1967 Chevorlet Caprice on 2040-cars

Elk Grove, California, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:396 ci

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Chevrolet

Model: Caprice

Trim: 2 dr hardtop vinyl top

Options: Leather Seats

Drive Type: automatic

Safety Features: Disk Brake Conversion

Mileage: 53,929

Power Options: Air Conditioning

Sub Model: 396

Exterior Color: Black

Interior Color: Black

1967 CAPRICE 2DR VINYL HARDTOP

396 CUBIC INCH

450 HORSEPOWER

FRAME-OFF RESTORATION

TUBULAR A-ARM SUSPENSION

LADDER BAR /TRACTION SUPPORT

LONG TUBE HEADERS

FLOWMASTER EXHAUST

BEDLINER-UNDERCOATING

ELDELBROCK INTAKE MANIFOLD

HOLLEY MECHANICAL FUEL PUMP

ELDELBROCK 750 CARB.

NORTHERN TWO CORE RADIATOR

DISK BRAKE CONVERSION KIT

NEW BLACK LEATHER INTERIOR

Chevrolet Caprice for Sale

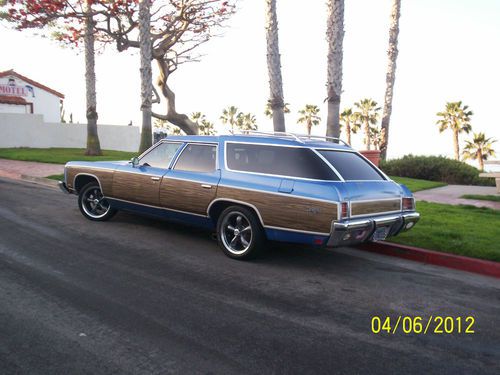

1973 chevrolet caprice estate wagon 4-door 7.4l(US $20,000.00)

1973 chevrolet caprice estate wagon 4-door 7.4l(US $20,000.00) 1994 chevrolet caprice classic one owner wagon 3r row serviced v8 loaded rare(US $7,950.00)

1994 chevrolet caprice classic one owner wagon 3r row serviced v8 loaded rare(US $7,950.00) 1996 caprice classic port injected v8 alloys 32k miles mint no rust

1996 caprice classic port injected v8 alloys 32k miles mint no rust 1988 chevrolet caprice hearse by eureka..rare chevy halloween haunted house prop(US $2,500.00)

1988 chevrolet caprice hearse by eureka..rare chevy halloween haunted house prop(US $2,500.00) 1966 caprice bucket seats(US $9,000.00)

1966 caprice bucket seats(US $9,000.00) 91 caprice classic impala 4-door sedan chevy gm ss financing trades shipping

91 caprice classic impala 4-door sedan chevy gm ss financing trades shipping

Auto Services in California

Young`s Automotive ★★★★★

Yas` Automotive ★★★★★

Wise Tire & Brake Co. Inc. ★★★★★

Wilson Motorsports ★★★★★

White Automotive ★★★★★

Wheeler`s Auto Service ★★★★★

Auto blog

2015 Chevy Silverado, GMC Sierra recalled for steering issues

Thu, Sep 13 2018DETROIT — General Motors Co is recalling more than 1 million pickup trucks and sport utility vehicles in the United States due to issues with a temporary loss of power steering, the National Highway Traffic Safety Administration said. The recall is for 2015 models. They are: the Chevy Silverado 1500, Suburban and Tahoe, GMC Sierra 1500, Yukon and Yukon XL and Cadillac Escalade. The problem may cause difficulty steering the vehicle, especially at low speeds, increasing the risk of a crash, the auto safety regulator said in a document dated Sept. 12. The document did not highlight any reports of accidents and injuries, because of the power steering issue. GM dealers will update the power steering module software, free of charge for owners of the affected vehicles. In 2014, the No.1 U.S. automaker had recalled nearly 800,000 pickup trucks worldwide because of the same problem. GM did not immediately respond to a request for comment.Related Video:

