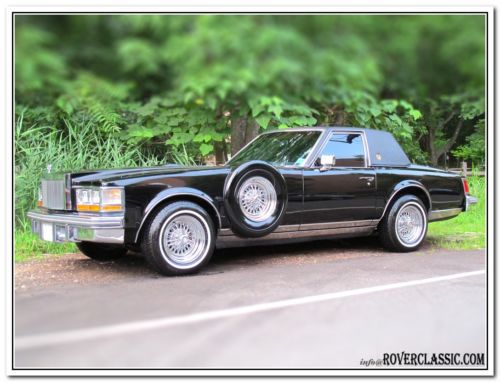

2002 Cadillac Seville Sts Sedan 4-door 4.6l on 2040-cars

Roanoke, Virginia, United States

|

65000 orig miles. 32 valve north star v8. Black on black. Touch screen navigation, sat radio, Bluetooth cd reciever. Factory soft top. Chrome wheels with good year eagles with great tread. Every option available on these cars. $60k when new. It really has it all. Interior is great paint is great. Overall excellent condition in and out. Fresh oil change, new interstate battery and good inspection. Must see

|

Cadillac Seville for Sale

2001 cadillac seville sls sedan 4-door 4.6l(US $4,600.00)

2001 cadillac seville sls sedan 4-door 4.6l(US $4,600.00) Beautiful gray 78 seville classic with sun roof

Beautiful gray 78 seville classic with sun roof 1979 cadillac seville opera ... grandeur motor car ... 57k miles ... one owner(US $13,900.00)

1979 cadillac seville opera ... grandeur motor car ... 57k miles ... one owner(US $13,900.00) 2002 cadillac seville sts sedan 4-door 4.6l

2002 cadillac seville sts sedan 4-door 4.6l 2003 cadillac seville with 29,231 actual miles , vogue tires and wheels , mint

2003 cadillac seville with 29,231 actual miles , vogue tires and wheels , mint Cadillac seville sts low miles 4 dr sedan automatic gasoline 4.6l v8 tpi dohc 32

Cadillac seville sts low miles 4 dr sedan automatic gasoline 4.6l v8 tpi dohc 32

Auto Services in Virginia

Weaver`s Automotive ★★★★★

Wayne`s Auto Repair & Towing Service ★★★★★

Volvo Specialists Inc ★★★★★

Thomas Wheel Alignment & Tire Service ★★★★★

The Body Works of VA INC ★★★★★

The Body Works of VA INC ★★★★★

Auto blog

Cadillac upgrades ATS sedan to match new coupe

Thu, 10 Jul 2014The big news when it comes to the Cadillac ATS for 2015 is surely the addition of the new coupe model, but that doesn't mean that Cadillac has forgotten about the sedan as well. In fact GM's luxury brand has rolled out a few choice enhancements for the four-door to bring it more in line with the new coupe.

Among those changes that we spotted a couple of weeks ago is a new front fascia that incorporates the brand's new wreath-less emblem, and a sleeker front bumper. The interior has been upgraded as well with new trim options as well as some new tech including Siri Eyes Free functionality, dictated text messaging and optional inductive smartphone charging.

Though the ATS Coupe does away with the base engine, sedan buyers can still opt for the 2.0-liter four with 202 horsepower and 191 pound-feet of torque. The 3.6-liter V6 carries over unchanged at 321 hp and 275 lb-ft, but the 2.0-liter turbo four gets the upgraded torque rating of 295 lb-ft (the highest in the range) to go with its 272 hp. Some new color choices are also among the upgrades you can read more about in the press release below.

2015 Chevy Silverado, GMC Sierra recalled for steering issues

Thu, Sep 13 2018DETROIT — General Motors Co is recalling more than 1 million pickup trucks and sport utility vehicles in the United States due to issues with a temporary loss of power steering, the National Highway Traffic Safety Administration said. The recall is for 2015 models. They are: the Chevy Silverado 1500, Suburban and Tahoe, GMC Sierra 1500, Yukon and Yukon XL and Cadillac Escalade. The problem may cause difficulty steering the vehicle, especially at low speeds, increasing the risk of a crash, the auto safety regulator said in a document dated Sept. 12. The document did not highlight any reports of accidents and injuries, because of the power steering issue. GM dealers will update the power steering module software, free of charge for owners of the affected vehicles. In 2014, the No.1 U.S. automaker had recalled nearly 800,000 pickup trucks worldwide because of the same problem. GM did not immediately respond to a request for comment.Related Video:

Cadillac Celestiq and Honda Civic Type R revealed | Autoblog Podcast #740

Fri, Jul 29 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. They kick things off by talking about the latest vehicle reveals, specifically the Cadillac Celestiq show car and the 2023 Honda Civic Type R. They discuss Chevy's move to offer incentives to help prevent customers from flipping the new Corvette Z06. Greg has spent time behind the wheel of the 2022 Range Rover First Edition, while John has been driving the 2023 Genesis GV60 Performance. From the mailbag, a listener is looking to replace a 2003 Subaru Forester with something that can hold three dog crates and gets decent fuel economy. Another listener asks whether to keep a 2008 Porsche 911 Turbo or replace it with a 992-generation 911 for which he is awaiting an allocation. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #740 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cadillac Celestiq show car revealed 2023 Honda Civic Type R revealed Chevy offers incentives to prevent Corvette Z06 flipping Cars we're driving 2023 Genesis GV60 Performance 2022 Land Rover Range Rover First Edition Spend My Money: Replacing a 2003 Subaru Forester Spend My Money Update: New or 2008 Porsche 911? Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: