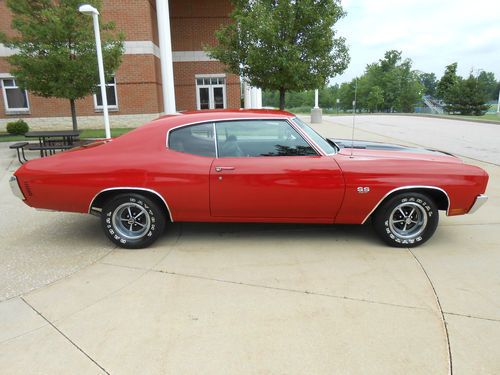

1970 Chevelle Ss - 454 - Automatic - Low Reserve on 2040-cars

Macedonia, Ohio, United States

Body Type:Coupe

Engine:454

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Interior Color: Black

Make: Chevrolet

Number of Cylinders: 8

Model: Chevelle

Trim: Super Sport

Drive Type: RWD

Mileage: 70,880

Sub Model: SS

Warranty: Vehicle does NOT have an existing warranty

Exterior Color: Red

Chevrolet Chevelle for Sale

Auto Services in Ohio

Zig`s Auto Service Inc ★★★★★

World Auto Network ★★★★★

Woda Automotive ★★★★★

Wholesale Tire Co ★★★★★

Westway Body Shop ★★★★★

Toth Buick GMC Trucks ★★★★★

Auto blog

2015 Chevrolet Colorado GearOn Edition is ready to do that outdoorsy thing

Fri, Feb 13 2015Bikes, skis, kayaks... the Chevrolet Colorado GearOn is ready to accommodate all of them, thanks to a trip to the Bowtie's accessories catalog. The special edition Colorado features the basics of Chevy's GearOn accessories, including a bars package, bed divider and tie-down rings, which can be supplemented with other accessories to haul all manner of outdoor equipment. Beyond that, though, Chevy has fitted a few other items to lift up the Colorado's styling, including gloss-black 18-inch wheels, black Bowtie emblems, a body-color grille, off-road assist steps and front foglights. It's a tidy little update to the compact truck's still-fresh styling. Check it out in our full gallery of live images, direct from the Chicago Auto Show. Related Video: Featured Gallery 2015 Chevrolet Colorado GearOn Edition: Chicago 2015 View 14 Photos Related Gallery Chevrolet Colorado GearOn Special Edition Image Credit: Live photos copyright 2015 Drew Phillips / AOL Aftermarket Chicago Auto Show Chevrolet Truck Videos Chicago

The Army goes off-roading with a hydrogen Chevy Colorado

Sun, Nov 22 2015The Chevrolet Colorado is joining the service. General Motors is working with the US Army Tank Automotive Research, Development & Engineering Center (TARDEC) to build a Colorado powered by a commercial hydrogen fuel cell stack, and the Army will use it in "extremes of daily military use for 12 months." TARDEC is the department that tests "advanced military automotive technology" and integrates them into ground systems. The aim is to see how well the benefits of a fuel cell vehicle can be adapted to the battlefield; hydrogen-powered vehicles are quiet, torquey, produce water, and can be used to provide electricity in the field. GM says the design sketch above "foreshadows" the Colorado that will go to boot camp and beyond, making it clear that this won't be the average midsize pickup. The press release below has more. Related Video: GM and U.S. Army to Demonstrate Extreme Off-Road Hydrogen Fuel Cell Chevrolet Colorado Agreement focused on proving unique utility and viability of fuel cell propulsion WARREN, Mich. 2015-11-19 – General Motors and the U.S. Army Tank Automotive Research, Development & Engineering Center (TARDEC) are modifying a Chevrolet Colorado midsize pickup truck to run on a commercial hydrogen fuel cell propulsion system and will expose the truck to the extremes of daily military use for 12 months. "Hydrogen fuel cell technology is important to GM's advanced propulsion portfolio, and this enables us to put our technology to the test in a vehicle that will face punishing military duty cycles," said Charlie Freese, executive director of GM's Global Fuel Cell Engineering activities. Fuel cell propulsion has very high low-end torque capability useful in off-road environments. It also offers exportable electric power and quiet operation, attractive characteristics to both commercial and military use. "The potential capabilities hydrogen fuel cell vehicles can bring to the Warfighter are extraordinary, and our engineers and scientists are excited about the opportunity to exercise the limits of this demonstrator," said TARDEC Director Paul Rogers. "FCVs are very quiet vehicles, which scouts, special operators and other specialties place a premium," he said. "What's more, fuel cells generate water as a by-product, something extremely valuable in austere environments." GM and TARDEC have fuel cell development and research facilities located 20 minutes apart in Pontiac and Warren, Mich.

2021 Chevy Silverado, GMC Sierra fuel economy to go down due to global chip shortage

Mon, Mar 15 2021Production of the 2021 Chevy Silverado and 2021 GMC Sierra is continuing, but the global semiconductor chip shortage is resulting in a mid-year change. Or rather, an omission. Basically, the availability of cylinder deactivation for the 5.3-liter V8 will be significantly reduced, resulting in a reduction of 1 mpg combined for affected models. This applies whether that engine has the six- or eight-speed automatic, as well as to both the regular Active Fuel Management and the more advanced Dynamic Fuel Management cylinder deactivation systems. DFM does remain with the pairing of 5.3-liter V8 and 10-speed automatic that comes standard on the LT Trail Boss and High Country. "Due to the micro controller shortage, the components that control AFM/DFM in the engine control module (ECM) have been removed," GM spokesperson Michelle Malcho told Autoblog. She also indicated that the engines will still have the AFM/DFM hardware in place, but that GM will not allow activation of the systems in the future with an ECM change. Malcho also confirmed to Autoblog that the Silverado and Sierra's other engines will continue to have AFM and DFM, including the 2.7-liter turbo inline-four, 4.3-liter V6 and 6.2-liter V8. In an earlier statement to Reuters, she declined to say the volume of vehicles affected. "By taking this measure, we are better able to meet the strong customer and dealer demand for our full-size trucks as the industry continues to rebound and strengthen," Malcho wrote Reuters in an email. The change runs through the 2021 model year, she said. Malcho told Reuters it would not have a major impact on the Detroit automaker's U.S. corporate average fuel economy (CAFE) numbers. "We routinely monitor our fleet for compliance in the U.S. and Canada, and we balance our portfolio in a way that enables us to manage unforeseeable circumstances like this without compromising our overall (greenhouse gas) and fuel economy compliance," she said. GM's fleetwide fuel economy in the 2018 model year was 22.5 miles per gallon and was projected to rise to 22.8 mpg for 2019, according to a report by the Environmental Protection Agency. To meet federal CAFE requirements, automakers like GM often use credits from either earlier years where they faced less stringent rules and performed better than the requirements or buy credits from other automakers. GM said last month the chip shortage could shave up to $2 billion from this year's earnings.

1967 chevelle malibu

1967 chevelle malibu 1966 chevrolet chevelle

1966 chevrolet chevelle 1964 chevelle malibu - 56k miles

1964 chevelle malibu - 56k miles 1970 chevelle malibu convertible

1970 chevelle malibu convertible 1971 chevelle ss big block 454

1971 chevelle ss big block 454 1972 chevelle malibu

1972 chevelle malibu