1986 Chevrolet Caprice Classic Brougham Sedan 4-door 5.0l on 2040-cars

Bridgeport, Connecticut, United States

|

car runs and drives good needs some studs for exhaust,it also needs a good paint job,.I am the third owner all owners are adults car is solid and dependable. shipping is the responsibility of buyer.

|

Chevrolet Caprice for Sale

Auto Services in Connecticut

Tasca Chrysler Dodge Jeep RAM ★★★★★

Superior Transmission ★★★★★

Secor Volvo ★★★★★

Precision Auto Body & Garage ★★★★★

Pine Bush Equipment Co Inc ★★★★★

Middletown Plate Glass Co Inc ★★★★★

Auto blog

2020 Chevy Trax and Buick Encore spied testing

Tue, Aug 14 2018We just recently saw a little crossover SUV from General Motors being tested, and we weren't positive what brand it belonged to. We narrowed it down to Chevy or GMC, but we're feeling more confident that it's a GMC now, since both the next generation Chevy Trax and Buick Encore subcompact crossover SUVs have been spied testing together. Of the two, the Chevy has the more radically different sheet metal. It ditches the somewhat frumpy, lumpy shape of the current Trax for a body inspired by the bigger Chevy Blazer. The roofline has sharp corners, and the hood is wide and flat. The front fascia, though obscured, shows the most connection to the bigger crossover. It has the same split headlight configuration, and it looks as though the grille takes up a sizable section of the fascia. View 7 Photos The Buick Encore on the other hand looks evolutionary in design. The body still has plenty of curves, and the distinctive, sharply rising window sill are all hallmarks of the current Encore design. The headlights and grille are similar, too, though the grille appears to be slightly updated to fit in with the Enclave and Regal. It's understandable that Buick might want to play it safe with the new Encore, since the model is Buick's best seller, selling about 23,000 units in the last quarter, nearly twice that of the next best performer, the Enclave. Since this is the first time we've seen these little crossovers, we expect it will still be a year or two before we get to see them fully revealed. They will probably continue to use small-displacement turbocharged four-cylinder engines with either front- or all-wheel drive. Related Video:

Can Fernando Alonso win Indy? Here's why and why maybe not

Sat, May 27 2017SPEEDWAY, IN – The month of May has been a joy ride for Fernando Alonso at Indianapolis Motor Speedway. The two-time Formula 1 champion came to Indy having never turned left in a race car without also turning right. But he acquired such a feel for Indy's 2 1/2 -mile rectangle during a month of practice and qualifying that he's considered a strong contender to win the 101st Indianapolis 500 on Sunday, rookie or not. "You're not trying to bring somebody on who has very little experience driving very high-performance cars," said 2003 Indy 500 winner Gil deFerran, who this month has helped Alonso learn the nuances that make the speedway such a tough place to conquer. "I suppose it would be a little bit different if you were dealing with a younger, much less experienced person." Driving a McLaren Honda from the potent Andretti Autosport team, Alonso was consistently near the top of the speed charts in practice, he qualified fifth fastest at 231.300 mph, and he handled runs in heavy traffic like a driver who'd done it many times before. But those were the prelims. The race is another creature. "The car felt the best (it has) in the last two weeks. I was making some moves, taking some different lines. I am extremely happy." Other drivers say the speedway looks different on race day when the crowd, expected to top 300,000, fills the grandstands and makes an already narrow track seem even tighter. The three-wide rolling start is something Alonso has never experienced, and he will see the green flag from the middle of the second row between Takuma Sato and J.R. Hildebrand. And the space he'll be given by his competitors in the first 180 laps may disappear In the last 20 when it's every driver for themselves. Can a rookie like Alonso win this race? Absolutely, as Andretti driver Alexander Rossi showed last year when his team used a fuel-mileage strategy to win in his first taste of Indy. We're talking about Fernando Alonso here, who easily could show his rookie stripes to the rest of the field most of the day. His best lap in Friday's final practice, 226.608, was fifth fastest in the field and, more important, he said the car felt comfortable in heavy traffic. "The car felt the best (it has) in the last two weeks," Alonso said. "I was making some moves, taking some different lines.

Chevy shows much-improved 2014 Corvette interior in new video

Mon, 11 Feb 2013If you want a closer look at what went into designing and building the interior for the 2014 Chevrolet Corvette, we've got just the thing. General Motors has released a new video detailing the cabin's evolution from conception to execution, complete with commentary from Ryan Vaughn, performance car interior design manager with Chevrolet. The quick clip details how manufacturing, engineering and design within General Motors worked together from the first sketches to ensure no compromises had to be made later down the line. How novel.

With plenty of hides traced with contrast stitching and available real carbon fiber trim, the cabin looks to be a few hundred miles ahead of the C6. Given how readily critics derided the previous generation for its cabin, the C7 should make writers work a little harder to find something to complain about. Check out the video below for yourself.

1975 chevrolet caprice

1975 chevrolet caprice 1975 chevrolet caprice classic convertible

1975 chevrolet caprice classic convertible 1970 chevrolet caprice base hardtop 2-door 5.7l

1970 chevrolet caprice base hardtop 2-door 5.7l 1975 blue!

1975 blue! 1994 hevy caprice classic on 28' davin floaters

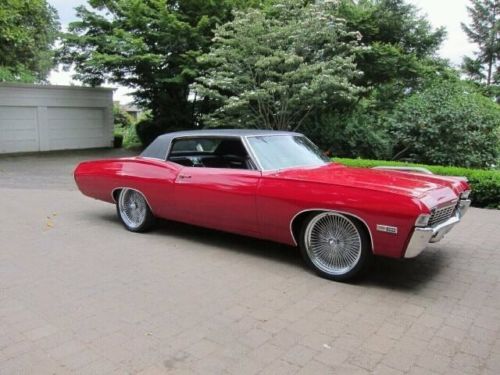

1994 hevy caprice classic on 28' davin floaters 1968 chevrolet caprice hardtop 2-door 396

1968 chevrolet caprice hardtop 2-door 396