1970-1972 Chevelle New Video!!!! on 2040-cars

Sheffield, Alabama, United States

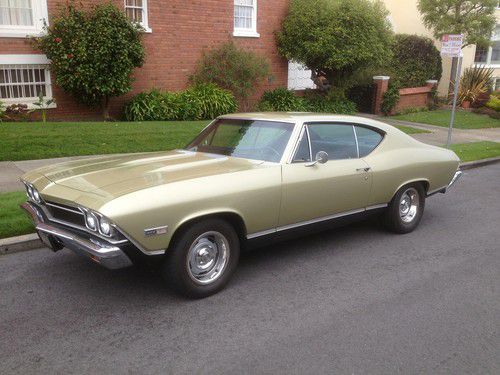

Body Type:Coupe

Engine:350

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Chevrolet

Model: Chevelle

Trim: malibu

Warranty: Vehicle does NOT have an existing warranty

Drive Type: 350 turbo

Options: Cassette Player, Leather Seats

Mileage: 1

Exterior Color: Gray

Interior Color: Black

Chevrolet Chevelle for Sale

1964 chevelle series 300 2 door wagon v8 4 speed malibu ss nova camaro rare1965

1964 chevelle series 300 2 door wagon v8 4 speed malibu ss nova camaro rare1965 Original california car, excellent condition, 5 speed manual(US $23,000.00)

Original california car, excellent condition, 5 speed manual(US $23,000.00) 1967 chevy chevelle "ss" 396/350 hp - full restoration

1967 chevy chevelle "ss" 396/350 hp - full restoration 1965 chevelle convertible project car hot rod muscle car malibu ss(US $5,000.00)

1965 chevelle convertible project car hot rod muscle car malibu ss(US $5,000.00) 1967 chevrolet chevelle 4 door station wagon---awesome!! **we ship worldwide**(US $22,999.00)

1967 chevrolet chevelle 4 door station wagon---awesome!! **we ship worldwide**(US $22,999.00) Ultra rare rotisserie restored- 1969 chevrolet chevelle 300 deluxe factory ss396

Ultra rare rotisserie restored- 1969 chevrolet chevelle 300 deluxe factory ss396

Auto Services in Alabama

Wycoff Motors ★★★★★

Tweet Shop ★★★★★

Triple G Mufflers & Auto Repair ★★★★★

Town & Country Ford ★★★★★

Springville Road Auto & Tire ★★★★★

Rex`s Auto Service ★★★★★

Auto blog

GM recalling 686k Lambda-platform models for hatch repair

Fri, Jul 10 2015General Motors is recalling 686,287 units of its Lambda platform crossovers. On models equipped with a power rear hatch the system can potentially fail. This campaign includes the 2008-2012 Buick Enclave, 2009-2012 Chevrolet Traverse, 2007-2012 GMC Acadia, and 2007-2010 Saturn Outlook. According to GM's documents to the National Highway Traffic Safety Administration (as a PDF), dirt can get into a portion of the strut that holds up the hatch and cause the part to prematurely fail. There's a redundancy in place called the Prop Rod Recovery system that's designed to shut the liftgate if there's a malfunction. However, if the breakdown happens too quickly after the hatch is opened the prop rod might not work the way it's supposed to. If someone were in the way of the falling liftgate, they could be hurt. For the repair, dealers will update the software for the power liftgate actuator motor control unit to prevent the hatch from closing so quickly. They'll also check the operation of the system afterward. Related Video: RECALL Subject : Liftgate Struts may Fail and Liftgate may Fall Report Receipt Date: JUN 30, 2015 NHTSA Campaign Number: 15V415000 Component(s): STRUCTURE Potential Number of Units Affected: 686,287 All Products Associated with this Recall Vehicle Make Model Model Year(s) BUICK ENCLAVE 2008-2012 CHEVROLET TRAVERSE 2009-2012 GMC ACADIA 2007-2012 SATURN OUTLOOK 2007-2010 Details Manufacturer: General Motors LLC SUMMARY: General Motors LLC (GM) is recalling certain model year 2008-2012 Buick Enclave vehicles manufactured January 3, 2007, to February 29, 2012, 2009-2012 Chevrolet Traverse vehicles manufactured July 6, 2008, to February 29, 2012, 2007-2012 GMC Acadia vehicles manufactured September 15, 2006, to February 29, 2012, and 2007-2010 Saturn Outlook vehicles manufactured August 17, 2006, to March 18, 2010. The affected vehicles, equipped with the power liftgate option, have gas struts that hold the power liftgate up when open. These struts may prematurely wear and the open liftgate may suddenly fall. CONSEQUENCE: If the open liftgate unexpectedly falls, it may strike a person, increasing their risk of injury. REMEDY: GM will notify owners, and dealers will update the software for the power liftgate actuator motor control unit so that the motor will prevent the rapid closing of the lift gate, free of charge. The manufacturer has not yet provided a notification schedule.