GM to invest $150 million in Flint to boost heavy-duty pickup production

Thu, Jun 13 2019FLINT, Mich. — General Motors President Mark Reuss said on Wednesday that the automaker is investing about $150 million at its Flint Assembly plant in Michigan to boost production of heavy duty trucks by another 40,000 vehicles a year. Reuss announced the investment at the Flint truck assembly plant wearing a United Auto Workers pin. The Detroit automaker had announced back in February it was adding 1,000 jobs in Flint to build a new generation of heavy-duty pickup trucks. GM did not say that the latest investment would add more jobs at the plant, but Reuss said there could be opportunities to add workers as the launch of the automaker's new trucks progresses. GM has been under pressure from President Donald Trump and lawmakers of both parties to add jobs in the United States after it said last November it would idle the Chevy Cruze assembly plant in Lordstown, Ohio, and likewise had no new products for three other U.S. manufacturing plants. The Flint investment will include upgrades to the plant's conveyors and other new tooling, and will be completed in the first half of 2020. GM has invested more than $1.6 billion in the plant since 2013. Last month, GM said it would invest $24 million to increase truck production at its assembly plant in Fort Wayne, Indiana, which makes Chevrolet Silverado and GMC Sierra models. Sales of heavy-duty pickups in the United States have grown to more than 600,000 vehicles a year, up more than 20 percent since 2013, according to industry data. Prices for luxury models can easily top $70,000. GM's Chevrolet and GMC brands have long trailed Ford's F-series heavy duty trucks in the lucrative segment. The new Chevrolet and GMC heavy duty trucks have been re-engineered to tow heavier trailers, and keep pace in what has become an arms race among the Detroit Three automakers to claim superior torque and towing capability. Related: Silverado HD vs. 2019 Ram, Ford heavy duty trucks: How they compare on paper

Recharge Wrap-up: Chevy Volt named KBB "Best Buy," slow BMW i3 sales in Germany

Wed, Nov 19 2014The Chevrolet Volt has been awarded Kelley Blue Book's Electric/Hybrid Car Best Buy for 2015. KBB cited the car's electric commuter capabilities, extended range, acceleration, design and overall value as reasons to place it above the Nissan Leaf, BMW i3 and Toyota Prius. It works well in the real world, and doesn't leave drivers with range anxiety. Plus, it's comfortable, and a fun car to drive, according to KBB. Read more at Kelley Blue Book. The BMW i3 is seeing slow sales in Germany. BMW has sold about half the number of i3s it expected in its home country, with about 1,900 sold in the first nine months. BMW projected sales of 5,000 to 6,000 in the first year. BMW partly blames long shipping times for the slow sales, and the company is offering incentives in hopes of getting more people to adopt the electric car. In the US, BMW sold more than 1,000 units each month between August and October. Read more at Green Car Reports. Audi is pursuing new carbon-neutral synthetic fuels - or e-fuels - such as Audi e-diesel. Audi's newest project uses electrolysis of water to create hydrogen, which it then reacts with CO2 extracted from the air. The result is a liquid - called Blue Crude - full of energy from hydrocarbon compounds. The Blue Crude can then be converted into a sulfur-free synthetic diesel called e-diesel. This e-diesel can be used as a drop-in fuel, blended into fossil diesel for a more renewable fuel. Read more at Hybrid Cars. Uber is partnering with Spotify to allow passengers to choose what music they listen to during their ride. Users will be able to choose their own playlist that will be ready and playing for them when they are picked up. It offers a more personalized experience from the ride-hailing service, which, according to Uber CEO Travis Kalanick, is "nirvana" for music lovers. Paying Spotify users will be able to use the feature initially in London, Los Angeles, Mexico City, Nashville, New York, San Francisco, Singapore, Stockholm, Sydney and Toronto. Check out the video below and read more at Wired. Featured Gallery 2014 Chevrolet Volt View 11 Photos Related Gallery 2014 BMW i3: First Drive View 33 Photos News Source: Kelley Blue Book, Green Car Reports, Hybrid Cars, WiredImage Credit: Chevrolet Green Audi BMW Chevrolet Transportation Alternatives Technology Emerging Technologies Electric Videos recharge wrapup