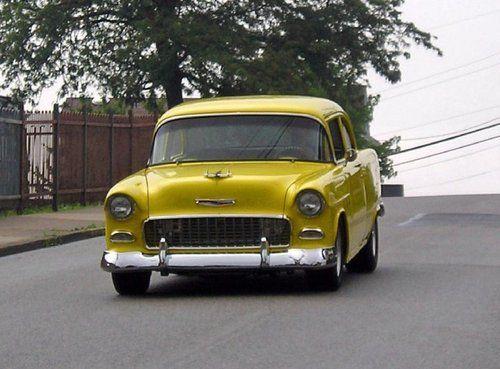

1955 Chevrolet Bel Air Hardtop; 2 Door on 2040-cars

Fort Worth, Texas, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:350

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chevrolet

Model: Bel Air/150/210

Warranty: Vehicle does NOT have an existing warranty

Trim: Hardtop Coupe; 2 Door

Options: CD Player

Drive Type: RWD

Power Options: Air Conditioning

Mileage: 0

Exterior Color: Onyx Black

Interior Color: Red

Disability Equipped: No

Number of Cylinders: 8

Chevrolet Bel Air/150/210 for Sale

1955 chevy 210 h/t

1955 chevy 210 h/t 1958 chevrolet delray 348 cu in tri power 4 speed, sell or trade

1958 chevrolet delray 348 cu in tri power 4 speed, sell or trade 1955 chevy 210 sedan total body off restoration no trades(US $42,500.00)

1955 chevy 210 sedan total body off restoration no trades(US $42,500.00) 1955 chevy 210 4 door partly restored.with 327 v8 and automatic transmission.

1955 chevy 210 4 door partly restored.with 327 v8 and automatic transmission. 1955 chevy 210 pro street(US $29,500.00)

1955 chevy 210 pro street(US $29,500.00) Rare 1953 chevrolet bel air 69 k on odometer!! con

Rare 1953 chevrolet bel air 69 k on odometer!! con

Auto Services in Texas

Z Rated Automotive Sales & Service ★★★★★

Xtreme Tinting & Alarms ★★★★★

Wayne`s World of Cars ★★★★★

Vaughan`s Auto Glass ★★★★★

Vandergriff Honda ★★★★★

Trade Lane Motors ★★★★★

Auto blog

My year in EVs: 8 electrics that are changing the car industry

Wed, Dec 1 2021The year 2021 will go down as an inflection point in the auto industryís transition to electric vehicles. It's when many much-anticipated models became reality. No longer sketches or sketchy prototypes, electric vehicles appeared from all corners with everything from the Lucid Air to Ford Mustang Mach-E changing how we think about transportation. I managed to drive a lot of them, and as I went through my notes, I realized I¬íve got a mini memoir of the seminal EVs of 2021. Here¬ís my take on eight of them. Hummer EV Easily the most over-the-top EV I tested this year. The 1,000-hp super truck lived up to the hype with its domineering presence, stupendous power and simply being a reincarnated Hummer. I took it for a short spin on- and off-road at the General Motors Proving Grounds in Milford, Mich., and was impressed with the airy cabin, removable sky panels and expansive touchscreens. Yes, I crab walked, which felt like steering a pontoon boat, though I can see why it would be useful. Lucid Air Dream Performance The most beautiful sedan I tested all year, EV or otherwise. Unlike the futuristic Mercedes EQS ¬ó which is quite attractive ¬ó Lucid¬ís car is a blend of mid-century modern interior aesthetics and classic European exterior styling. When I walked up for my test drive, someone who I¬ím pretty sure was comedian Jon Lovitz was sitting inside and taking it all in. As it sat in the valet of a hotel in a wealthy suburban enclave north of Detroit, the Lucid drew more attention than any of the Mercedes, Cadillacs or Lexus models passing by. The driving experience was enveloping. Starting at $169,000 for the Performance model (reservations are closed), the Lucid I sampled packed 1,111 hp and 471 miles of range. From the precise steering to the comfortable suspension, the dynamics were spot-on. It's a formidable product, and all the more impressive given it¬ís Lucid¬ís first. Chevy Bolt EV The Bolt was the most pleasant surprise for me. It handled well, offered low-to-the-ground hot hatch dynamics and the steering was dialed-in. Adding a crossover variant for the new generation was a smart play. On a summer morning where I went to a first drive of the Ford Bronco at an off-road course, my hour-long commute in the Bolt was an enjoyable appetizer.¬† The Bolt was also my biggest disappointment due to its extensive recalls for fire risk. Ironically, I had the Bolt in my driveway when the initial recall went out for the previous generation (2017-19).

