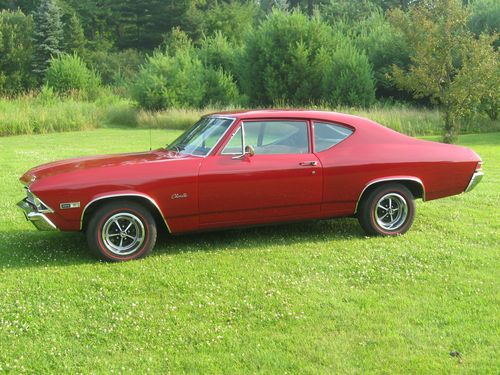

1968 Chevelle on 2040-cars

Tomah, Wisconsin, United States

Vehicle Title:Clear

Make: Chevrolet

Drive Type: 3 speed overdrive

Model: Chevelle

Mileage: 10,000

Trim: 300 series 2 dr sedan

California Car

Frame Off restoration

300 series 2DR Sedan

396 3 Speed Overdrive

Power Steering

Power Disk Brakes

Vintage Air

Cruise Control

608-387-3224

Chevrolet Chevelle for Sale

1966 chevrolet chevelle 283 v8 powerglide automatic ps bench seat check it out(US $14,999.00)

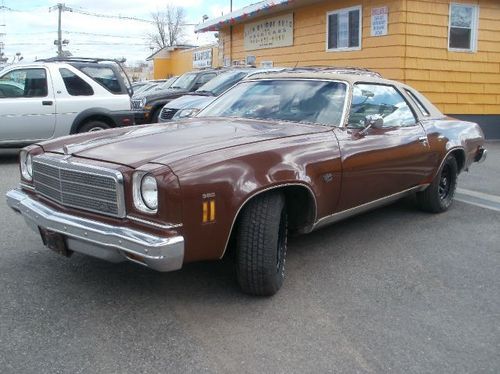

1966 chevrolet chevelle 283 v8 powerglide automatic ps bench seat check it out(US $14,999.00) 1974 chevrolet chevelle malibu classic 350 v8 4barrel aut0 coupe cheap rare fast

1974 chevrolet chevelle malibu classic 350 v8 4barrel aut0 coupe cheap rare fast No reserve 1970 chevelle no reserve

No reserve 1970 chevelle no reserve 1969 chevelle malibu convertible

1969 chevelle malibu convertible 66 chevelle

66 chevelle Tuxedo black 1972 chevelle supersport 454 replica!(US $19,900.00)

Tuxedo black 1972 chevelle supersport 454 replica!(US $19,900.00)

Auto Services in Wisconsin

Todd`s Automtv ★★★★★

Sturtevant Auto ★★★★★

Stephan`s Auto Repair ★★★★★

State Auto Sales ★★★★★

Scott`s Towing & Recovery ★★★★★

Schmelz Countryside Volkswagen/Saab Car Sales ★★★★★

Auto blog

May 2016: FCA wins, Ford and GM stumble on weak car volumes

Wed, Jun 1 2016The May 2016 sales numbers are in, and it looks as though FCA is getting some vindication for boldly cancelling two slow-selling car models. Meanwhile, Ford saw overall sales dip and GM's May volume took a big dive versus the same month in 2015. While Marchionne's decision to axe the Chrysler 200 and Dodge Dart has drawn criticism as being short-sighted, it's working for FCA so far. Although the Dart and 200 aren't out of production yet and no capacity has been shifted to crossover or trucks, May's numbers show that the emphasis on Jeep and Ram models makes sense right now. FCA's US sales rose 1 percent last month compared to May 2015, putting the year-to-date total at 955,186 vehicles, an increase of 6 percent compared to the same period last year. Standouts included the Jeep Renegade, Compass, and Patriot, and the Fiat 500X. Ram pickup sales were down 3 percent. And your fun fact is that Alfa Romeo sales were up precisely 10 percent, for a total of 44 4Cs sold versus 40 in the same month last year. At FoMoCo, the Ford brand took a hit to the tune of 6.4 percent from May 2015 to 2016, registering 226,190 sales last month. Lincoln showed improvement on its modest numbers, going from 9,174 to 9,807, a 6.9 percent increase. Overall, Ford was down 5.9 percent for the month to 235,997; despite the slump, year-to-date total Ford sales are up 4.2 percent to 1,112,939. Strong sellers included Escape, Expedition, F-Series, and Transit - big stuff. Most small and/or efficient models (Fiesta, Focus, Fusion, C-Max) saw sales slides. Fusion sales were also down, likely due to effects of model changeover to the freshened 2017 model. Ford has promised four new crossovers and SUVs by 2020 and if things keep trending this way the company will be able to sell them, but things could change in the next four years. GM saw the worst of it for domestic brands. Retail and fleet sales were down for each of the four divisions, with the May 2016 total dropping 18 percent to 240,450 vehicles. GM's year-to-date sales are down 5.0 percent in 2016 to 1,183,705. Both the Sierra and Silverado were down significantly, and the majority of Chevy, Buick, GMC, and Cadillac nameplates saw sales decreases, with both small cars and larger utilities included. Not even big stuff could help GM this month, it seems. We'll have more on the rest of the industry's May sales as those figures trickle in.

