on diesel-powered cars based on our perceptions of and experience with them. I used to thoroughly dislike oil burners for their noise, smoke and lackluster performance, and the fact that they ran on greasy, smelly stuff that was more expensive than gasoline, could be hard to find and was nasty to get on your hands when refueling. Those negatives, for me, trumped diesel's major positives of big torque for strong acceleration and better fuel economy. Are any of those knocks on diesel still valid today? I'm not talking semis, which continue to annoy me when their operators for some reason almost never shut them down. At any busy truck stop, the air seems always filled with the sound – and sometimes smell – of dozens of big-rig diesels idling endlessly and mindlessly. Or diesel heavy-duty pickups. Those muscular workhorses are far more refined than they once were and burn much less fuel than their gasoline counterparts. But good luck arriving home late at night, or departing early morning, without waking your housemates and neighbors with their clattery racket. No, I'm talking diesel-powered passenger cars, which account for more than half the market in Europe (diesel fuel is cheaper there) yet still barely bump the sales charts in North America. Diesel fuel remains more expensive here, too few stations carry it, and too many Americans remember when diesel cars were noisy, smelly slugs. Also, US emissions requirements make them substantially more expensive to certify, and therefore to buy. But put aside (if you can) higher vehicle purchase and fuel prices, and today's diesel cars can be delightful to drive while delivering much better fuel efficiency than gas-powered versions. So far in the US, all except Chevrolet's compact Cruze Diesel come from German brands, and all are amazingly quiet, visually clean (no smoke) and can be torquey-fun to drive. When a GM Powertrain engineering team set out to modify a tried-and-true GM of Europe turbodiesel four for North American Chevy Cruze compacts, says assistant chief engineer Mike Siegrist, it had a clear target in mind: the Volkswagen Jetta TDI 2.0-liter diesel. And they'll tell you that they beat it in nearly every way. "I believe we have a superior product," he says. "It's powerful, efficient and clean, and it will change perceptions of what a diesel car can be." The 2.0L Cruze turbodiesel pumps out 151 SAE certified horses and 264 pound-feet of torque (at just 2,000 rpm) vs.