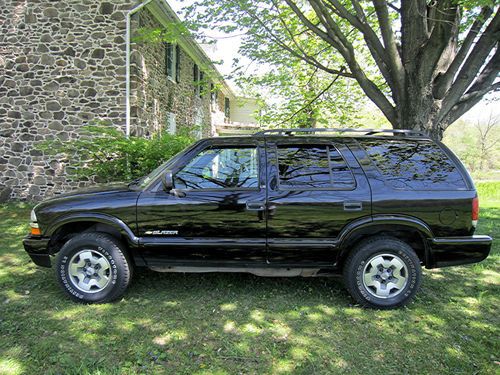

1998 Chevrolet Blazer Ls Sport Utility 4-door 4.3l on 2040-cars

Las Vegas, Nevada, United States

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Engine:4.3L V6 Cylinder Gasoline Fuel

Transmission:Automatic

Make: Chevrolet

Model: Blazer

Trim: LS Sport Utility 4-Door

Drive Type: 4WD

Mileage: 99,000

Exterior Color: Green

Interior Color: Gray

Options: Cassette Player

Number of Cylinders: 6

Safety Features: Anti-Lock Brakes

Power Options: Air Conditioning

98, 4x4 Chevy Blazer well maintained and in good condition, w/ satillite radio, recent tune up, new tires, brakes, trans, transfer case, drive cable, steering column with all paperwork to prove work done. Great work truck or everyday driver. Have new car and have no need for it anymore, has been good to me, and replaced anything that needed to be for maintanace, w/ all paperwork. Available for test drive daily. Just have no need for truck anymore.

Chevrolet Blazer for Sale

1993 chevrolet s10 blazer base sport utility 2-door 4.3l(US $2,000.00)

1993 chevrolet s10 blazer base sport utility 2-door 4.3l(US $2,000.00) 1972 chevrolet blazer

1972 chevrolet blazer 2001 chevrolet blazer lt 4x4 runs strong! no reserve

2001 chevrolet blazer lt 4x4 runs strong! no reserve Chevrolet k-5 diesel blazer 1984 4wd 6.2l ex-military issue // everyday driver

Chevrolet k-5 diesel blazer 1984 4wd 6.2l ex-military issue // everyday driver 2003 chevrolet blazer ls sport utility 4-door 4.3l

2003 chevrolet blazer ls sport utility 4-door 4.3l 1993 chevy k1500 blazer silverado 5.7l v8 4x4(US $2,200.00)

1993 chevy k1500 blazer silverado 5.7l v8 4x4(US $2,200.00)

Auto Services in Nevada

Updated Auto ★★★★★

Sudden Impact Auto Body and Collision Repair Specialists ★★★★★

Sudden Impact Auto Body & Collision Repair Specialists ★★★★★

Speed House ★★★★★

Smog-N-Go ★★★★★

Skip`s Spring Svc ★★★★★

Auto blog

Weekly Recap: Tesla loses money, still dominates the news

Sat, Aug 8 2015Some people get an inordinate amount of attention. In politics, it's Donald Trump. In football, it's Jim Harbaugh. And in the auto world, it's Elon Musk and his always-fascinating electric car company, Tesla Motors. General Motors is spending $877 million to upgrade a factory. So what! US auto sales are up. Who cares? Tesla has a metal snake that will recharge your car! So was the week in Tesla Ė er, the industry. Snarkiness aside, Tesla did dominate the news cycle, led by the announcement the company lost $184 million in the second quarter. Tesla also said it expects to deliver between 50,000 and 55,000 vehicles this year, and is preparing for a full launch of the Model X crossover in September. Musk also made news during the earnings call by simply not answering a question about ride sharing, leading to speculation Tesla could be considering its own operation. While the financials were the arguably the most important company news, reports of a Model S cyber hacking were more compelling fodder for Tesla followers. Researchers were able to attack the sedan and bring it to a stop, though they required access to the car first. Tesla says it already has deployed a remedy for the situation. On a lighter note, Tesla published a video of its metal charger prototype that autonomously uncoils like a snake to power up the company's vehicles, provoking plenty of humorous comments and comparisons. Watch it and decide for yourself. While some of this might seem trivial, much of Tesla's recent attention has been warranted. It's the first startup US automaker in decades to launch from nothing and actually gain traction in the market. Sure, Musk is a lightning rod and Tesla always seems to be in the spotlight. But amid all of the publicity, it easy to lose sight of the new reality: Tesla is a force. OTHER NEWS & NOTES 2016 Chevy Volt lights up 106 MPGe The Chevy Volt's vitals are looking healthier for 2016. The second-generation plug-in hybrid racks up a gaudy 106 miles per gallon equivalent, which is an increase of eight MPGe from the 2015 model. The new Volt can travel 53 miles on electricity, a significant jump from the 2015 Volt's 38-mile range. The new car also has a 420-mile total range when factoring in the capability of the gasoline engine, which is 40 miles greater than the current car offers.

2023 J.D. Power Initial Quality Study shows there's less quality than last year

Thu, Jun 22 2023Vehicle inventory, vehicle pricing, and the supply chain are finally showing improvement. Vehicle quality, on the other hand, is still going the wrong way. That's the takeaway from the 2023 J.D. Power Initial Quality Study that found overall problems exceeded last year's record high. The study surveyed owners of 2022-model-year vehicles to assess the average rate of problems per 100 vehicles (PP100) during the first 90 days of ownership. The average figure for the¬†32 ranked manufacturers in 2020¬†was about 166 problems per 100 vehicles. In¬†the 2021 IQS, that dropped to an average of 162. For 2022, the average jumped to 180 problems. For 2023, the PP100 is up to an industry average of 192 ó an increase of 30 problems per 100 vehicles in just two years. Let's get to the good news first: Dodge reclaimed the crown of having the lowest number of problems per 100 vehicles at 140. Buick won last year with 139 PP100, falling to third this year. Dodge was the first American automaker to top the IQS in 2021. Its return as the least problematic gives parent company Stellantis three wins in four years after Ram was crowned in 2021. It also gives U.S. brands a four-peat after Buick topped the chart in 2022 by having owners report the fewest problems. This year's top 10 is Dodge, Ram, Alfa Romeo, Buick, Chevrolet, GMC, Porsche, Cadillac, Kia, and Lexus. Stellantis gathered a few feathers for its cap, in fact. Maserati showed the largest improvement year-on-year, followed by Alfa Romeo, and Alfa Romeo posted the lowest PP100 among the premium class, beating Porsche and Cadillac. Alfa Romeo has been vocal about working to improve quality, mentioning Lexus as a target. Last year the Japanese brand finished sixth, the Italians finished near the bottom, between Jaguar and Mitsubishi. This year Alfa jumped to third, Lexus dropped to tenth. Ram was the third-best on the list of improvers from 2022 to 2023.¬†¬† The individual model with the lowest PP100 is the Nissan Maxima. Now for the troublesome bits. In the words of¬†Frank Hanley, senior director of auto benchmarking at J.D. Power, "The industry is at a major crossroad and the path each manufacturer chooses is paramount for its future.

Recharge Wrap-up: Tesla P85D upgrades coming soon, lease a Chevy Volt for $149 a month

Wed, Dec 31 2014CarCharging has raised $6 million from shareholders and has restructured to save cash. The EV charging company plans to expand further in 2015 - with an eye toward achieving profitability - in part by investing in technology and "unlocking the value of our significant equipment inventory," says CarCharging CEO Michael D. Farkas. The group expects to reduce administrative costs by 40 percent, and has hired an interim Chief Financial Officer to help carry out its plans for growth. CarCharging raised the cash through offering convertible preferred stock to its shareholders, whom Farkas thanked "for their passion and patience." Read more in the press release below. Rydell Chevrolet in Los Angeles is offering Chevrolet Volt leases for $149 per month. In a video ad, Rydell offers the Volt for $169 a month with $3,390 due at signing, but another ad shows the offer at $149 a month with $3,550 down or $248 per month with $0 down. Rydell Chevrolet will ship the car anywhere in the lower 48 states. It also appears they offer cupcakes. See Rydell's video below, or read more at Inside EVs. Tesla will upgrade the Model S P85D with higher performance and top speed. The free update, which is due "in the next few months" according to a statement from Tesla, will raise the electronically limited top speed from 130 to 155 miles per hour. "Additionally, an over-the-air firmware upgrade to the power electronics will improve P85D performance at high speed above what anyone outside Tesla has experienced to date," Tesla says. The update will be available for the lifetime of the car, which includes subsequent owners. Read more at Green Car Reports. Car Charging Group Completes $6 Million Capital Raise Concurrently Enacts Restructuring Actions to Reduce Cash Burn MIAMI BEACH, Fla., Dec. 29, 2014 /PRNewswire/ -- Car Charging Group, Inc. (OTCQB: CCGI) ("CarCharging" or the "Company"), the largest owner, operator, and provider of electric vehicle (EV) charging services, today announced that it has closed an offering (the "Offering") and raised net proceeds of up to $6 million with current institutional shareholders. The Offering consisted of convertible preferred securities with a conversion price of $0.70 and warrants exercisable at $1.00. Proceeds will be used to: - Strengthen CarCharging's balance sheet; - Build on the past year's progress; and - Provide growth capital for expanding the Company's network.