Entertainment - Navigation - Moonroof - 20s - 4x4 on 2040-cars

Carrollton, Texas, United States

Engine:8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

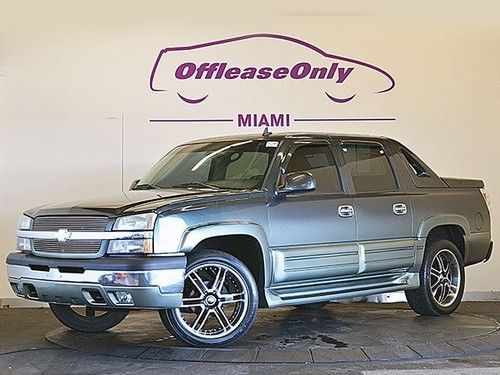

Make: Chevrolet

Cab Type (For Trucks Only): Crew Cab

Model: Avalanche

Warranty: Vehicle does NOT have an existing warranty

Mileage: 83,332

Sub Model: LTZ 4X4 Nav

Exterior Color: White

Disability Equipped: No

Interior Color: Tan

Doors: 4

Drive Train: Four Wheel Drive

Chevrolet Avalanche for Sale

1500 5dr cre suv 5.3l leather cd 4-speed a/t 4-wheel abs 4-wheel disc brakes a/c(US $8,900.00)

1500 5dr cre suv 5.3l leather cd 4-speed a/t 4-wheel abs 4-wheel disc brakes a/c(US $8,900.00) Leather cd player running boards memory seat tow pakg off lease only(US $11,999.00)

Leather cd player running boards memory seat tow pakg off lease only(US $11,999.00) 2005 chevrolet avalanche 1500 lt one owner tow package low miles(US $15,995.00)

2005 chevrolet avalanche 1500 lt one owner tow package low miles(US $15,995.00) Chevrolet avalanche ltz 4x4

Chevrolet avalanche ltz 4x4 2008 chevrolet avalanche ltz crew cab pickup 4-door 5.3l(US $17,995.00)

2008 chevrolet avalanche ltz crew cab pickup 4-door 5.3l(US $17,995.00) 2007 chevrolet avalanche ltz crew cab pickup 4-door 5.3 loaded navigation clean!

2007 chevrolet avalanche ltz crew cab pickup 4-door 5.3 loaded navigation clean!

Auto Services in Texas

Wolfe Automotive ★★★★★

Williams Transmissions ★★★★★

White And Company ★★★★★

West End Transmissions ★★★★★

Wallisville Auto Repair ★★★★★

VW Of Temple ★★★★★

Auto blog

GM puts e-commerce shopping in car dashboards

Tue, Dec 5 2017DETROIT — General Motors on Tuesday said it will equip newer cars with in-dash e-commerce technology, betting it can profit as drivers order food, find fuel or reserve hotel rooms by tapping icons on the dashboard screen, instead of using smartphones while driving. GM's Marketplace technology, developed with IBM, will be uploaded automatically to about 1.9 million model-year 2017 and later vehicles starting immediately, with about 4 million vehicles across the Chevrolet, Buick, GMC and Cadillac brands equipped with the capability in the United States by the end of 2018, GM said. GM will get an undisclosed amount of revenue from merchants featured on its in-dash Marketplace, Santiago Chamorro, GM vice president for global connected customer experience, said during a briefing for reporters. Customers will not be charged for using the service or the data transmitted to and from the car while making transactions, he said. "This platform is financed by the merchants," Chamorro said. GM will get paid for placing a merchant's application on its screens, and "there's some level of revenue sharing" based on each transaction, he said. It is too soon to say how much revenue GM could realize from the Marketplace system, he said. The GM Marketplace will compete for customer clicks and revenue with hand-held smartphones, which offer a far richer array of applications than the GM system will at the outset. Amazon.com is partnering with other automakers, including Ford, to offer in-car e-commerce capability through Amazon's Alexa personal assistant system. For example, GM will launch Marketplace with just Shell and Exxon Mobil icons in the fuel category. The only restaurant available for in-car table reservations at launch is the chain TGI Fridays, GM said. In addition, there will be apps for parking, and ordering ahead at coffee shops and restaurants such as Starbucks, Dunkin' Donuts and Applebee's. "We will be adding more vendors," with some coming in the first quarter of 2018, Chamorro said. In addition, he said GM plans to expand integration into its vehicles of music, news and other information services. GM also hopes to use its in-car Marketplace connections to expand purchases of products and services, such as additional access to in-car wifi, from its own replacement parts business and dealer network. Customers can "expect to see more service promotions coming through the platform," Chamorro said. Reporting by Joe WhiteRelated Video:

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Chevy Trax engineer says GMC version possible

Mon, Dec 8 2014The Buick Encore is doing so well and its platform-mate the Chevrolet Trax has such good reviewer vibes going for it already, that a GMC version hasn't been ruled out. During the recent press launch, Automotive News asked lead engineer Al Manzor if the Trax could wear a GMC-branded suit, to which Manzor replied, "I think that is certainly possible." That's a long way from telling us anything about the probability of a GMC version of the Trax, and a legion of questions would need to be answered before it could happen. How would a GMC version be priced to leave room for the $26,465 GMC Terrain but not eat into sales of the $20,995 Trax or the $24,035 Encore? Or would that matter? Could it primarily be considered to encourage a new faction of The Yukon Set at the compact end, GMC buyers being famously committed to the marque? And of course, would there be a Denali version? It'll probably be a long while before we have any kind of answers, but if you want to see it happen, the door to your campaign of persuasion is at least ajar.