1968 Chevy Bel Air Restore To It's Natural Beauty on 2040-cars

Orangeburg, South Carolina, United States

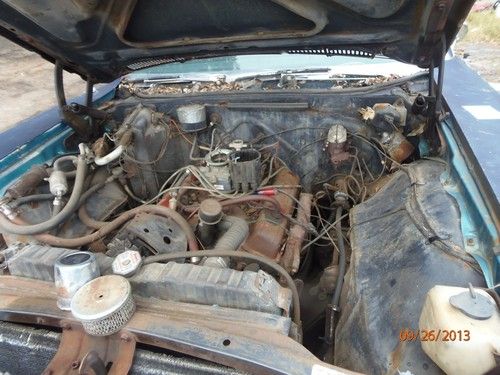

Engine:V8

Make: Chevrolet

Trim: Full Size

Model: Bel Air/150/210

Mileage: 90,000

Drive Type: Automatic

Needs to be fully restored.

Chevrolet Bel Air/150/210 for Sale

1956 chevy bel air 4 door sedan

1956 chevy bel air 4 door sedan 1956 chevy 210 wagon hot rod street rod resto mod body off restoration

1956 chevy 210 wagon hot rod street rod resto mod body off restoration 1957 chevrolet bel air sport sedan street rod loaded all new(US $35,000.00)

1957 chevrolet bel air sport sedan street rod loaded all new(US $35,000.00) Restored 1953 bel air 350/350 ford 9" ps pdb camaro clip tilt brand new paint

Restored 1953 bel air 350/350 ford 9" ps pdb camaro clip tilt brand new paint 1954 chevrolet belair street rod a/c full power restored street rod make offer

1954 chevrolet belair street rod a/c full power restored street rod make offer Chevrolet, bel air hardtop, 1954. inline 235, t5(US $16,500.00)

Chevrolet, bel air hardtop, 1954. inline 235, t5(US $16,500.00)

Auto Services in South Carolina

Wingard Towing Service ★★★★★

Sumter Tire Plus LLC ★★★★★

Stepp`s Garage & Towing ★★★★★

Stateline Auto Brokers ★★★★★

Patterson`s Towing & Recovery ★★★★★

Parish Automotive ★★★★★

Auto blog

Next-gen Chevy Volt gets Corvette looks, adjustable regen levels

Sat, Dec 20 2014The hood may say "full speed ahead." The regenerative braking system says "slow down a bit." One person's automotive improvements is another's identity crisis, all in a day's work analyzing the new Chevrolet Volt. The next-generation version of General Motors' first extended-range plug in will include design touches taken from to the new Chevrolet Corvette, GM's iconic sports car. Hexagonal taillights and a "taut" hood will be part of the new package, Automotive News says, citing General Motors design chief Ed Wilbur. But does that mean the Volt is shedding any of its green-car cred? Not at all, if one considers that the Volt will also let the driver adjust the degree of regenerative braking using steering-wheel paddles to dial up and recapture as much energy as possible and engage in "one-pedal" driving or turn it down for easier coasting. Check out the 55-second video below featuring GM executives Mark Reuss and Andrew Farah trying out the Volt's new regenerative-braking system that was first used on the Cadillac ELR. GM will have more details for us when it unveils the 2016 Chevy Volt at the North American Auto Show in Detroit next month. The new version is said to have a larger battery, a longer all-electric driving range and more power, but Chevy's been fairly mum on those sorts of performance details so far. Green Chevrolet Electric volt cadillac elr corvette regenerative braking

Here's why automakers roll out those Texas-themed pickup trucks

Thu, Sep 29 2016Every year, automakers with a full-size truck link make a big show of the Texas State Fair, usually involving a reveal of a new model. Sometimes they show a whole new truck, and other times a special edition centered on the Lone Star state. While some people might write this off as a quirk of the industry, others might be wondering, "What's the big deal with Texas?" As it turns out, part of the big deal with Texas is big truck sales. According to Dave Sullivan, product analysis manager at AutoPacific, Texas buys more trucks than any other state in the country. It's not a small margin either. Edmunds.com, one in five trucks sold in the US are sold in Texas. The state also accounts for 15 percent of the country's large truck sales, which is more than twice that of California, the second largest truck market in America. Even when you break down sales only in Texas, trucks are a huge piece of the pie - Sullivan says that a quarter of new vehicle sales in Texas are trucks. One in five trucks sold in the US are sold in Texas. But it's not just sales that make truck builders give attention to Texas. As Sullivan explained, "Pickups are life in Texas." Both he and Hugh Milne, marketing and advertising manager for the Chevy Silverado line, said that trucks are key fixtures in Texas society, as both work trucks and luxury vehicles (or Texas Cadillacs as Milne called them). Milne said Texas is so important in the truck market that if you want to be successful in the rest of the country, "you've got to be successful in Texas." As for the State Fair, it has become a prime location for reveals in part because of the importance of the Texas market and because of how big the fair is. Milne also revealed that the State Fair also hosts its own auto show, so it's an ideal venue for a vehicle introduction. So there you have it. Why do truck builders obsess over Texas? It's because Texas obsesses over trucks. When you have one market that loves your product that much, you give it the attention it deserves. Related Video: Image Credit: Donovan Reese via Getty Images Auto News Marketing/Advertising Chevrolet Ford RAM Truck f-150 texas state fair

2016 Chevy Volt powertrain technical details

Wed, Feb 11 2015The last time General Motors launched a Chevy Volt, it was operating without really knowing how people would use the plug-in hybrid. Sure, it had experience with the EV1, but the Volt was a new kind of car, and you can see in the archives just how much time GM spent explaining this fresh, new powertrain to potential customers. Then, once the vehicle was released, the company collected voluntary data from a large number of owners to learn about their driving and charging habits. The company also asked them what they wanted most in the new version. There's got to be an algorithm buried somewhere in GM headquarters that was used to take all of the numbers GM collected and spat out the headline figures for the 2016 Volt: 50 miles of EV range and 41 miles per gallon. Another important number – price – is something GM isn't talking about yet (expect it in April or May), but the company is sharing some powertrain details about the upcoming car. At a preview lunch in Detroit last week for the SAE 2015 Hybrid & Electric Vehicles Technologies Symposium that's happening now in California, GM engineers Peter Savagian (who is presenting a paper on the new inverter used in the updated Volt) and Tim Grewe (talking about the entire second-generation powertrain) sat down with AutoblogGreen to tell us about the Volt's all-new propulsion system: The overall gist is that the new Voltec 5ET50 drive unit is lighter, smaller and more powerful thanks to a redesigned two-motor traction drive. As previously reported, the new engine is a 1.5-liter DOHC four-cylinder that offers 101-horsepower (at 5,600 RPM). Grewe said it's "great for range extension." The electric motor side of the powertrain offers 149 motoring horsepower from a two-motor, continuously variable transaxle. Initially, the new engine will be made in Mexico. GM will move production to Flint, MI during the first year it makes the 2016 Volt. The battery is slightly bigger in the new Volt – 18.4 kWh compared to 16.5 in the current-gen – and will have less range variation in the cold. GM is also using more of the overall capacity in the pack in the 2016 Volt than in previous versions, but is not saying how much more. GM is not ready to publish acceleration times just yet, but the 2016 Volt has improved numbers, especially when going from 30-60 miles per hour. Most everything on the new powertrain has become more efficient compared to the first-gen Volt.