GM pickup truck plant in Flint to add 1,000 assembly workers

Tue, Feb 5 2019FLINT, Mich. — General Motors said Tuesday it will add 1,000 workers to build new heavy-duty pickup trucks at its plant in Flint, Michigan, and will give priority to GM workers who were laid off elsewhere. The announcement comes the day after GM said it was starting to hand pink slips to about 4,000 salaried workers in the latest round of a restructuring announced in late November that will ultimately shrink its white-collar workforce in North America by 15 percent out of 54,000. GM has come under fire from U.S. President Donald Trump and Midwestern lawmakers for its plans to stop production at five North American factories and cut up to 15,000 jobs in all. The automaker has said it is trying to find new jobs for 1,500 U.S. hourly workers at the affected plants. Flint's truck plant could be a haven for many of these employees. Sales of heavy-duty pickups in the United States have grown to more than 600,000 vehicles a year, up more than 20 percent since 2013, according to industry data. Prices for luxury models can easily top $70,000. GM on Tuesday will celebrate the launch of a new generation of heavy-duty GMC and Chevrolet pickups at the assembly plant in Flint, Michigan, that is now building all such trucks for the company. Elsewhere in the company on Monday, two people briefed on the cuts in the white-collar salaried workforce said GM is cutting hundreds of jobs at its information technology centers in Texas, Georgia, Arizona and Michigan and more than 1,000 jobs at its Warren, Michigan Tech Center. GM is filing new required mass layoff notices with state agencies and disclosed the cuts to lawmakers. The largest U.S. automaker announced in November it would cut a total of about 15,000 jobs and end production at five North American plants. The cuts include eliminating about 8,000 salaried workers, or about 15 percent. GM cut about 1,500 contract workers in December and said 2,300 salaried workers accepted buyouts, officials said. "These actions are necessary to secure the future of the company, including preserving thousands of jobs in the U.S. and globally. We are taking action now while the overall economy and job market are strong, increasing the ability of impacted employees to continue to advance in their careers, should they choose to do so," GM spokesman Pat Morrissey said, adding the bulk of the cuts should be completed in the next two weeks. Morrissey said GM would provide salaried workers with severance packages and job placement services.

Burt Reynolds' vehicles up for auction at Barrett-Jackson

Tue, Sep 25 2018Burt Reynolds' influence on car culture cannot be overstated. Be it "Smokey and the Bandit" or "Cannonball Run," his films inspired a generation of car enthusiasts. He died a few weeks back from cardiac arrest at age 82. This weekend, four vehicles from Reynolds' personal collection — three Pontiacs and a Chevy — will go up for auction at Barrett-Jackson in Las Vegas. It seems Reynolds had plans to sell the cars before he passed. He even filmed a short teaser for the auction and planned to attend the event himself. Three of the cars are Pontiac Trans Ams. Two are re-creations of the cars he drove in "Bandit" and the film "Hooper." Both are 1978 models. The third Trans Am is from 1984 and was used to promote Reynolds' USFL team, the Tampa Bay Bandits. The fourth vehicle is a 1978 Chevy R30 pickup truck. It's styled like the truck he drove in "Cannonball Run." None of the vehicles were actually used in the movies. But they were registered in his name, making them far more legitimate than some other movie-inspired clones. It's unclear how many Bandit Trans Ams Reynolds has owned over the years. Another car connected to him sold for $450,000 back in 2014. His death is sure to drive the price of these new cars even higher. Related Video: Image Credit: Barrett-Jackson Celebrities Chevrolet Pontiac Auctions Truck Coupe pontiac trans am burt reynolds