AWD turbodiesel Equinox, Terrain dropped for 2020

Thu, May 2 2019Citing low demand, General Motors is dropping the AWD diesel options off the Chevrolet Equinox and GMC Terrain roster. Chevrolet spokesman Kevin Kelly confirmed to CarsDirect that for 2020, the diesel versions of these SUVs will only be offered with front-wheel-drive. CarsDirect notes that with the AWD diesel Equinox and Terrain gone, the only AWD diesel option in this class is the Mazda CX-5 Skyactiv diesel, which is significantly more expensive: As the AWD diesel CX-5 is only available in a fully loaded Signature specification, the $42,045 price tag is almost $10k heftier than the cheapest comparable Equinox, the AWD 1.6-liter diesel LT which starts from $32,495. The 2019 GMC Terrain AWD SLE costs $34,795 in comparison, which works out to being around $7,200 cheaper than the Mazda. The higher trim levels for the Equinox and Terrain are Premier and SLT, respectively. Some reasoning behind the AWD diesel GM SUV's low uptake is their own price difference to base FWD gasoline models: you can get a 1.5-liter Equinox for less than §25,000 listed. While the 2.2-liter Mazda has plenty more power at 168 hp and 290 lb-ft, compared to 137hp and 240 lb-ft in the 1.6-liter GM SUVs, the Equinox and Terrain are notably more frugal – they are rated 32mpg combined, while the Mazda can manage 28 mpg. With better fuel economy and a significantly lower list price, the General Motors twins are at least more wallet-friendly when it comes to numbers, and as the vehicles will cease to be built in that configuration there's likely to be some cash on the hood on ones in stock. News Source: CarsDirectImage Credit: Chevrolet Chevrolet GM GMC confirmed gmc terrain chevrolet equinox

Recharge Wrap-up: Tesla P85D upgrades coming soon, lease a Chevy Volt for $149 a month

Wed, Dec 31 2014CarCharging has raised $6 million from shareholders and has restructured to save cash. The EV charging company plans to expand further in 2015 - with an eye toward achieving profitability - in part by investing in technology and "unlocking the value of our significant equipment inventory," says CarCharging CEO Michael D. Farkas. The group expects to reduce administrative costs by 40 percent, and has hired an interim Chief Financial Officer to help carry out its plans for growth. CarCharging raised the cash through offering convertible preferred stock to its shareholders, whom Farkas thanked "for their passion and patience." Read more in the press release below. Rydell Chevrolet in Los Angeles is offering Chevrolet Volt leases for $149 per month. In a video ad, Rydell offers the Volt for $169 a month with $3,390 due at signing, but another ad shows the offer at $149 a month with $3,550 down or $248 per month with $0 down. Rydell Chevrolet will ship the car anywhere in the lower 48 states. It also appears they offer cupcakes. See Rydell's video below, or read more at Inside EVs. Tesla will upgrade the Model S P85D with higher performance and top speed. The free update, which is due "in the next few months" according to a statement from Tesla, will raise the electronically limited top speed from 130 to 155 miles per hour. "Additionally, an over-the-air firmware upgrade to the power electronics will improve P85D performance at high speed above what anyone outside Tesla has experienced to date," Tesla says. The update will be available for the lifetime of the car, which includes subsequent owners. Read more at Green Car Reports. Car Charging Group Completes $6 Million Capital Raise Concurrently Enacts Restructuring Actions to Reduce Cash Burn MIAMI BEACH, Fla., Dec. 29, 2014 /PRNewswire/ -- Car Charging Group, Inc. (OTCQB: CCGI) ("CarCharging" or the "Company"), the largest owner, operator, and provider of electric vehicle (EV) charging services, today announced that it has closed an offering (the "Offering") and raised net proceeds of up to $6 million with current institutional shareholders. The Offering consisted of convertible preferred securities with a conversion price of $0.70 and warrants exercisable at $1.00. Proceeds will be used to: - Strengthen CarCharging's balance sheet; - Build on the past year's progress; and - Provide growth capital for expanding the Company's network.