GM profit dips on truck changeover, but beats estimates

Thu, Apr 26 2018DETROIT ó General Motors on Thursday reported a higher-than-expected quarterly profit despite a drop in production of high-margin pickup trucks, as it gears up for new models that are expected to boost profits next year. Like rivals Ford and Fiat Chrysler Automobiles, GM is banking on highly-profitable Chevy Silverado and GMC Sierra pickup trucks to lift profits, as consumers shift away from traditional passenger cars in favor of these larger, more comfortable trucks, SUVs and crossovers. During the first quarter, the process of changing over to GM's new pickups resulted in a drop in production of 47,000 units. GM Chief Financial Officer Chuck Stevens said the production drop had resulted in a drop in pre-tax profit of up to $800 million. Earlier this year, GM said its 2018 profits would be flat compared with 2017, but expected its all-new pickup trucks would boost margins starting in 2019. On Thursday, GM reiterated its full-year 2018 forecast for adjusted earnings in a range from $6.30 to $6.60 per share. The automaker said capital expenditures were more than $500 million higher in the quarter because of investments its new pickup trucks and a family of low-cost vehicles under development with Chinese partner SAIC Motor Corp. On Wednesday, rival Ford said it would stop investing in most traditional passenger sedans in North America. CFO Stevens told reporters on Thursday that GM has "already indicated that we will make significantly lower investments on a go-forward basis" in sedans. 2019 GMC Sierra View 21 Photos GM benefited from a lower effective tax rate in the quarter, but adjusted pre-tax margin fell to 7.2 percent from 9.5 percent a year earlier. Stevens said the company's profit margin should hit 10 percent or higher in the second quarter and for the full year. GM said material costs were $700 million higher in the first quarter, and it expects those costs to continue rising. The automaker said it would counter those increases with cost cutting measures. "It is a more difficult environment than it was three or four months ago," Stevens said when asked about rising commodity prices from potential steel and aluminum tariffs announced by the Trump administration. "But we are confident we can continue to offset that." The company reported quarterly net income of $1.05 billion or $1.43 per share, a drop of nearly 60 percent from $2.61 billion or $1.75 per share a year earlier. Analysts had on average expected earnings per share of $1.24.

The Jitterbugs somersaulted at the 1986 Chicago Auto Show for the Chevy Nova

Tue, Dec 30 2014Judging by the vintage videos that the Chicago Auto Show has been uploading, if you wanted to check out the latest vehicles and watch some dancers in the same place in the late '80s and early '90s, then the Windy City event was definitely the place to be. We've already seen the Footlockers pitching the Cavalier in '88 and a troupe of women singing about the Geo brand in '91. Apparently, the trend went back even further, though. Just take a look at this group called the Jitterbugs selling some badge-engineered products from Chevrolet at the 1986 show. Flanked by the Chevy Nova and Spectrum, these guys managed to do a few pretty impressive jumps and somersaults but mixed them with some rather uninspired spins, as well. Also, wait for 1:24 into the clip to see the least enthusiastic backup dancers that the world has ever known. The Jitterbugs are even further proof that Chevy's habit of mixing dancing and its vehicles goes back even further than the Volt. News Source: ChicagoAutoShow via YouTube Auto News Marketing/Advertising Chicago Auto Show Chevrolet Videos Chicago chevy nova